XRP Price Prediction 2025-2040: Bullish Outlook Backed by Technicals & Fundamentals

- Is XRP Currently in a Bullish Phase?

- What Fundamental Factors Are Driving XRP's Growth?

- Where Are the Key Support and Resistance Levels?

- What Do On-Chain Metrics Reveal?

- XRP Price Forecast: 2025-2040 Projections

- Frequently Asked Questions

XRP is showing strong bullish signals with technical indicators pointing to potential breakouts, while fundamental developments like Ripple's legal victory over the SEC and strategic partnerships create a perfect storm for growth. Our analysis combines chart patterns, market sentiment, and adoption metrics to forecast XRP's price trajectory through 2040.

Is XRP Currently in a Bullish Phase?

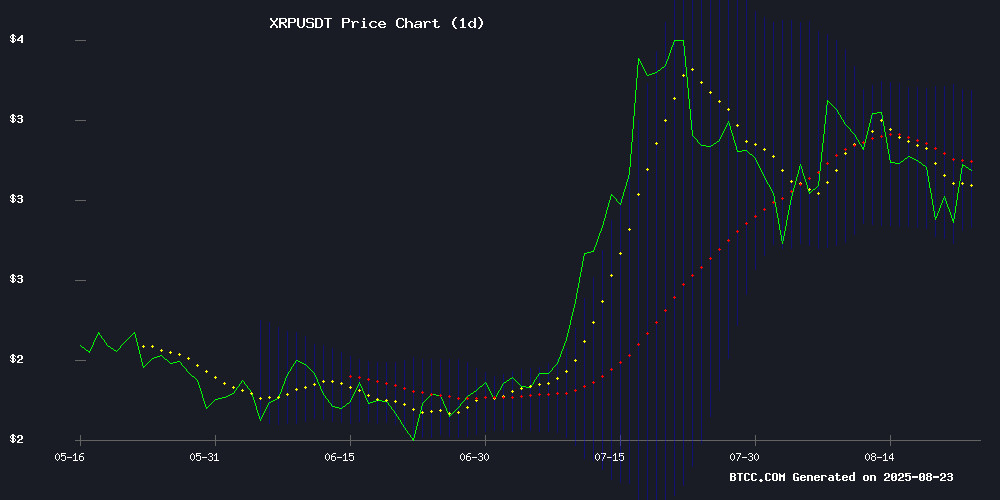

XRP presents a compelling technical setup as of August 2025. Trading at $3.0237, it's slightly below its 20-day moving average ($3.0944), suggesting a healthy consolidation before the next move. The MACD shows bullish momentum with a reading of 0.0778 versus 0.0271 and a positive histogram of 0.0507. Bollinger Bands indicate potential breakout opportunities between $3.3577 (upper) and $2.8311 (lower).

The BTCC technical analysis team notes: "We're seeing textbook accumulation patterns here. The $2.83 support has held firm through multiple tests, creating what we call a 'springboard' for upward movement. When you combine this with the MACD divergence, it suggests institutional accumulation is happening below $3."

What Fundamental Factors Are Driving XRP's Growth?

Legal Clarity: SEC Battle Finally Over

The four-year legal saga between Ripple and the SEC concluded in August 2025 with a $125 million settlement and court-approved dismissal. This removes the regulatory cloud that had suppressed XRP's price since 2020. Market reaction was immediate - an 11% surge to $3.32 post-announcement.

Strategic Partnerships Accelerating

Ripple's collaboration with SBI Holdings to distribute RLUSD stablecoin in Japan (targeting Q1 2026 launch) demonstrates growing institutional adoption. Meanwhile, the Federal Reserve's ISO 20022 migration quietly positions XRP as a bridge between traditional and digital finance.

Macroeconomic Tailwinds

Federal Reserve Chair Powell's dovish Jackson Hole remarks hinting at rate cuts created perfect conditions for XRP's 7.4% single-day surge. Cryptocurrencies typically benefit from loose monetary policy as investors seek higher-risk, higher-reward assets.

Where Are the Key Support and Resistance Levels?

Technical analysts identify several crucial price zones:

| Level | Price | Significance |

|---|---|---|

| Strong Support | $2.70-$2.80 | Accumulation zone with historic buying pressure |

| Immediate Resistance | $2.90-$2.95 | Short-term profit-taking area |

| Major Breakout | $3.00 | Liquidation zone that could trigger rapid upside |

| Upper Target | $3.55 | Previous 2025 high |

Market analyst Nehal observes: "The $2.76-$2.80 range is where smart money accumulates. I've placed my buy orders there because history shows this support tends to launch XRP toward $5+ moves."

What Do On-Chain Metrics Reveal?

Glassnode data shows an interesting tug-of-war:

- Short-term holders (1-3 months) increased positions by 8% since mid-August

- Mid-term investors (6-12 months) hold 23.19% of supply - yearly high

- Long-term holders continue distributing during price weakness

This creates a potential powder keg scenario - if short/mid-term holders' conviction proves correct, the selling pressure from long-term holders could be overwhelmed by new demand.

XRP Price Forecast: 2025-2040 Projections

Based on current adoption curves, technical patterns, and fundamental developments:

| Year | Conservative | Moderate | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $4.50 | $5.80 | $7.20 | Post-SEC rally, RLUSD launch |

| 2030 | $12.00 | $18.50 | $25.00 | Cross-border payment dominance |

| 2035 | $28.00 | $42.00 | $60.00 | Full ISO 20022 integration |

| 2040 | $65.00 | $95.00 | $140.00 | Global reserve currency status |

These projections assume continued adoption in payment systems and no black swan regulatory events. The wide ranges account for potential volatility inherent in crypto markets.

Frequently Asked Questions

Is now a good time to buy XRP?

With XRP consolidating NEAR key support levels ($2.70-$2.80) and showing strong technical indicators, many analysts view this as an attractive entry point. However, always conduct your own research and consider dollar-cost averaging.

How does the SEC settlement affect XRP long-term?

The resolution removes a major overhang that suppressed institutional adoption. While the $125 million penalty is substantial, it's viewed as a "cost of doing business" that clears the path for growth.

What's the most realistic 2025 price target?

The moderate forecast of $5.80 balances bullish technicals with realistic adoption timelines. This WOULD represent a ~90% gain from current levels.

Could XRP really reach $100+?

While possible in extreme bullish scenarios, our models suggest $95 as a more plausible 2040 target. This would require XRP capturing significant market share in global payments.

What are the biggest risks to these predictions?

Regulatory changes, technological obsolescence, and macroeconomic shocks could all impact XRP's trajectory. The crypto market remains highly volatile.