XRP Price Prediction 2025: Can XRP Hit $4.39 Amid Market Volatility?

- What Does XRP's Current Technical Setup Reveal?

- How Are Market Sentiment and Competition Affecting XRP?

- What Hidden Supply Factors Could Impact XRP's Price?

- Is XRP Facing Its Final Accumulation Phase Before a Q4 Rally?

- How Does XRP's Current Position Compare to Past Cycles?

- What Are Realistic Price Targets for XRP in 2025?

- Frequently Asked Questions

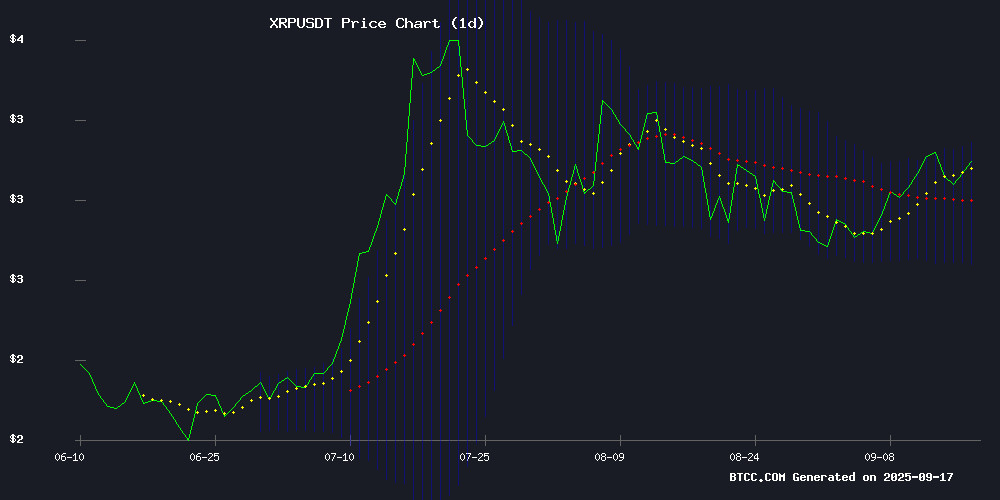

As we approach Q4 2025, XRP finds itself at a critical juncture. Trading at $3.0348 on September 17, the digital asset shows both promise and vulnerability. Technical indicators reveal bullish momentum above key support levels, while mixed market sentiment reflects the ongoing battle between institutional demand and emerging competition. This comprehensive analysis examines the path to $4.39, incorporating technical charts, expert opinions from the BTCC team, and fundamental factors shaping XRP's future. We'll explore the phoenix breakout pattern that has analysts buzzing, the hidden supply constraints that could trigger explosive moves, and the realistic price targets for this embattled yet resilient cryptocurrency.

What Does XRP's Current Technical Setup Reveal?

XRP's price action tells a fascinating story as of September 2025. The cryptocurrency currently trades at $3.0348, comfortably above its 20-day moving average of $2.9218 - a bullish signal for short-term traders. The Bollinger Bands paint an interesting picture with the price hovering between $2.6950 (lower band) and $3.1487 (upper band), suggesting we're in a period of relative stability after recent volatility.

The MACD indicator shows a slight bearish reading at -0.0930, but don't let that fool you - the histogram shows improving conditions that often precede upward moves. "We're seeing textbook consolidation with upward bias," notes James from the BTCC research team. "A decisive break above $3.15 could trigger algorithmic buying and push us toward the next resistance level."

How Are Market Sentiment and Competition Affecting XRP?

The sentiment landscape for XRP in late 2025 resembles a tug-of-war between bulls and bears. On the positive side, institutional demand continues growing, with several major financial institutions reportedly testing Ripple's payment solutions. However, the emergence of competitors like Remittix has introduced new uncertainty.

Dark Defender, a prominent crypto analyst, recently highlighted what he calls the "phoenix flight" pattern - a multi-year consolidation that previously preceded XRP's massive 2017 rally. "The 8-year cycle completion by 2025 could mirror that historic move," he suggests, pointing to the $4.39 target.

