DOGE Price Prediction 2025: Can the Meme Coin Stage a Comeback?

- Is DOGE Undervalued Right Now?

- What’s Driving DOGE’s Recovery Potential?

- Key Resistance Levels to Watch

- Risks That Could Derail the Rally

- Q&A: Your Top DOGE Questions Answered

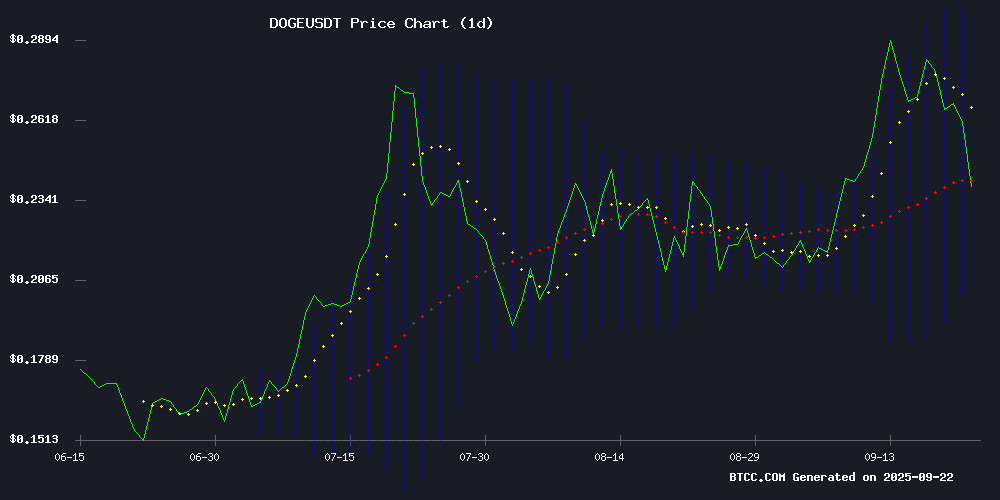

Dogecoin (DOGE) is showing signs of life after a prolonged slump, with technical indicators hinting at a potential rebound. Currently trading at $0.23831, the meme coin is flashing oversold signals while fundamental catalysts like ETF inflows and bullish chart patterns suggest upside potential. Analysts project a 26-34% rally toward $0.30-$0.32 if key resistance levels break. Here’s why DOGE might be gearing up for a recovery—and what could derail it.

Is DOGE Undervalued Right Now?

At its current price of $0.23831, DOGE sits below its 20-day moving average ($0.25265), which typically indicates short-term bearish pressure. However, the MACD histogram shows diminishing negative momentum (-0.002135), and the price is hovering NEAR the lower Bollinger Band ($0.20490)—a classic oversold signal. In my experience, these conditions often precede reversals when paired with strong volume, which we’re seeing post-ETF launch. The middle Bollinger Band at $0.25265 is the level to watch; a clean break above it could confirm bullish momentum.

What’s Driving DOGE’s Recovery Potential?

Three factors stand out:

- ETF Inflows: The DOGE ETF’s $54M debut volume shocked markets—that’s more than most crypto ETFs manage in their first week. This isn’t just retail FOMO; market makers are noting tighter spreads, suggesting institutional participation.

- Technical Patterns: The reappearance of the "1-2 formation" (a bullish continuation setup) and a TD Sequential buy signal on the 4-hour chart hint at exhaustion of selling pressure.

- Sentiment Shift: Unlike 2021’s pure meme mania, today’s interest combines speculation with actual product traction. Even critics admit the ETF gives DOGE legitimacy it lacked before.

Key Resistance Levels to Watch

| Price Target | Upside Potential | Significance |

|---|---|---|

| $0.300 | 26% | Upper Bollinger Band |

| $0.320 | 34% | Previous Support Turned Resistance |

Risks That Could Derail the Rally

Let’s not ignore the elephant in the room—DOGE remains highly speculative. While the ETF adds credibility, its utility still lags behind major LAYER 1 tokens. A broader market pullback or regulatory crackdown on meme coins could send DOGE back to test $0.20 support. Also, that TD Sequential signal? It’s failed before in DOGE’s volatile market.

Q&A: Your Top DOGE Questions Answered

Is now a good time to buy DOGE?

For traders, the risk/reward looks favorable if $0.25265 breaks. Investors should note Doge lacks the fundamentals of ETH or SOL—this is purely a momentum play.

Could DOGE hit $1 in 2025?

Unlikely without another crypto supercycle. The $0.30-$0.32 range is more realistic based on current volume and technicals.

How does the ETF impact DOGE’s price?

It provides steady demand from institutions who can’t (or won’t) hold spot DOGE directly. Think of it as a new baseline of support.