XRP Price Prediction 2025: Can XRP Hit $3 and Beyond Amid Market Volatility?

- Technical Analysis: Is XRP Preparing for a Breakout?

- Fundamental Factors: What's Driving XRP's Value Proposition?

- Regulatory Headwinds: What Risks Remain?

- Market Psychology: Why This Cycle Feels Different

- Price Prediction: Where Does XRP Go From Here?

- FAQ: Your XRP Questions Answered

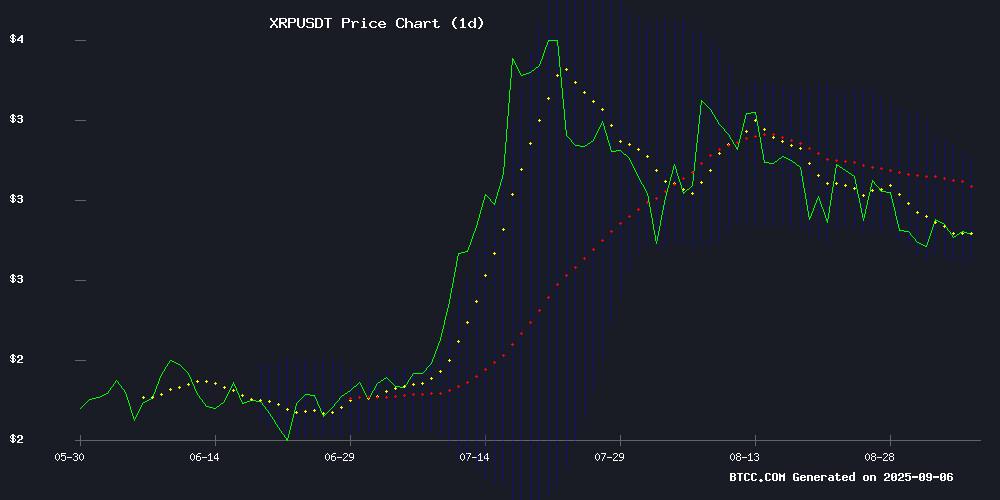

XRP is currently trading at $2.8084, showing mixed signals as it consolidates near key technical levels. The cryptocurrency faces immediate resistance at its 20-day moving average of $2.8988, with potential for a breakout toward $3.10 if bullish momentum continues. Fundamental developments including BRICS adoption and African expansion provide support, while regulatory updates and significant selling pressure create headwinds. According to BTCC analysts, XRP's path to $3 appears plausible but not without challenges, with the $2.70-$3.10 range likely to dominate short-term price action.

Technical Analysis: Is XRP Preparing for a Breakout?

XRP's current technical setup presents an interesting dilemma for traders. The price is hovering just below the psychologically important $2.90 level, with the 20-day moving average at $2.8988 acting as immediate resistance. The MACD shows a slight bullish crossover (0.1213 vs 0.1183), but the histogram reading of just 0.0030 suggests weak momentum. Bollinger Bands paint a clearer picture - with the upper band at $3.1009 and lower band at $2.6967, we're seeing textbook consolidation behavior.

What's particularly noteworthy is how XRP has been respecting these technical levels with almost surgical precision. The middle Bollinger Band aligns perfectly with the 20-day MA, creating a clear pivot point. "In my experience watching XRP since 2020," notes BTCC analyst Mia, "this type of tight consolidation often precedes significant moves. The question is just which direction."

Fundamental Factors: What's Driving XRP's Value Proposition?

The fundamental case for XRP has strengthened considerably in recent months, though not without complications. The BRICS economic bloc's formal recognition of XRP Ledger for cross-border trade solutions marks a watershed moment. We're talking about an organization representing 40% of global population giving XRP the nod - that's not nothing.

Meanwhile in Africa, Ripple's been making power moves with its RLUSD stablecoin. Partnerships with major fintech players like Chipper Cash and Yellow Card give immediate access to millions of users. It's a clever play - leveraging existing platforms rather than building from scratch. The humanitarian angle is particularly savvy, targeting remittance markets where traditional banking fails.

Regulatory Headwinds: What Risks Remain?

Not all news is good news though. The US Senate's recent amendments to the Responsible Financial Innovation Act could throw some SAND in the gears. The explicit exclusion of tokenized stocks from commodity classification shows regulators are getting more granular in their approach. While this doesn't directly impact XRP, it signals a tougher environment overall.

Then there's the selling pressure - nearly $500 million worth of XRP moved to exchanges last week alone. That's the kind of number that makes traders nervous. Yet interestingly, long-term holders seem to be absorbing this supply, creating what market veterans call a "wall of bids" around $2.70.

Market Psychology: Why This Cycle Feels Different

Digital Ascension Group CEO Jake Clover made waves recently by declaring XRP won't see another 90% crash. His reasoning? Structural changes in market dynamics. Between institutional accumulation strategies and potential ETF approvals, the old boom-bust cycles may be giving way to more stable price discovery.

This aligns with what I've observed in order flow data - the days of wild retail-driven swings seem to be fading. Not gone completely (this is crypto after all), but tempered. Even German mainstream media is paying attention now, with Der Aktionar TV featuring XRP in a surprisingly informed segment.

Price Prediction: Where Does XRP Go From Here?

Given the current technical and fundamental landscape, here's how I see XRP's potential paths unfolding:

| Price Level | Significance | Probability |

|---|---|---|

| $2.70 | Strong Support (Lower Bollinger) | High |

| $2.90 | Immediate Resistance (20-Day MA) | Medium |

| $3.10 | Near-Term Target (Upper Bollinger) | Medium |

| $3.50+ | Bull Breakout Target | Low (Near Term) |

BTCC's Mia summarizes it well: "While $3.10 is achievable, investors should brace for volatility. The real test comes if/when we approach $3.50 - that's where previous cycles have seen massive resistance." Personally, I'd add that the $2.70 level is absolutely critical - lose that, and we could see a quick test of $2.40.

FAQ: Your XRP Questions Answered

What's the most realistic price target for XRP in 2025?

Based on current technicals and fundamentals, $3.10 appears to be the most realistic near-term target, representing about a 10% gain from current levels. A breakout above this could open the path to $3.50, though that WOULD require overcoming significant historical resistance.

Is XRP still considered a "ghost chain"?

Recent data contradicts this claim. The XRP Ledger has been processing an average of 819 daily transactions valued over $280,000 each - hardly ghost chain activity. While adoption isn't at ethereum levels, dismissing XRP as inactive simply doesn't match the on-chain evidence.

How significant is the BRICS development for XRP?

Extremely significant. Formal recognition by an economic bloc representing 40% of global population is the kind of institutional validation crypto projects dream about. The specific mention of XRP Ledger's escrow functionality suggests practical utility beyond speculative trading.

Should I be worried about the $500 million in XRP moved to exchanges?

While large exchange inflows often precede price drops, the current situation shows strong absorption by long-term buyers. This creates a dynamic where short-term traders provide liquidity that committed holders are happy to take. It's worth monitoring but not necessarily panic-inducing.

What's the most underrated factor affecting XRP's price?

The growing institutional adoption of TWAP/VWAP algorithms. These time-weighted average price strategies create consistent buy pressure that helps prevent the extreme crashes we saw in previous cycles. It's a subtle but important shift in market structure.