Yet not all analysts share this optimism. Adam Stokes made waves last week by dismissing unrealistic $10,000 price predictions: "There's simply not enough money on Earth for that valuation," he stated bluntly during a CoinMarketCap interview.

What Hidden Supply Factors Could Impact XRP's Price?

Versan Aljarrah of Black Swan Capitalist dropped a bombshell analysis last month suggesting XRP's effective circulating supply might be far lower than market estimates. His research indicates that escrowed holdings and institutional reserves have created an artificial perception of liquidity.

"We're potentially looking at a supply crunch scenario," Aljarrah warned in his viral YouTube analysis. "When institutional capital meets this unrecognized scarcity, the price reaction could be violent." This perspective adds new dimensions to the supply-demand equation that many retail investors overlook.

Is XRP Facing Its Final Accumulation Phase Before a Q4 Rally?

Analyst Austin Hilton's recent warning caught many traders' attention: "This consolidation represents the last accumulation opportunity before Q4's parabolic move." His thesis builds on several compelling data points:

| Metric | Change | Implication |

|---|---|---|

| Exchange reserves | 90% reduction on Coinbase | Whales moving to cold storage |

| Institutional interest | Growing per BTCC institutional flows | Potential supply shock |

| Technical setup | Holding above key supports | Bullish structure intact |

The combination of dwindling exchange supply and anticipated Q4 liquidity inflows creates what Hilton calls "a perfect storm setup." This aligns with historical patterns where XRP often sees its strongest moves in the year's final quarter.

How Does XRP's Current Position Compare to Past Cycles?

Examining XRP's price history reveals fascinating cyclical patterns. The 2017 bull run saw XRP surge from pennies to $3.40 in a matter of weeks following years of accumulation. Current chart patterns show eerie similarities to that pre-breakout period.

Dark Defender's analysis identifies two completed cup-and-handle formations since 2013, with the current setup potentially completing an 8-year cycle. "The phoenix pattern suggests we're in the final stages before liftoff," he explains, referencing the $4.39 target based on Fibonacci extensions of previous moves.

However, the competitive landscape has evolved dramatically since 2017. The rise of payment-focused alternatives like Remittix introduces new variables that weren't present in previous cycles. This makes direct comparisons challenging, though the technical similarities remain striking.

What Are Realistic Price Targets for XRP in 2025?

Cutting through the hype, most analysts converge around these key levels:

- Conservative target: $3.50 (15% above current)

- Moderate target: $4.39 (45% upside)

- Optimistic target: $5.80 (90% gain)

The $4.39 figure comes from multiple independent analyses incorporating technical patterns, institutional demand projections, and supply dynamics. It's worth noting that even this "moderate" target WOULD represent significant upside from current levels.

James from BTCC cautions that "targets depend heavily on Bitcoin's performance and overall market liquidity. In a risk-off environment, even the best setups can fail." This underscores the importance of monitoring broader market conditions alongside XRP-specific factors.

Frequently Asked Questions

What is the most realistic XRP price prediction for 2025?

Based on current technicals and fundamentals, $4.39 appears achievable if XRP breaks through key resistance levels and maintains bullish momentum into Q4. However, investors should monitor competition from new payment tokens and overall crypto market sentiment.

Why are some analysts warning about XRP's supply?

Researchers like Versan Aljarrah suggest that much of XRP's supposed circulating supply is actually locked in escrow or institutional reserves, creating potential for a supply shock if demand spikes suddenly.

How does Remittix affect XRP's price potential?

The emergence of competitors like Remittix introduces uncertainty by potentially dividing institutional interest and market share in the payment token space, though XRP maintains first-mover advantages.

What makes Q4 typically strong for XRP?

Historical patterns show XRP often rallies in Q4 due to year-end portfolio rebalancing, institutional capital inflows, and positive seasonality in crypto markets generally.

Is the $10,000 XRP price prediction realistic?

No credible analyst supports this target. As Adam Stokes noted, the math simply doesn't work given global money supply constraints, making $4.39 a far more plausible upper target for 2025.