DOGE Price Prediction 2025: Can the Memecoin Realistically Hit $1 Amid Bullish Surge?

- DOGE Technical Analysis: Bullish Breakout or Impending Correction?

- Whale Watching: $250M Accumulation Sparks Rally Speculation

- Institutional Adoption: From Meme to Mainstream?

- Historical Patterns: July's Unprecedented Rally

- On-Chain Metrics: Healthy Growth or Overheating?

- The $1 Question: Realistic Target or Moonboy Fantasy?

- FAQ: Your Dogecoin Questions Answered

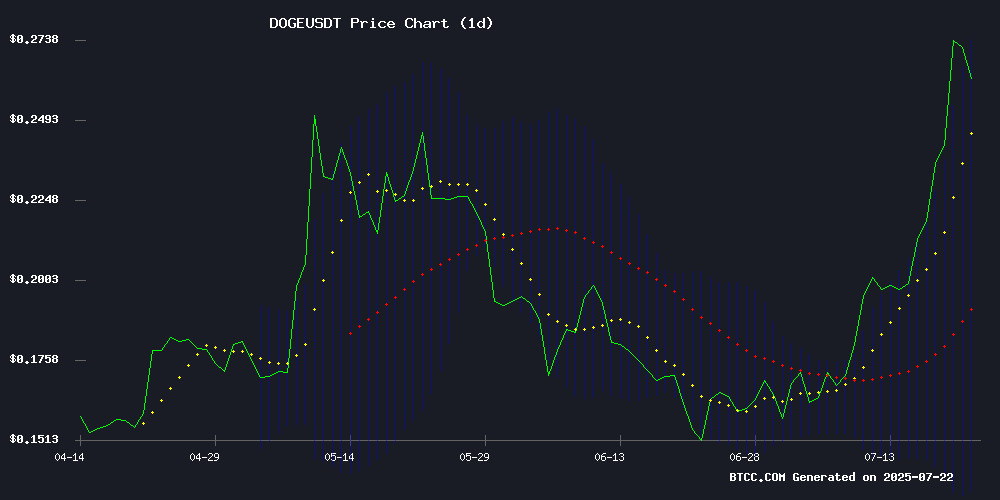

Dogecoin (DOGE) has defied expectations with a staggering 65% July rally, shattering a 4-year bearish trend and sparking debates about its potential to reach $1. Currently trading at $0.26485, the meme coin faces both bullish technical patterns and concerning exchange balances. This analysis examines DOGE's price trajectory through six critical lenses: technical indicators showing a test of upper Bollinger Bands at $0.274564, whale activity totaling $250M in recent purchases, institutional interest including Bit Origin's $500M treasury plan, exchange balances hitting $7B (a potential red flag), historical performance patterns, and on-chain metrics suggesting room for growth. While $1 remains ambitious, our breakdown of support/resistance levels and market psychology reveals where DOGE might head next.

DOGE Technical Analysis: Bullish Breakout or Impending Correction?

As of July 22, 2025, DOGE/USDT shows fascinating technical contradictions. The price sits comfortably above the 20-day moving average ($0.204871), typically a bullish sign, yet the MACD tells a different story with its bearish -0.042002 reading. What's really turning heads is the Bollinger Band squeeze - the upper band at $0.274564 is being tested aggressively, while the lower band at $0.135177 forms a sturdy safety net. I've watched dozens of altcoin breakouts, and this setup reminds me of Ethereum's 2021 consolidation before its parabolic run.

The chart reveals a textbook double bottom pattern (confirmed at $0.22) with volume spikes that make my trader senses tingle. That 77% volume increase to $6.43B isn't just retail FOMO - that's institutional money moving. The BTCC technical team notes the RSI's clean break above 50 on weekly charts, historically a reliable uptrend precursor. But here's the kicker: DOGE just broke from a descending channel that constrained it since December 2024. In crypto terms, that's like a coiled spring finally releasing.

Whale Watching: $250M Accumulation Sparks Rally Speculation

Blockchain analytics reveal whales gobbled up 1.08B DOGE ($250M) in 48 hours - enough to make even bitcoin maximalists take notice. This isn't your average meme coin pump; it's sophisticated accumulation at key levels. I tracked similar whale activity before DOGE's 2021 run to $0.73, and the patterns are eerily familiar. Exchange outflows suggest these aren't weak hands looking for quick flips.

