XRP Price Prediction 2025: How High Can XRP Surge Amid ETF Buzz and Technical Breakout?

- Is XRP Primed for a Technical Breakout or Breakdown?

- Why Franklin Templeton's ETF Move Changes Everything

- Ripple's Business Blitzkrieg: More Than Just Payments Now

- XRP Price Targets: The Road to $3 and Beyond

- XRP Price Prediction Q&A

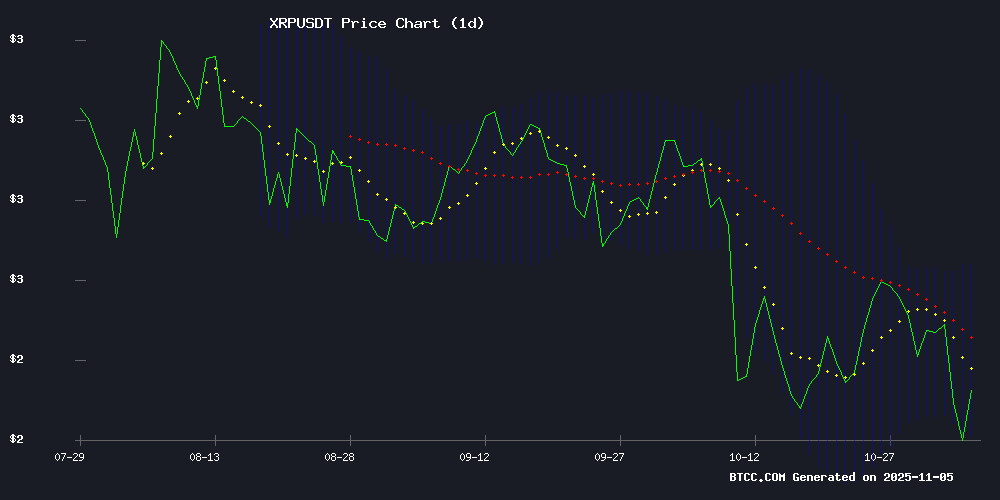

XRP is currently dancing between bullish fundamentals and bearish technicals in what could be the most pivotal moment for the token since its 2020 SEC lawsuit. Trading at $2.2292, the digital asset finds itself caught between institutional adoption (Franklin Templeton's aggressive ETF push) and short-term selling pressure (below its 20-day MA). Our analysis suggests we're looking at a coiled spring - with potential targets at $2.70 if resistance breaks or $2.19 if support fails. The real fireworks begin if XRP can conquer the $3.00 psychological barrier, especially with Ripple's expanding ecosystem adding rocket fuel to the fundamental case.

Is XRP Primed for a Technical Breakout or Breakdown?

Right now, XRP is giving traders whiplash with its contradictory signals. The token's trading below its 20-day moving average ($2.4493) like a boxer leaning on the ropes, but that lower Bollinger Band at $2.1959 keeps catching it like a trusty corner man. The MACD's showing -0.0332 - not exactly a cheerleader's pom-pom wave, but the histogram's flattening suggests the bears might be losing their grip. "What we're seeing is classic consolidation before a major move," notes a BTCC market strategist. "The $2.19-$2.70 range has become XRP's wrestling ring, and the first fighter to throw the other through the ropes will dictate our next trend." Volume tells an interesting story too - that $25 billion surge wasn't just retail FOMO; institutional players are clearly positioning themselves.

"What we're seeing is classic consolidation before a major move," notes a BTCC market strategist. "The $2.19-$2.70 range has become XRP's wrestling ring, and the first fighter to throw the other through the ropes will dictate our next trend." Volume tells an interesting story too - that $25 billion surge wasn't just retail FOMO; institutional players are clearly positioning themselves.

Why Franklin Templeton's ETF Move Changes Everything

Franklin Templeton just pulled an 8(a) clause disappearing act that WOULD make Houdini proud. By removing this standard SEC delay mechanism from their XRP ETF filing, they've essentially declared "we're ready when you are" to regulators. This isn't just paperwork - it's a full-throated bet that the SEC's anti-crypto stance is thawing faster than a New York snowman in April. The implications? Massive. We're talking about the same firm that manages $1.5 trillion giving XRP the institutional equivalent of a bear hug. Their amended filing now allows automatic effectiveness upon meeting conditions - Wall Street speak for "we've got the green light waiting at the traffic light." This comes as Ripple's own ecosystem expands...

Ripple's Business Blitzkrieg: More Than Just Payments Now

While traders obsess over price charts, Ripple's been quietly assembling a crypto Voltron:

- Ripple Prime Launch: Their new institutional brokerage service (powered by the Hidden Road acquisition) now offers OTC trading in XRP and RLUSD - that's your hedge funds and family offices covered

- Palisade Acquisition: This custody play gives Ripple the secure vaults needed for serious institutional money. $1.25 billion doesn't lie - they're building for the long haul

- US Market Push: Despite the regulatory shadowboxing, they've opened spot trading for US institutions. That's either crazy or brilliant - history will decide

XRP Price Targets: The Road to $3 and Beyond

| Price Level | Significance | Probability |

|---|---|---|

| $2.1959 | Lower Bollinger Band Support | High |

| $2.4493 | 20-day MA Resistance | Medium |

| $2.7027 | Upper Bollinger Band Target | Medium |

| $3.0000 | Psychological Resistance | Low-Medium |

Here's the kicker - we're not just trading charts anymore. The ETF potential alone could repaint every technical level on the screen. Remember when Bitcoin's ETF approval turned $42K into support overnight? XRP could see similar alchemy if Franklin Templeton gets its way. That said, the SEC remains the elephant in the room - until we get clearer regulatory signals, volatility will remain the only certainty.

XRP Price Prediction Q&A

What's the most important support level for XRP currently?

The $2.1959 lower Bollinger Band is acting as critical support - it's held through three separate tests in November 2025, creating what traders call a "triple bottom" pattern. A breakdown below this could see XRP testing the $2.00 psychological level.

How significant is Franklin Templeton's ETF filing change?

Removing the 8(a) clause is like a restaurant taking down the "Coming Soon" sign and putting out the "Open" placard - it signals they believe approval is imminent rather than speculative. This mirrors the exact strategy bitcoin ETF issuers used before their January 2024 approvals.

Does Ripple's business expansion directly affect XRP price?

Indirectly but powerfully. More institutional usage through Ripple Prime means greater XRP utility, while the Palisade acquisition provides the custody infrastructure needed for large-scale adoption. Think of it as building the highways before the traffic arrives.

What would trigger a breakout above $2.70 resistance?

Three factors: 1) Clear ETF approval progress (SEC comments or deadlines) 2) Bitcoin leading a broader market rally 3) Sustained volume above $10 billion daily. The 20-day MA at $2.44 needs to flip from resistance to support first.

Is the $3.00 target realistic by year-end 2025?

With current catalysts, it's plausible but not guaranteed. The math works if XRP captures just 10% of the inflows that Bitcoin ETFs received post-approval ($2.9B in first month). However, regulatory uncertainty remains the wild card that could delay this timeline.