BTC Price Prediction 2025: Will Bitcoin Hold the $110,500 Pivot Point?

- What's Driving Bitcoin's Price Action in Late August 2025?

- How Significant Is the $110,500 Level for Bitcoin?

- What Are the Key Technical Indicators Saying?

- How Strong Are Bitcoin's Fundamentals Right Now?

- What Are the Risks to Bitcoin's Price Outlook?

- How Are Institutions Positioning in Bitcoin?

- What's the Historical Context for Bitcoin's Current Position?

- What Are Analysts Saying About Bitcoin's Outlook?

- Frequently Asked Questions

Bitcoin finds itself at a critical juncture in late August 2025, testing key support levels while institutional adoption continues to grow. This analysis examines BTC's technical positioning near $110,500, explores fundamental drivers including a $3 billion corporate accumulation plan, and assesses whether current market conditions present a buying opportunity or signal caution. With bitcoin ETFs nearing gold ETF AUM levels and technical indicators showing mixed signals, traders face complex decisions in this volatile market environment.

What's Driving Bitcoin's Price Action in Late August 2025?

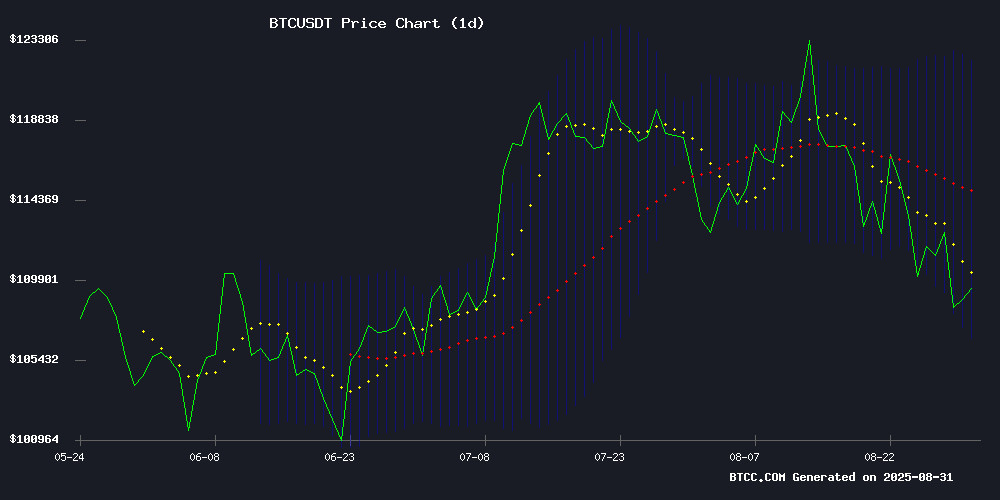

As of August 31, 2025, Bitcoin trades at $109,431, sitting below its 20-day moving average of $114,397 but above critical support at $106,622. The MACD reading of 4,311 suggests bullish momentum remains intact, though price action near the lower Bollinger Band indicates potential short-term weakness. According to TradingView data, Bitcoin has seen increased volatility this week following its rejection from the $124,000 resistance level earlier in August.

Source: BTCC Trading Platform

How Significant Is the $110,500 Level for Bitcoin?

The $110,500 level has emerged as a critical pivot point in Bitcoin's August 2025 price action. A sustained break below this level could trigger further downside toward $105,000, while holding above it may reignite the push toward $120,000. The BTCC research team notes that this level coincides with:

- The 0.382 Fibonacci retracement from July's rally

- Previous resistance-turned-support from early August

- Institutional accumulation zones identified by on-chain analysts

What Are the Key Technical Indicators Saying?

Bitcoin's technical setup presents a mixed picture as we close August 2025:

| Indicator | Value | Interpretation |

|---|---|---|

| Price vs 20-day MA | -4.3% below | Short-term caution |

| MACD | 4,311 | Bullish momentum intact |

| Bollinger Position | Near lower band | Potential oversold condition |

How Strong Are Bitcoin's Fundamentals Right Now?

