BTC Price Forecast 2025-2040: Expert Analysis & Market Projections

- What's Driving Bitcoin's Current Price Action?

- How Are Institutional Players Shaping Bitcoin's Future?

- What Macroeconomic Factors Could Impact BTC?

- Are Bitcoin ETFs Becoming the Tail That Wags the Dog?

- What Do On-Chain Metrics Reveal About BTC's Health?

- BTC Price Forecast: 2025-2040 Projections

- Frequently Asked Questions

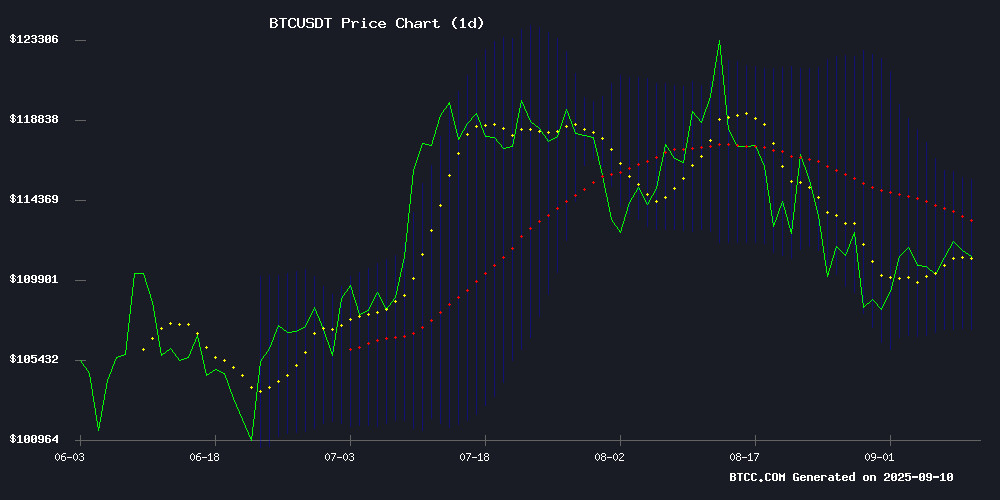

As we navigate through September 2025, bitcoin continues to demonstrate remarkable resilience, currently trading at $112,569.76 with bullish technical indicators. This comprehensive analysis examines BTC's price trajectory through 2040, incorporating institutional adoption trends, macroeconomic factors, and on-chain metrics. From corporate treasury strategies to ETF inflows and the evolving regulatory landscape, we break down the key drivers that could propel Bitcoin to new heights or present temporary roadblocks. Our forecast models present conservative, moderate, and bullish scenarios based on current market dynamics, technological developments, and historical patterns.

What's Driving Bitcoin's Current Price Action?

Bitcoin's current stability above $112,000 reflects a fascinating tug-of-war between institutional accumulation and macroeconomic uncertainty. The cryptocurrency has established solid support at $107,175.54 while facing resistance near $113,200. Technical indicators paint a mixed but generally optimistic picture - the price holding above both the 20-day moving average ($111,404.61) and middle Bollinger Band suggests underlying strength, though the MACD's negative reading (-1,115.30) hints at near-term consolidation.

Source: BTCC Market Data

How Are Institutional Players Shaping Bitcoin's Future?

The institutional Bitcoin adoption narrative gained substantial momentum in 2025, with several landmark developments:

- Metaplanet's ¥212.9 billion Bitcoin acquisition signaled Japanese corporations embracing BTC treasury strategies

- GameStop's surprise $528.6 million Bitcoin holdings revealed in Q2 earnings shocked traditional markets

- Asset Entities' transformation into a Bitcoin-focused treasury company (Strive, Inc.) with $750 million funding plans

These moves create structural demand that could cushion Bitcoin against retail investor whims. The BTCC research team notes, "Corporate treasury adoption has evolved from novelty to necessity for forward-thinking companies."

What Macroeconomic Factors Could Impact BTC?

Cryptocurrency markets currently hold their breath ahead of two critical events:

| Event | Date | Market Expectations | Potential BTC Impact |

|---|---|---|---|

| U.S. CPI Data | September 2025 | 3.2% YoY inflation | High volatility trigger |

| Fed Rate Decision | September 2025 | 82% chance of 25bps cut | Potential bullish catalyst |

The 10-Year Treasury spread's potential flip bears watching - historically, this precedes equity downturns that could drag crypto markets down through their 0.76 correlation coefficient with the S&P 500.

Are Bitcoin ETFs Becoming the Tail That Wags the Dog?

Spot Bitcoin ETFs recorded $364.3 million inflows on Monday alone, surpassing last week's four-day total. BlackRock's IBIT led with $169.5 million, creating an unusual dynamic where ETF demand potentially drives spot markets rather than vice versa. Santiment data shows this divergence from typical patterns where retail investors usually lead such movements.

What Do On-Chain Metrics Reveal About BTC's Health?

Blockchain analytics uncover several noteworthy trends:

- Whale activity on Binance cooled significantly (Exchange Whale Ratio dropped from 0.55 to 0.28)

- Supply redistribution from 1,000+ BTC wallets to 100-1,000 BTC holders suggests institutional custody migration

- Germany's dormant $5 billion in seized BTC creates potential future supply shock

These metrics suggest reduced immediate sell pressure but highlight the market's sensitivity to large holder movements.

BTC Price Forecast: 2025-2040 Projections

Our analysis incorporates technical indicators, adoption curves, and halving cycles to present three scenarios:

| Year | Conservative | Moderate | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $135,000 | $165,000 | $210,000 | ETF adoption, halving effects |

| 2030 | $350,000 | $550,000 | $850,000 | Institutional allocation, scarcity premium |

| 2035 | $800,000 | $1.2M | $2.0M | Global reserve asset status |

| 2040 | $1.5M | $2.8M | $5.0M | Network effects, digital gold narrative |

The moderate 2030 projection of $550,000 assumes Bitcoin captures approximately 10% of the global store-of-value market. Our bullish 2040 scenario ($5M) factors in hyperbitcoinization scenarios where BTC becomes the dominant global reserve asset.

Frequently Asked Questions

What's the most realistic Bitcoin price prediction for 2025?

Our moderate forecast suggests $165,000 by year-end 2025, based on current ETF inflow rates, institutional adoption trends, and post-halving supply dynamics. However, macroeconomic conditions could significantly impact this projection.

How reliable are long-term Bitcoin price forecasts?

While historical patterns and mathematical models provide frameworks, cryptocurrency markets remain highly speculative. Forecasts beyond 5 years should be viewed as directional indicators rather than precise predictions, as they can't account for black swan events or regulatory changes.

What could derail Bitcoin's bullish trajectory?

Potential risks include: 1) Regulatory crackdowns in major economies, 2) Catastrophic technical failures, 3) Emergence of superior blockchain technology, 4) Prolonged global recession reducing risk appetite, and 5) Central bank digital currencies crowding out crypto.

Why do analysts disagree so much on BTC's future price?

Price models vary based on assumptions about adoption curves, monetary inflation, competitor cryptocurrencies, and whether Bitcoin achieves "digital gold" status. Disagreements often stem from different weightings of these factors rather than data discrepancies.

How does the Fed's monetary policy affect Bitcoin?

Bitcoin has shown mixed correlation with monetary policy - it sometimes behaves as an inflation hedge but often trades with risk assets. Currently, rate cuts could boost BTC by increasing liquidity, while hikes might pressure prices temporarily until inflation narratives dominate.