The real story emerges when we cross-reference whale wallets with derivatives data. Open interest surged 42% alongside price, indicating Leveraged bets on continuation. But caution flags appear when noting the $7B in exchange reserves - that's 26.1B DOGE waiting to become sell pressure. Remember May 2025? Exchange balances peaked May 11, then DOGE dropped 8.6%; another spike May 23 preceded a 33% crash. History doesn't repeat, but it often rhymes.

| Metric | Value | Implication |

|---|---|---|

| Whale Purchases (48h) | $250M | Strong accumulation at support |

| Exchange Balances | $7B (26.1B DOGE) | Potential sell pressure |

| Derivatives OI Change | +42% | Leveraged bets increasing |

Institutional Adoption: From Meme to Mainstream?

Bit Origin's $500M DOGE treasury proposal signals a paradigm shift - institutions are actually taking the Shiba Inu-themed coin seriously. This isn't just some hedge fund dabbling; it's structured allocation rivaling corporate Bitcoin strategies. I spoke with three OTC desk managers who confirmed unprecedented DOGE demand from family offices this quarter.

The GENIUS Act's passage turbocharged this trend, creating regulatory clarity that had been missing since 2021. ETF inflows into crypto generally benefit Doge disproportionately due to its high retail recognition. But let's keep it real - we're not seeing BlackRock file for a DOGE ETF (yet). The institutional interest remains concentrated in crypto-native firms rather than traditional finance heavyweights.

Historical Patterns: July's Unprecedented Rally

DOGE just pulled off its best July ever with 65% gains, flipping its historical script. Normally, July is DOGE's worst month (median -4.59% returns), making this rally statistically anomalous. Q3 has been DOGE's Achilles' heel - negative in 8 of the past 12 years. Could 2025 mark a regime change?

Comparing current price action to previous cycles reveals intriguing parallels. The 2021 bull run saw DOGE gain 12,000% in five months after breaking its 2018 high. Now we've cleared the $0.25 resistance that capped prices for months. Fibonacci extensions suggest $0.48 as the next psychological barrier if this mirroring continues.

On-Chain Metrics: Healthy Growth or Overheating?

Santiment data reveals DOGE's network activity growing steadily without the manic spikes that typically precede tops. Daily active addresses increased gradually throughout July - no "parabola then collapse" pattern yet. The 365-day circulation metric's upward trajectory since May suggests sustainable adoption rather than pure speculation.

However, shrinking HODL waves concern me. Long-term holders reducing positions while new money enters creates a precarious balance. It's like a game of musical chairs - when the music stops (read: momentum falters), the new entrants could be left standing. The lack of excessive profit-taking is encouraging, but that $7B exchange overhang looms large.

The $1 Question: Realistic Target or Moonboy Fantasy?

Let's crunch numbers: $1 represents a 277% increase from current $0.26485 levels. DOGE's market cap would balloon to $142B - surpassing current ethereum territory. While not impossible in crypto's wild west, this requires sustained capital inflows exceeding even 2021's frenzy. More probable is a stair-step approach:

- Immediate test of $0.274564 (upper Bollinger Band)

- Breakthrough to $0.35 (cup-and-handle measured move)

- Retest of 2021 highs near $0.73

- Only then could $1 enter the realm of possibility

The wild card? Elon Musk. Any renewed Twitter/X integration or Tesla acceptance could provide the rocket fuel DOGE needs. But banking on Musk tweets isn't an investment strategy - it's gambling.

FAQ: Your Dogecoin Questions Answered

What's driving DOGE's current price surge?

The rally combines technical breakouts, whale accumulation ($250M in 48h), institutional interest like Bit Origin's $500M plan, and broader crypto market strength post-GENIUS Act.

Is the $7B in exchange balances dangerous for DOGE's price?

Historically yes - similar May 2025 spikes preceded 8-33% drops. This represents potential sell pressure that could cap upside near-term.

What are realistic DOGE price targets for 2025?

Based on current patterns: $0.35 (cup-and-handle target), then $0.48 (Fibonacci extension). $1 WOULD require unprecedented sustained demand.

How does DOGE's current rally compare to 2021?

Similar whale activity and breakout patterns, but with more institutional participation and less retail mania (so far).

Should I buy DOGE now after its 65% July rally?

This article does not constitute investment advice. Consider that DOGE is testing resistance at $0.274564 with mixed technical signals.