XRP Price Prediction 2025: Technical Consolidation Signals Potential Breakout Ahead

- What's the Current Technical Setup for XRP?

- How Are Market Forces Influencing XRP's Price Action?

- What Regulatory Developments Could Impact XRP?

- Where Are the Fundamental Adoption Catalysts?

- What Are the Price Projections for XRP?

- XRP Price Prediction FAQ

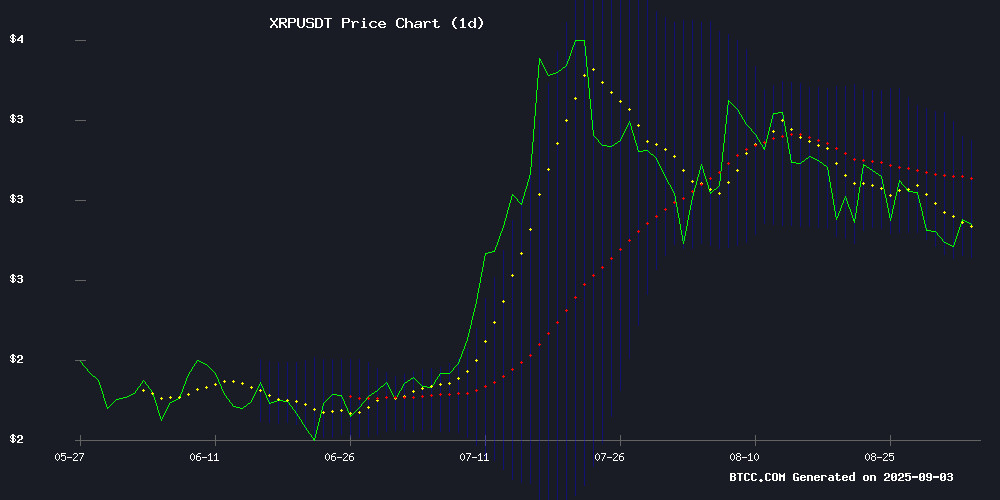

XRP finds itself at a critical technical juncture in September 2025, trading at $2.85 just below its 20-day moving average while showing mixed momentum signals. Our analysis reveals a brewing battle between whale accumulation and long-term holder distribution, set against a backdrop of regulatory developments and fundamental adoption catalysts. With Bollinger Bands suggesting a range between $2.72-$3.17 and Changelly's eye-popping $2,000+ long-term projection, we break down the key factors every XRP investor should watch.

What's the Current Technical Setup for XRP?

XRP's chart paints a picture of consolidation with potential brewing beneath the surface. The digital asset currently trades at $2.85, slightly below the psychologically important 20-day moving average at $2.94 (TradingView data). The MACD shows weakening momentum at -0.0101, but here's the interesting part - the narrow spread between MACD (0.1151) and signal line (0.1252) suggests we might be setting up for a trend reversal.

Bollinger Bands reveal the immediate playing field: $2.72 lower band support with $3.17 upper resistance and the middle band at $2.94 serving as the pivot point. "This technical setup shows XRP testing key support levels," notes our BTCC analyst. "A decisive break above the 20-day MA could trigger upward momentum toward that $3.17 upper band."

How Are Market Forces Influencing XRP's Price Action?

The market's telling two different stories through on-chain data. On one side, whales holding 100M-1B XRP went on a $1.1 billion buying spree over three days - their first significant MOVE after three weeks of radio silence. That's the kind of institutional-scale accumulation that typically precedes price movements.

But here's the plot twist: long-term holders are distributing assets at the fastest pace in two months. The age consumed metric shows dormant XRP flooding exchanges - historically a precursor to corrections. This creates what we call the "whale vs diamond hands standoff" where price could go either way depending on which faction gains dominance.

What Regulatory Developments Could Impact XRP?

The regulatory arena remains a battleground with SWIFT's Chief Innovation Officer Tom Zschach recently taking shots at Ripple's centralized governance model. "Surviving lawsuits isn't resilience," Zschach stated, directly challenging Ripple's regulatory victory narrative. This matters because Ripple's pursuing a national banking license - a move that WOULD position them as both partner and competitor to traditional banks.

Meanwhile, all eyes are on the October 18 deadline for a pivotal XRP ETF decision. crypto expert Gordon's cryptic "Something HUGE is coming" tweet has the community buzzing with speculation. Whether this turns out to be substantial or just hype remains to be seen, but the timing certainly raises eyebrows.

Where Are the Fundamental Adoption Catalysts?

Beyond the price charts, real-world adoption continues progressing:

- China's CNPC evaluating Ripple's RLUSD stablecoin for cross-border payments

- SolMining launching XRP-powered cloud mining contracts

- Ripple's partnership with Thunes network enhancing real-time payments

These developments provide fundamental support for XRP's utility case. As one trader put it, "The tech's getting better while the regulatory fog slowly lifts - that's usually when things get interesting."

What Are the Price Projections for XRP?

| Timeframe | Target Price | Key Levels |

|---|---|---|

| Short-term (1-2 weeks) | $3.00 - $3.17 | Break above 20-day MA |

| Medium-term (1-2 months) | $3.50 - $3.75 | Sustained volume increase |

| Long-term (2040 projection) | $2,000+ | Mass adoption scenario |

Changelly's recent analysis projects XRP could reach $2,215 by December 2040 - a move that would represent gains between 1,430% and 73,979% from expected 2026-2034 levels. While these long-term numbers grab headlines, near-term price action will likely hinge on the October 18 regulatory decision and whether whale accumulation can overpower long-term holder distribution.

This article does not constitute investment advice.

XRP Price Prediction FAQ

What's the current support and resistance for XRP?

XRP is currently trading between $2.72 (lower Bollinger Band) and $3.17 (upper Bollinger Band), with the 20-day moving average at $2.94 serving as immediate resistance.

Why are whales accumulating XRP now?

The $1.1 billion accumulation over three days suggests institutional players see value at current levels, potentially anticipating positive developments around the October 18 deadline or broader market recovery.

How reliable is Changelly's $2,000 XRP prediction?

While the 2040 projection makes for exciting speculation, such long-term forecasts involve numerous variables. The prediction assumes mass adoption scenarios that may or may not materialize.

What's the significance of October 18 for XRP?

The date marks a key regulatory deadline for XRP exchange-traded funds (ETFs), with potential approval serving as a major institutional adoption catalyst.

How does Ripple's banking license bid affect XRP?

Success would position Ripple as both service provider and competitor to traditional banks, creating complex dynamics that could impact XRP's utility and valuation.