Bitcoin Price Forecast 2025: Can BTC Really Hit $200K Amid Current Market Conditions?

- Technical Analysis: Is Bitcoin's Current Consolidation Bullish or Bearish?

- Market Sentiment: Why Are Institutions Bullish While Network Activity Declines?

- Metaplanet's Bitcoin Bet: How Index Inclusion Could Fuel Institutional Adoption

- The Fee Market Crisis: Threat to Network Security or Temporary Lull?

- VanEck's $180K Target: Rational Confidence or Wishful Thinking?

- Altseason Looms: Will Bitcoin Dominance Crash as Predicted?

- The Path to $200,000: Mathematical Reality or Pipe Dream?

- Frequently Asked Questions

As bitcoin hovers around $112,531 in late August 2025, the crypto community is buzzing about its potential to reach $200,000. This analysis dives deep into the technical indicators showing BTC testing crucial support at $111,000, examines the mixed market sentiment between negative fee compression and positive institutional interest, and evaluates whether the required 78% price surge is achievable. With insights from on-chain data, institutional moves, and historical patterns, we explore the complex factors that could propel or prevent Bitcoin from hitting this ambitious target.

Technical Analysis: Is Bitcoin's Current Consolidation Bullish or Bearish?

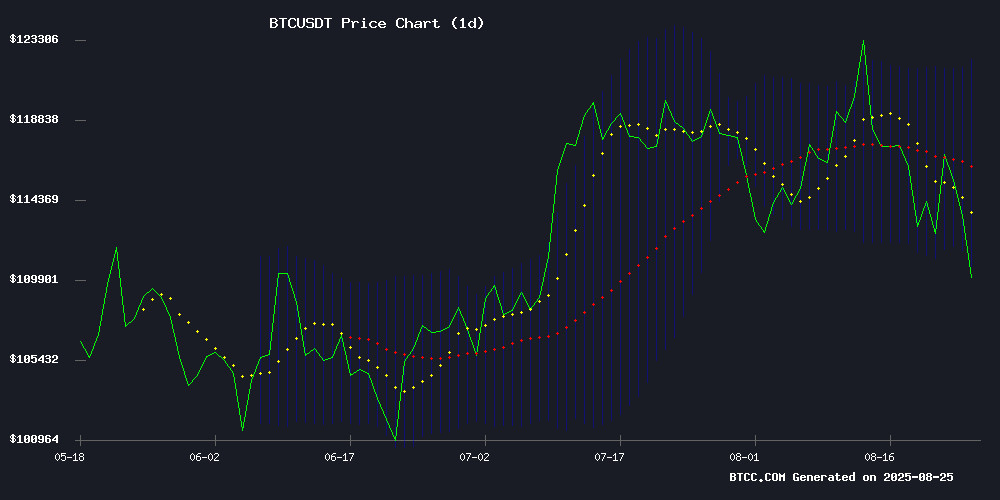

Bitcoin's price action in August 2025 presents a classic case of market indecision. Trading at $112,531 as of August 25, BTC sits below its 20-day moving average of $116,585 - typically a short-term bearish signal. The MACD indicator tells an interesting story though, with a positive reading of 1,067.22 but showing weakening momentum as the signal line lingers at 35.15. Bollinger Bands paint a picture of consolidation, with the upper band at $121,897 and lower support at $111,274. What's fascinating is how BTC keeps testing that lower band like a boxer leaning on the ropes - each touch could either spring it back into the fight or signal a knockout. The BTCC research team notes, "The $111,000 level has become psychological support. A daily close below might trigger stops down to $105,000, while holding could set up a rebound toward the $116,585 midpoint."

Bollinger Bands paint a picture of consolidation, with the upper band at $121,897 and lower support at $111,274. What's fascinating is how BTC keeps testing that lower band like a boxer leaning on the ropes - each touch could either spring it back into the fight or signal a knockout. The BTCC research team notes, "The $111,000 level has become psychological support. A daily close below might trigger stops down to $105,000, while holding could set up a rebound toward the $116,585 midpoint."

Market Sentiment: Why Are Institutions Bullish While Network Activity Declines?

The current fundamental landscape resembles a tug-of-war between opposing forces. On the bearish side, Bitcoin's transaction fees have collapsed to 2011 levels (just 3.5 BTC average), mining companies like Hut 8 are pivoting to AI, and profit-taking pressure persists. Yet institutional players like VanEck maintain $180,000 price targets, CME basis rates are surging to 9%, and Metaplanet's FTSE Japan Index inclusion signals growing mainstream acceptance. This divergence creates what I like to call the "institutional disconnect" - where traditional finance sees long-term value while on-chain metrics suggest short-term cooling. Glassnode data shows nearly half of recent blocks operating below capacity, with mempools frequently empty. Meanwhile, corporate treasuries added 72,000 BTC last month alone. It's as if two different Bitcoin markets exist simultaneously.

