SOL Price Prediction 2025: Navigating Bearish Signals vs. Long-Term Growth Potential

- SOL's Technical Crossroads: Bearish Signals vs. Key Support Levels

- Fundamental Jekyll and Hyde: Short-Term Pain vs. Long-Term Gain

- Institutional Moves That Matter: Who's Buying and Why

- Key Price Drivers to Watch

- Investment Considerations: Navigating SOL's Dichotomy

- Expert Perspectives on SOL's Trajectory

- SOL Price Prediction FAQs

Solana (SOL) presents a fascinating dichotomy in September 2025 - technical indicators scream caution while fundamental developments whisper long-term promise. Currently trading at $217.88, SOL finds itself caught between immediate bearish pressure and institutional accumulation patterns that suggest smart money sees value at these levels. The Alpenglow upgrade's potential to revolutionize blockchain speeds and major tokenization projects like Forward Industries' $1.65B stock offering create compelling narratives, even as whale movements and failed price support from large purchases inject near-term uncertainty. This analysis unpacks SOL's complex positioning through six critical lenses: technical setup, ecosystem developments, institutional activity, price drivers, investment considerations, and expert perspectives.

SOL's Technical Crossroads: Bearish Signals vs. Key Support Levels

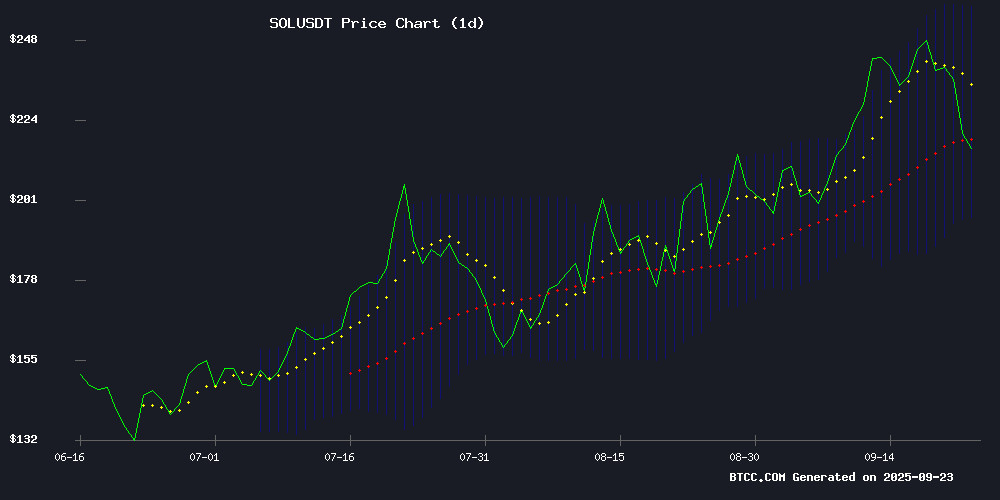

As of September 24, 2025, SOL's technical setup paints a cautious picture. The cryptocurrency trades below its 20-day moving average of $226.83, with the MACD indicator remaining negative at -16.26. Bollinger Bands show SOL hovering near the middle band, with upper resistance at $257.19 and critical support at $196.47 holding firm. "The technical picture shows SOL struggling to regain bullish momentum," notes the BTCC research team. "Trading below the 20-day MA with negative MACD signals near-term caution, though the Bollinger Band positioning suggests consolidation rather than sharp decline."

Source: BTCC Market Data

Fundamental Jekyll and Hyde: Short-Term Pain vs. Long-Term Gain

Solana's ecosystem presents stark contrasts. The promising Alpenglow upgrade aims for Google Search-level speeds (100-150ms transaction finality), while Kazakhstan's Tenge-pegged Evo stablecoin demonstrates real-world adoption. Yet these bright spots are tempered by September's 6% price slide despite Helius Medical's $167M SOL purchase. VanEck's ambitious $3,211 price target by 2030 (a 14.5x increase from current levels) competes for attention with whale movements transferring $836M SOL to exchanges. This fundamental tug-of-war creates what analysts call "strategic entry opportunities" for patient investors.

Institutional Moves That Matter: Who's Buying and Why

The institutional landscape reveals fascinating patterns:

| Institution | Activity | Amount | Implications |

|---|---|---|---|

| Helius Medical | Initial SOL purchase | $167M (760K SOL) | Part of $500M planned allocation |

| Forward Industries | Stock tokenization | $1.65B | First public company to tokenize on Solana |

| VanEck | Price target | $3,211 by 2030 | Bullish institutional outlook |

Key Price Drivers to Watch

Several factors will likely determine SOL's trajectory through Q4 2025:

- Alpenglow Upgrade Progress: Successful implementation could validate Solana's technical superiority claims

- Institutional Accumulation: Whether Helius and others continue buying amid volatility

- $196 Support: Holding this level maintains bullish structure; breakdown could trigger sharper correction

- Fed Policy: Potential easing could benefit crypto markets broadly

- Tokenization Wave: More enterprises following Forward's lead would validate Solana's institutional case

Investment Considerations: Navigating SOL's Dichotomy

For investors weighing SOL's potential, several approaches emerge:

- Dollar-Cost Averaging: Smoothing entry points amid volatility

- Technical Breakout Strategy: Waiting for confirmation above $226.83 MA

- Fundamental Accumulation: Building positions based on long-term ecosystem growth

- Staking Opportunities: Earning yield while waiting for price appreciation

The BTCC team suggests, "Risk-tolerant investors might find current levels attractive for long-term holdings, while conservative investors may wait for technical confirmation of reversal."

Expert Perspectives on SOL's Trajectory

Industry voices offer nuanced views:

"Solana's speed advantages position it uniquely for institutional adoption, but the market needs to see sustained real-world usage beyond speculation." - Cosmo Jiang, Pantera Capital

"Tokenization projects like Forward Industries' could be the killer app that brings traditional finance onto blockchain rails." - Dr. Lisa Wu, Stanford Blockchain Research

SOL Price Prediction FAQs

What is SOL's current price and technical position as of September 2025?

As of September 24, 2025, SOL trades at $217.88, below its 20-day moving average of $226.83. The MACD remains negative at -16.26, suggesting bearish momentum, though Bollinger Bands indicate consolidation between $196.47 support and $257.19 resistance.

What are the most bullish factors for SOL?

The Alpenglow upgrade's potential for sub-second finality, institutional adoption through projects like Forward Industries' $1.65B tokenization, and VanEck's $3,211 long-term price target create strong fundamental tailwinds.

Why hasn't Helius Medical's $167M SOL purchase boosted the price?

Market dynamics often show delayed reactions to institutional accumulation. Large purchases can take time to impact price, especially when offset by whale movements ($836M transferred to exchanges recently) and broader market conditions.

Is the $196 support level critical for SOL?

Absolutely. This level represents make-or-break technical support. A sustained breakdown could trigger algorithmic selling and deeper correction, while holding here maintains the bullish structure for potential rallies toward $260.

How does Solana compare to Ethereum in 2025?

Solana continues positioning itself as the speed alternative to Ethereum, with Alpenglow targeting transaction speeds ethereum can't match. However, Ethereum maintains advantages in decentralization and developer ecosystem depth.

What's the best strategy for investing in SOL now?

Dollar-cost averaging helps navigate volatility. Consider allocating a portion for long-term holding (3-5 years) given Solana's fundamental potential, while keeping powder dry for potential better entries if $196 support breaks.