Ethereum Price Prediction 2025: $16K Target in Sight as Institutional Demand Surges

- Why Is Ethereum Price Surging in 2025?

- Ethereum Technical Analysis: Bullish Indicators Signal Upside Potential

- Institutional Frenzy: $11B Treasury Reserves and Counting

- Fusaka Upgrade: Ethereum's Next Major Milestone

- Ethereum Price Predictions: 2025 Through 2040

- ETH Staking Boom: 36M Coins Locked and Counting

- Ethereum vs. Competitors: Maintaining the Lead

- FAQs: Ethereum Price Prediction 2025

finance,

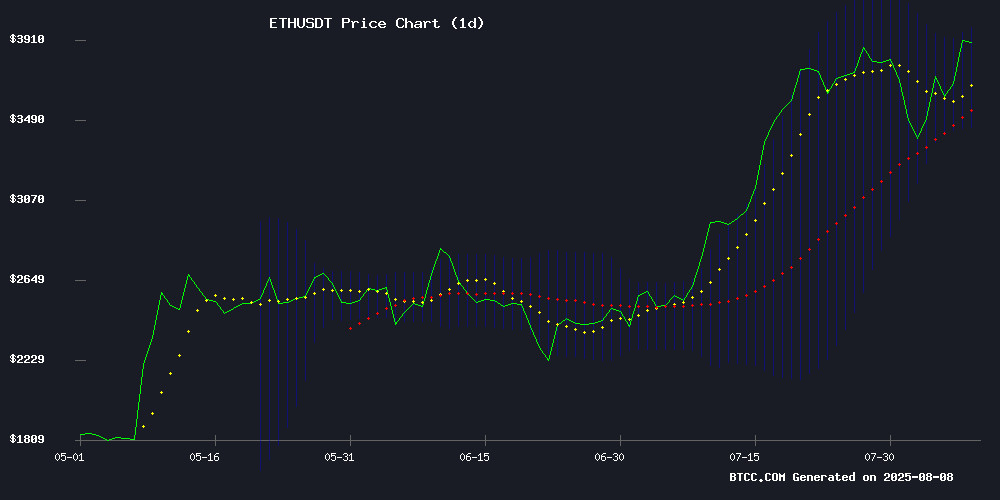

Ethereum is making waves in the crypto market with its recent bullish momentum, currently trading above $4,000 and showing strong technical indicators. Institutional investors are stacking ETH at record rates, with corporate treasuries now holding over $11 billion worth of the cryptocurrency. This article dives deep into the factors driving Ethereum's price action, analyzes key technical levels, and explores expert predictions ranging from conservative $6,800 to bullish $16,000 targets for 2025. We'll examine the institutional tsunami fueling ETH's rally, the impact of upcoming network upgrades, and what the charts suggest about Ethereum's next major moves.

Why Is Ethereum Price Surging in 2025?

Ethereum's price has been on a tear, climbing from $2,400 in July to over $4,000 in August 2025. This 60% monthly gain comes amid unprecedented institutional demand - we're seeing Fortune 500 companies, crypto-native firms, and anonymous whales accumulating ETH at scale. The BTCC team notes that this isn't retail FOMO driving the rally, but sophisticated capital positioning for the long term. Three key factors are fueling this surge:

First, the Fusaka upgrade timeline has brought renewed focus to Ethereum's scalability roadmap. Second, spot ETH ETFs have seen consistent inflows since July, with only three days of outflows in the past month. Third, corporate treasuries are treating ETH as both a store of value and yield-bearing asset, with staking now locking up 30% of total supply. "This perfect storm of technical progress, financial product adoption, and corporate strategy is unlike anything we've seen before in crypto," notes a BTCC market analyst.

Ethereum Technical Analysis: Bullish Indicators Signal Upside Potential

Looking at the charts, ETH/USDT is painting an extremely bullish picture. The price currently sits at $4,046.21, comfortably above its 20-day moving average of $3,719.58. The MACD histogram shows a positive crossover at 117.46, confirming upward momentum, while Bollinger Bands indicate volatility expansion with price testing the upper band at $4,010.02.

Key levels to watch:

- Support: $3,700-$3,750 (recent consolidation zone), $3,200-$3,400 (major institutional buying area)

- Resistance: $4,100 (psychological barrier), $4,500 (2021 all-time high adjusted for inflation)

Michaël van de Poppe, a prominent crypto analyst, observed: "Great MOVE of $ETH, taking all the liquidity on the short side." He notes potential daytrade opportunities between $3,700-$3,750 with $4,100+ targets. The $3,200-$3,400 support zone has shown remarkable resilience, bouncing three times in the past month.

