Bitcoin Price Prediction 2025: Why $164K BTC Target Remains Firm Despite Recent Volatility

- Is Bitcoin Still Bullish in 2025?

- What's Driving Institutional Bitcoin Adoption?

- How Are Global Regulations Affecting Bitcoin?

- What Technical Indicators Suggest About BTC's Next Move?

- Are Whale Movements a Concern for Bitcoin's Price?

- What Are the Long-Term Bitcoin Price Projections?

- Frequently Asked Questions

As bitcoin consolidates near $117,000, analysts remain bullish with a $164,000 price target in sight. This in-depth analysis examines the technical indicators, institutional adoption trends, and macroeconomic factors supporting Bitcoin's upward trajectory. From Thailand's crypto tourism initiative to Google's stake in TeraWulf, we break down the key developments shaping BTC's price action as of August 2025.

Is Bitcoin Still Bullish in 2025?

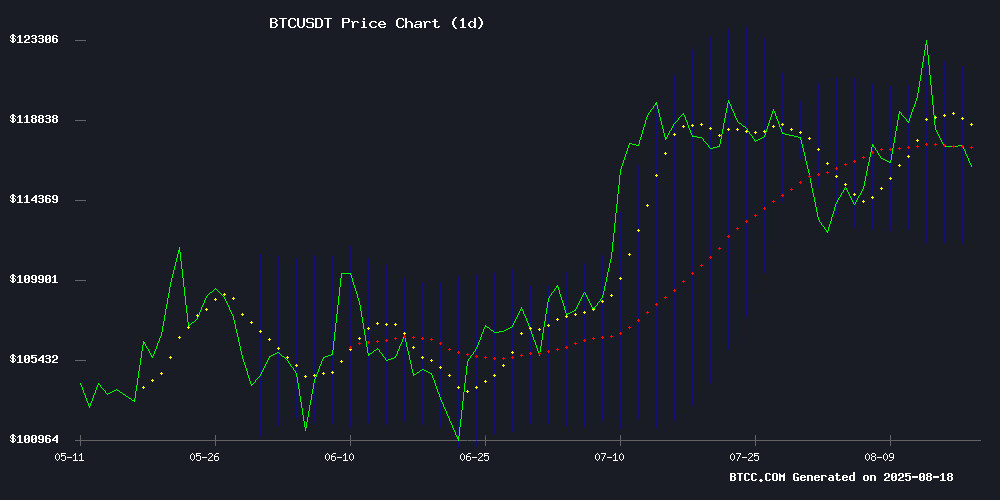

Despite recent volatility, Bitcoin maintains a strong bullish structure according to technical analysis. The cryptocurrency currently trades at 116,941.33 USDT, slightly above its 20-day moving average of 116,861.41. The Bollinger Bands show a tight range between 111,969.46 (lower band) and 121,753.36 (upper band), suggesting reduced volatility that typically precedes significant price movements.

Source: BTCC Trading Platform

What's Driving Institutional Bitcoin Adoption?

Several major developments highlight growing institutional interest:

| Institution | Action | Impact |

|---|---|---|

| Increased stake in TeraWulf to 14% | $3.2B financial backstop for mining expansion | |

| Amdax | Launching Bitcoin treasury on Euronext | Targeting 1% of BTC supply (210,000 BTC) |

| MicroStrategy | Added 430 BTC ($51.4M) to holdings | Total now 629,376 BTC at $73,320 average |

How Are Global Regulations Affecting Bitcoin?

Thailand's "TouristDigiPay" initiative, launching August 18, 2025, allows foreign visitors to convert cryptocurrency into Thai Baht. While innovative, the program operates within strict regulatory sandbox parameters - tourists must open local accounts and can't make direct crypto payments. This reflects the delicate balance governments strike between innovation and control.

Meanwhile, Dutch firm Amdax demonstrates Europe's growing crypto sophistication. As a fully licensed entity registered with both the Dutch Central Bank and the Authority for the Financial Markets, Amdax brings institutional-grade compliance to its upcoming Bitcoin treasury product.

What Technical Indicators Suggest About BTC's Next Move?

The MACD shows a bearish crossover but with narrowing divergence, suggesting potential consolidation before another upward move. Key resistance sits at the upper Bollinger Band (121,753.36), with a breakout potentially confirming bullish continuation.

Long-term indicators remain positive. The current cycle mirrors historical patterns where Bitcoin experiences mid-cycle consolidation before final parabolic moves. No sell signals have triggered since the March 2023 buy signal at $28,476.

Are Whale Movements a Concern for Bitcoin's Price?

Recent activity from dormant wallets has traders cautious:

- $3.78B transfer from wallets inactive since 2020-2022

- $353M movement from a five-year-old wallet holding $2.82B BTC

Historically, such movements precede major price inflection points. Similar activity in March 2024 preceded a 30% decline, though current market structure appears more resilient.

What Are the Long-Term Bitcoin Price Projections?

| Year | Conservative Target | Bullish Target | Key Drivers |

|---|---|---|---|

| 2025 | $140K | $164K | ETF inflows, halving effects |

| 2030 | $250K | $500K | Global reserve asset status |

| 2035 | $750K | $1.2M | Institutional dominance |

| 2040 | $1.5M | $3M+ | Scarcity premium |

Frequently Asked Questions

Is Bitcoin still a good investment in 2025?

While past performance doesn't guarantee future results, Bitcoin's fundamentals remain strong with growing institutional adoption and the recent halving's supply shock yet to fully impact markets. The $164K price target suggests significant upside potential from current levels.

What's the biggest risk to Bitcoin's price?

Regulatory changes pose the most significant risk, particularly if major economies restrict crypto access. The recent whale movements also suggest potential volatility ahead as large holders redistribute their positions.

How does Bitcoin's current price compare to historical cycles?

Bitcoin follows roughly four-year cycles tied to its halving events. The current cycle, which began after the 2022 lows, appears to be following historical patterns of mid-cycle consolidation before potential parabolic moves in late 2025/early 2026.

Should I be concerned about Bitcoin's energy usage?

The industry has made significant strides in sustainable mining, with estimates suggesting over 50% of Bitcoin mining now uses renewable energy. Companies like TeraWulf are leading this transition while maintaining profitability.

What makes BTCC a good platform for trading Bitcoin?

BTCC offers robust trading tools, competitive fees, and a secure platform for cryptocurrency trading. The exchange provides comprehensive charting tools and market analysis to help traders make informed decisions.