Bitcoin Investors Witness Market Shifts: Key Indicators at Play

Bitcoin's landscape is shifting—and the smart money is watching the dials.

The Signals That Don't Lie

Forget the hype. On-chain metrics and exchange flow data are telling a clearer story than any talking head on financial TV. We're seeing accumulation patterns that hint at a new phase, while volatility compresses like a spring. It's the quiet before... something.

Institutional Footprints in the Dust

The big players aren't just dipping toes anymore; they're mapping the terrain. Their moves—often slow, deliberate, and painfully bureaucratic—leave traces that retail can follow. It's a game of patience versus panic, and right now, patience is building a position.

The Macro Tides Pull Hard

Bitcoin doesn't trade in a vacuum. Traditional finance's obsession with interest rates and liquidity is now crypto's problem, too. Every central bank whisper sends ripples across both markets—proving, once again, that Wall Street's addiction to cheap capital is the world's most expensive habit.

So, is this a pause or a pivot? The indicators are setting up. The only thing left to do is watch them play out.

Summarize the content using AI

ChatGPT

Grok

The leading cryptocurrency has recently dipped below $90,000, causing continued volatility in altcoins. Investors face challenging times as the Federal Reserve’s pessimism dampens optimistic forecasts for the coming year, with critical support identified at $88,000. This article examines the current status of an on-chain alarm that accurately predicted the last three significant market movements.

ContentsMajor Cryptocurrency SignalCurrent Status in CryptocurrenciesMajor Cryptocurrency Signal

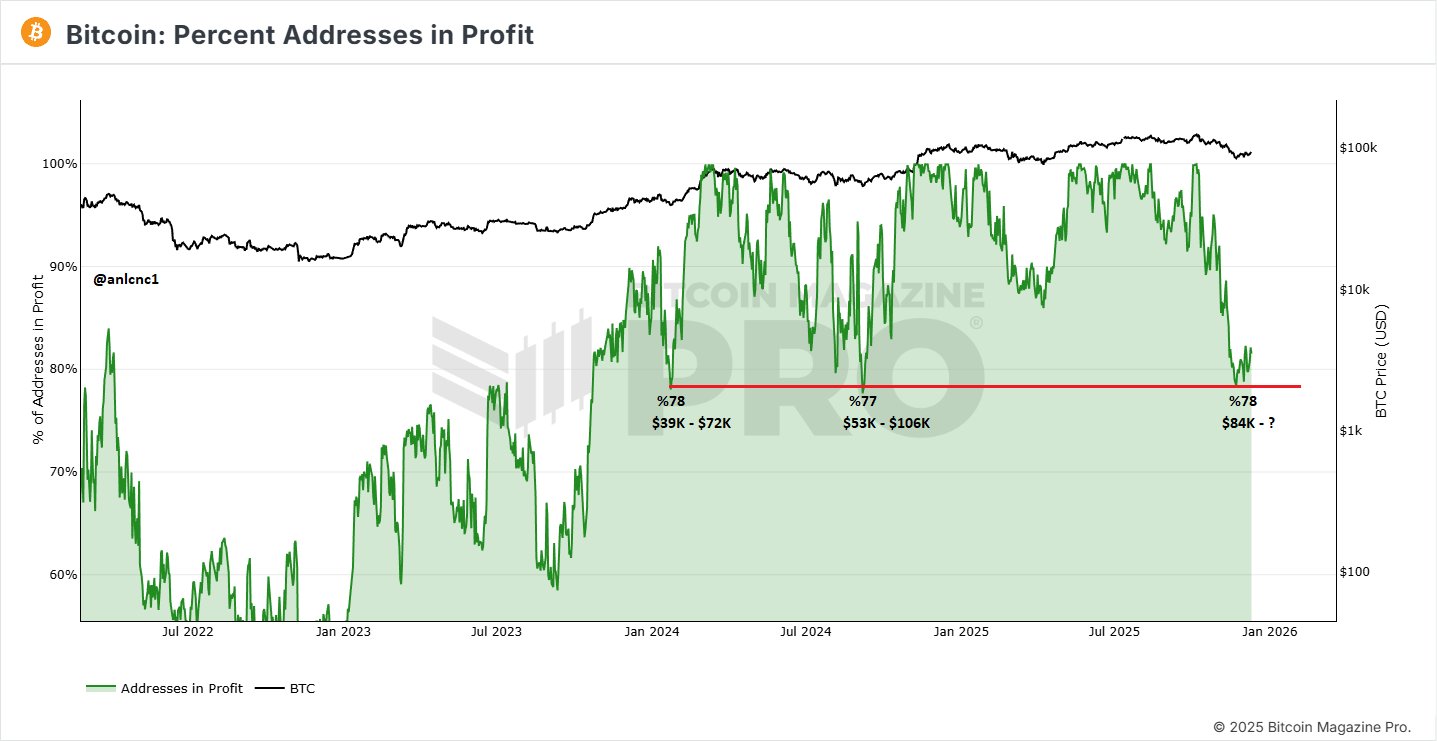

A significant indicator monitoring Bitcoin $90,359 investors’ profitability has revealed local lows at each occasion when the profit percentage dropped below 80%. This parameter serves as a crucial signal for pinpointing local bottoms in Bitcoin cycles. According to current analyses, profitability has once again decreased to 78%, closely mirroring previous cycles where a rebound occurred.

$90,359 investors’ profitability has revealed local lows at each occasion when the profit percentage dropped below 80%. This parameter serves as a crucial signal for pinpointing local bottoms in Bitcoin cycles. According to current analyses, profitability has once again decreased to 78%, closely mirroring previous cycles where a rebound occurred.

The analysis points out that when bitcoin addresses fell below 80% profitability, local dips emerged, leading to substantial gains in subsequent months. Currently, profitability has fallen to 78%, which correlates with the $84,000 level. Although the profitability rate is still relatively high, suggesting this is not a bear market bottom, historical patterns suggest potential for market gains as local dips form.

Current Status in Cryptocurrencies

Recent insights from CryptoQuant highlight the plight of short-term investors, who are now enduring one of 2025’s most challenging downturns despite previous substantial gains. Currently, prices remain below the realized price, putting many recent buyers at a loss.

“Despite short-term volatility, weak hands continue to sell during rebounds, maintaining market pressure. Structurally, such DEEP losses typically surface later in correction phases rather than earlier,” the analysis suggests.

An update on the Binance BTC/Stablecoin Reserve Ratio signals potential market turnaround. According to analyst anlcnc1, recent trends show a weakening in negative Bitcoin to Stablecoin flows, while a shift back to Stablecoin to Bitcoin flows is emerging, which is a positive development for the market.

“As previously mentioned, the weakening of negative flows and the resurgence of positive flows indicate a bullish trend. The current ratio stands at 1.23, and a rise above 1.50 WOULD confirm a market bottom, though the market is still at the dip formation stage.”

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.