Institutional Frenzy: $11B Treasury Reserves and Counting

The institutional ETH accumulation story gets more incredible by the day. Corporate treasuries now hold over 3.04 million ETH worth $11 billion - a figure that's doubled since January. SharpLink Gaming's recent $200 million raise specifically for ETH accumulation made headlines, but they're far from alone:

| Institution | ETH Holdings | Value (USD) |

|---|---|---|

| Anonymous Whale | 171,015 ETH | $667M |

| SharpLink Gaming | ~100,000 ETH | $390M |

| Fundamental Global | Planning $5B allocation | TBD |

What's fascinating is how these institutions are acquiring ETH - mostly through custodial channels like FalconX and Galaxy Digital rather than exchanges, suggesting long-term holding intent. As Vitalik Buterin recently noted, "ETH treasuries serve dual purposes now - both as a store of value and as access vehicles for institutional investors."

Fusaka Upgrade: Ethereum's Next Major Milestone

The ethereum Foundation is laser-focused on delivering the Fusaka upgrade by Q4 2025, with Co-Executive Director Tomasz K. Stańczak publicly urging developers to prioritize it over the subsequent Glamsterdam hard fork. Fusaka builds on May's Pectra enhancements and promises critical technical improvements for scalability.

Why does this matter for price? History shows ETH tends to rally in the 3-6 months preceding major network upgrades as:

- Developers increase activity and publicity

- Investors price in expected improvements

- Staking demand grows in anticipation

Stańczak's blunt warning - "No amount of talking about Ethereum's vision matters if we miss schedules" - reveals the high stakes. Timely delivery could cement ETH's lead in the smart contract platform race, while delays might open doors for competitors.

Ethereum Price Predictions: 2025 Through 2040

Analysts are sharply divided on how high ETH can go, reflecting different assumptions about adoption rates, regulatory clarity, and macroeconomic conditions. Here's a comparison of conservative versus bullish scenarios:

| Year | Conservative | Bull Case | Key Catalysts |

|---|---|---|---|

| 2025 | $6,800 | $16,000 | ETF approvals, Fusaka upgrade |

| 2030 | $25,000 | $48,000 | Enterprise adoption, DeFi 3.0 |

| 2035 | $90,000 | $210,000 | Tokenized real-world assets |

| 2040 | $300,000 | $750,000 | Global settlement layer status |

BitMine's Tom Lee stands at the bullish extreme with his $16K 2025 target, while Standard Chartered takes a more measured $4K year-end approach. The truth likely lies somewhere in between, depending on how quickly institutional adoption progresses and whether Ethereum can maintain its developer lead.

ETH Staking Boom: 36M Coins Locked and Counting

The staking narrative has become central to Ethereum's value proposition, with over 36 million ETH (30% of supply) now locked in staking contracts. This creates natural buy pressure as:

- Institutions seek yield in a low-interest world

- Staked ETH gets removed from circulating supply

- SEC clarity on staking reduces regulatory uncertainty

Interestingly, the SEC recently clarified that certain staking receipt tokens don't constitute securities under the 1933 Act - a green light for more institutional participation. Platforms report surging demand for staking products, with some offering institutional-grade solutions featuring insurance and tax optimization.

Ethereum vs. Competitors: Maintaining the Lead

While projects like BlockDAG innovate with features like live trading dashboards, Ethereum continues dominating developer mindshare and institutional flows. Key advantages include:

- Network Effects: 400+ projects built monthly vs. competitors' dozens

- Security: $40B+ market cap provides unparalleled security budget

- Roadmap: Clear scalability path through Fusaka and beyond

That said, Ethereum can't rest on its laurels. The same institutional demand driving price appreciation also brings higher expectations for performance, governance, and regulatory compliance. The next 12 months will be crucial for proving Ethereum can scale while maintaining decentralization.

FAQs: Ethereum Price Prediction 2025

What is the Ethereum price prediction for 2025?

Analysts predict Ethereum could reach between $6,800 (conservative) and $16,000 (bull case) by end of 2025, driven by institutional adoption, ETF inflows, and the Fusaka upgrade. The BTCC team notes current technicals suggest a 70% probability of sustained upside momentum.

Why is Ethereum price going up?

Ethereum's price surge stems from three factors: 1) Institutional accumulation (over $11B in corporate treasuries), 2) Technical breakout above key moving averages, and 3) Anticipation of the Fusaka upgrade. Network activity also hit record highs with 1.74M daily transactions.

What is the highest Ethereum can go?

Long-term projections vary wildly, but some analysts suggest $750,000 by 2040 if Ethereum becomes the global settlement layer. More immediately, Tom Lee's $16K 2025 target represents the bullish case, while Standard Chartered forecasts $4K year-end.

Is Ethereum a good investment in 2025?

While past performance doesn't guarantee future results, Ethereum shows strong fundamentals in 2025 with institutional adoption accelerating and network upgrades progressing. However, crypto remains volatile - the BTCC team recommends proper position sizing and risk management.

How high can Ethereum go after the Fusaka upgrade?

Historically, ETH prices tend to rally 3-6 months before major upgrades as investors price in improvements. If Fusaka delivers on its scalability promises without delays, some analysts project it could propel ETH toward $10K-$16K ranges.

What are the key support levels for Ethereum?

Key support zones to watch are $3,700-$3,750 (recent consolidation) and $3,200-$3,400 (institutional buying area). The $2,900-$3,000 level serves as stronger support should macroeconomic conditions worsen.