Metaplanet's Bitcoin Bet: How Index Inclusion Could Fuel Institutional Adoption

Metaplanet's September 22 inclusion in the FTSE Japan Mid-Cap Index marks a watershed moment for Bitcoin-centric equities. This isn't just another company adding BTC to its balance sheet - it's a strategic pivot where 91% of Q2 revenue came from Bitcoin put options. Their aggressive accumulation (adding 878 BTC in August to reach 18,991 BTC total) showcases conviction in their 210,000 BTC by 2027 roadmap. The index effect could be profound. As passive funds tracking the FTSE All-World Index (which Metaplanet now qualifies for) adjust holdings, we might see hundreds of millions in forced buying. Vanguard and other institutional managers don't care about price - they have to buy the constituents. This creates a fascinating dynamic where traditional finance mechanisms could indirectly boost Bitcoin demand.

The Fee Market Crisis: Threat to Network Security or Temporary Lull?

Bitcoin's fee revenue has plummeted over 80% since April 2024, with 15% of blocks processing transactions at near-zero cost. Galaxy Digital analysts warn this creates a "perfect storm" post-halving, where reduced block subsidies meet evaporating fee income. Historically, such fee compression followed speculative booms (remember the Runes protocol frenzy?). The question is whether this reflects a healthy purge of ephemeral activity or signals deeper issues. Some miners are already feeling the pinch - if this persists, hash rate adjustments might follow. Yet the counterargument is that Bitcoin's security doesn't need constant high fees, just adequate long-term incentives.

VanEck's $180K Target: Rational Confidence or Wishful Thinking?

VanEck's reaffirmed $180,000 year-end bitcoin price target raises eyebrows given recent volatility. Their conviction stems from CME basis rates hitting 9% (highest since February 2025's peak) and institutional products accumulating 54,000 BTC in July. Derivatives markets echo this optimism, with call/put ratios at 3.21x - the most bullish skew since June 2024. What's intriguing is how compressed 32% implied volatility makes leveraged bets cheaper now than in late 2024. Traders are paying just 6% of spot for out-of-the-money calls versus 18% historically. This options activity suggests smart money expects fireworks, even if retail traders remain cautious.

Altseason Looms: Will Bitcoin Dominance Crash as Predicted?

Analyst Egrag Crypto's warning of a 35% BTC dominance drop has the altcoin community buzzing. The weekly chart closing below the 21-week EMA historically preceded steep declines in Bitcoin's market share (47.86% and 42% in past cycles). However, skeptics note altcoins already had their volume surge over four years. The real question is whether we'll see broad-based altseason or selective outperformance. Some altcoins with strong fundamentals might shine while others get left behind. This potential rotation could actually benefit Bitcoin long-term by bringing fresh capital into crypto overall.

The Path to $200,000: Mathematical Reality or Pipe Dream?

| Metric | Current Value | Required for $200K |

|---|---|---|

| Price | $112,531 | +77.8% |

| 20-day MA | $116,585 | +71.5% |

| Bollinger Upper | $121,897 | +64.1% |

Reaching $200,000 from current levels requires a 78% surge - ambitious but not unprecedented in Bitcoin's history. The key catalysts WOULD likely be: 1) Breakthrough above $122,000 resistance 2) Sustained institutional inflows (especially from index-related buying) 3) Resolution of the fee market uncertainty 4) Macroeconomic conditions favoring risk assets The BTCC analyst team cautions: "While technicals show near-term resistance, institutional adoption trends could provide the catalyst. However, investors should prepare for volatility - this wouldn't be a straight line up."

Frequently Asked Questions

What's the most important support level for Bitcoin currently?

The $111,000 level has emerged as crucial short-term support, with the Bollinger Band lower boundary at $111,274 reinforcing this zone. A daily close below could trigger further downside toward $105,000.

Why are Bitcoin transaction fees at decade lows significant?

The 14-day average fee of just 3.5 BTC indicates reduced network activity, potentially signaling decreased utility demand or a shift toward layer-2 solutions. This impacts miner revenue post-halving.

How does Metaplanet's FTSE inclusion affect Bitcoin?

As passive index funds buy Metaplanet shares to match their benchmarks, it indirectly increases institutional Bitcoin exposure since Metaplanet holds 18,991 BTC and derives most revenue from BTC-related activities.

What would Bitcoin need to reach $200,000?

A 78% price increase from current $112,531 levels, likely requiring sustained institutional inflows, break of key resistances, and positive macroeconomic conditions favoring risk assets.

Is now a good time to buy Bitcoin?

Market conditions show consolidation with mixed signals. While long-term prospects appear strong, short-term volatility remains likely. Always conduct your own research before investing.