Despite recent price weakness, Bitcoin's fundamentals appear robust in late August 2025:

Japanese firm Convano has announced a $3 billion Bitcoin accumulation plan targeting 21,000 BTC by March 2027. This follows similar moves by MicroStrategy and Tesla earlier in the year.

Bitcoin ETFs now hold $150 billion in assets under management (AUM), rapidly closing the gap with Gold ETFs at $180 billion. At current growth rates, Bitcoin ETFs could surpass gold ETFs by early 2026.

Exchange reserves continue to decline while long-term holder balances increase, suggesting accumulation by strategic investors rather than speculative traders.

What Are the Risks to Bitcoin's Price Outlook?

Several factors could challenge Bitcoin's bullish case:

- Technical Breakdown: Failure to hold $106,622 support could trigger algorithmic selling and push prices toward $100,000.

- Market Sentiment: Google Trends data shows retail interest peaking, historically a contrarian indicator for short-term tops.

- Macroeconomic Factors: The Federal Reserve's September rate decision could impact risk assets broadly.

How Are Institutions Positioning in Bitcoin?

Institutional activity tells an interesting story in late August 2025:

Tokyo-listed Convano's aggressive accumulation plan represents the latest corporate endorsement of Bitcoin as a treasury asset. Director Taiyo Azuma stated in a Bloomberg interview: "Our goal is clear - to become one of the world's leading corporate Bitcoin holders." This follows similar moves by MicroStrategy, which now holds over 250,000 BTC in its treasury.

Meanwhile, Bitcoin ETFs continue to see steady inflows, with BlackRock's IBIT product leading the pack. The rapid growth of these instruments has transformed Bitcoin from a speculative asset to a mainstream portfolio holding in just a few years.

What's the Historical Context for Bitcoin's Current Position?

Examining Bitcoin's past cycles provides valuable perspective:

In 2021, similar retracements of 13-15% occurred regularly within the broader bull market. The current pullback from $124,000 to $108,000 represents about a 13% decline - well within historical norms for Bitcoin bull markets.

However, the MVRV Ratio at 2.1 suggests Bitcoin isn't as overheated as during previous cycle tops, when readings often exceeded 3.0. This could indicate room for further upside if macroeconomic conditions remain favorable.

What Are Analysts Saying About Bitcoin's Outlook?

Market commentators offer diverse perspectives:

JPMorgan recently framed Bitcoin as undervalued relative to gold, particularly given its fixed supply and growing institutional adoption. The bank's analysts note Bitcoin's annualized volatility has plummeted to record lows NEAR 30%, making it more palatable for conservative portfolios.

Some technical analysts point to RSI divergence and weakening Bitcoin Dominance (BTC.D) as potential warning signs. The BTC.D decline often precedes altcoin rallies, which could divert capital from Bitcoin in the short term.

Frequently Asked Questions

Is Bitcoin a good investment in August 2025?

Bitcoin presents both opportunities and risks at current levels. The $106,000-$110,000 range offers a potential accumulation zone for long-term investors, though short-term volatility may continue. Dollar-cost averaging and strict risk management remain prudent strategies.

What's the most important level to watch for Bitcoin?

The $110,500 level serves as the immediate pivot point, with $106,622 acting as critical support below. A break above $112,000 could signal renewed bullish momentum toward $120,000.

How significant is Convano's $3 billion Bitcoin purchase plan?

Convano's accumulation plan represents one of the largest corporate Bitcoin acquisition strategies to date, targeting 0.1% of total supply. This follows the playbook established by MicroStrategy and reinforces Bitcoin's growing acceptance as a corporate treasury asset.

Could Bitcoin ETFs really surpass gold ETFs?

At current growth rates, Bitcoin ETFs could overtake gold ETFs in AUM by early 2026. This WOULD represent a symbolic milestone in digital assets' journey toward mainstream financial acceptance.

What's the biggest risk to Bitcoin's price right now?

Failure to hold the $106,000 support level could trigger technical selling and push prices toward $100,000. Macroeconomic uncertainty surrounding September's Fed decision also poses a near-term risk.