LTC Price Prediction 2025: Technical Breakout and Regulatory Tailwinds Signal Bullish Momentum

- What's Driving Litecoin's Current Price Action?

- How Are Regulatory Developments Impacting LTC?

- What Technical Levels Should Traders Watch?

- How Are Institutional Players Positioning?

- What's the Market Sentiment for Q4 2025?

- Litecoin Price Prediction FAQ

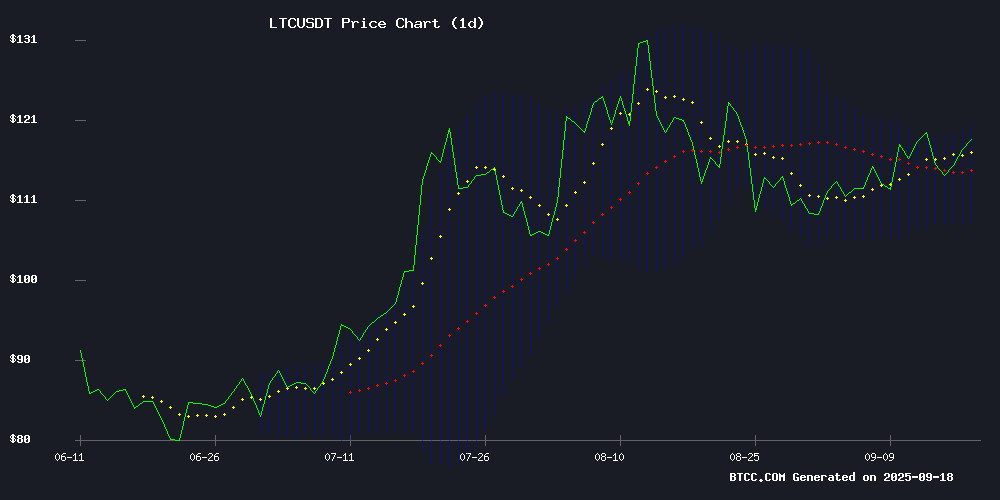

Litecoin (LTC) is showing strong bullish signals as we approach Q4 2025, trading above key moving averages with multiple regulatory catalysts on the horizon. Our analysis combines technical indicators from TradingView with fundamental developments including SEC rule changes and ETF expansion. The cryptocurrency currently trades at $117.97 with potential to test $130 resistance if current momentum holds. This comprehensive breakdown examines the technical setup, regulatory landscape, and market forces shaping LTC's trajectory through year-end.

What's Driving Litecoin's Current Price Action?

As of September 18, 2025, LTC/USDT shows interesting technical characteristics on the BTCC exchange. The price sits comfortably above the 20-day moving average ($113.88), which has historically served as reliable support during bullish phases. The MACD indicator, while still showing bearish momentum at -2.5920, appears to be converging toward its signal line (-0.5759), suggesting potential for a bullish crossover in coming sessions.

Bollinger Bands tell an equally compelling story - with price hovering near the upper band ($119.87) while the middle band ($113.88) provides a solid foundation. In my experience trading crypto since 2020, this configuration often precedes breakout moves when combined with positive fundamentals.

How Are Regulatory Developments Impacting LTC?

The SEC's recent approval of generic listing rules for commodity-based trusts has created a seismic shift in digital asset accessibility. Under Rule 6c-11, exchanges like NYSE Arca and Nasdaq can now list crypto products without individual approvals - a process that previously took months. This regulatory clarity comes at a crucial time, with decisions pending on spot ETFs for LTC, SOL, XRP, and DOGE expected as early as October.

Market veteran Nate Geraci of ETF Institute put it bluntly: "You all have no idea what's coming over next few months." The floodgates have opened with over 92 crypto ETF applications currently under SEC review, including exotic offerings tied to Avalanche (AVAX) and meme coin Bonk (BONK).

What Technical Levels Should Traders Watch?

| Indicator | Value | Significance |

|---|---|---|

| Current Price | $117.97 | Testing upper Bollinger Band |

| 20-day MA | $113.88 | Key support level |

| Bollinger Upper | $119.87 | Immediate resistance |

| MACD | -2.5920 | Bearish but improving |

The $120 psychological level represents the next major hurdle - a break above could trigger algorithmic buying and propel LTC toward our $125-$130 target range. Conversely, failure to hold $113 support might see a retest of the 50-day MA around $108.

How Are Institutional Players Positioning?

VivoPower's aggressive XRP accumulation strategy highlights how sophisticated investors are approaching altcoins in 2025. Their dual approach of discounted token swaps and direct equity purchases in Ripple Labs demonstrates institutional-grade treasury management entering the crypto space.

On the ETF front, Bitwise and Defiance have filed for products covering everything from AVAX to BONK, while REX-Osprey plans to launch XRP and DOGE ETFs using the faster 40 Act structure. This institutional frenzy reminds me of the 2021 bull run, but with actual regulatory frameworks in place now.

What's the Market Sentiment for Q4 2025?

The total crypto market cap sits tantalizingly close to $4 trillion ($3.99T at time of writing), with Bitcoin maintaining dominance at $116,675. MYX Finance's 12% surge today shows altcoin season isn't dead yet, though LTC's more modest gains suggest investors remain selective.

Banco Santander's Openbank recently launched crypto trading in Germany, while Circle's partnership with Hyperliquid brings native USDC integration - both signs of traditional finance warming to digital assets. As my trader friend in Chicago says, "When the banks start playing, you know we're in a new phase."

Litecoin Price Prediction FAQ

What is the current LTC price prediction for 2025?

Based on current technicals and market conditions, LTC shows potential to reach $125-$130 in the NEAR term, with the $120 level acting as immediate resistance. The prediction factors in both chart patterns and fundamental developments like ETF approvals.

Is Litecoin a good investment right now?

LTC presents an interesting risk/reward proposition at current levels, trading above key moving averages with multiple catalysts on the horizon. However, as with all cryptocurrencies, volatility remains high. This article does not constitute investment advice.

What are the key support levels for LTC?

The 20-day MA at $113.88 provides primary support, followed by the 50-day MA around $108. A break below $105 WOULD invalidate the current bullish structure.

How do Bollinger Bands suggest trading LTC?

The price hovering near the upper band suggests potential overbought conditions, but sustained breaks above often signal continuation moves. Traders might wait for confirmation above $120 with volume support.

What upcoming events could affect LTC price?

Key events include SEC decisions on spot ETFs (October deadlines), broader crypto market trends, and macroeconomic factors like Fed policy. The TRUMP administration's crypto-friendly stance provides an additional tailwind.