Ethereum Price Prediction 2025: Will ETH Hit $5,000 Before Year-End?

- Ethereum Technical Analysis: The Bull Case for $5,000

- The Institutional ETH Accumulation Game

- Derivatives Market Flashing Green Lights

- Key Resistance Levels to Watch

- Ethereum Price Prediction FAQ

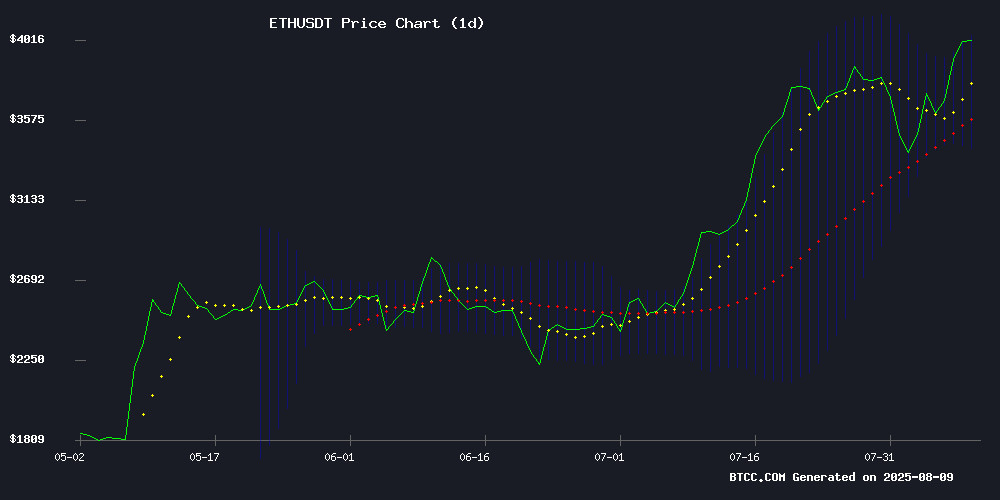

Ethereum is currently riding a massive bullish wave, having broken through the $4,000 psychological barrier with conviction. As of August 2025, ETH trades at $4,226.73 - up 18% weekly - with technical indicators suggesting this might just be the beginning of a historic run. The cryptocurrency shows all the classic signs of a major breakout: supply shock (exchange balances at 6-year lows), institutional accumulation, and bullish derivatives positioning. While $5,000 seems inevitable to many analysts, the path there involves navigating key resistance levels at $4,400 and $4,800. This analysis dives deep into the technicals, on-chain metrics, and market structure that will determine whether ETH can achieve this milestone before 2025 concludes.

Ethereum Technical Analysis: The Bull Case for $5,000

Looking at the daily chart, ETH has formed what technical analysts call a "textbook breakout." The price sits comfortably above its 20-day moving average ($3,741.24), with the MACD histogram printing a strong 83.26 reading - one of the most bullish configurations since the 2021 bull market. The Bollinger Bands tell an interesting story too; ETH is testing the upper band at $4,100.57, which typically indicates overbought conditions but can also signal sustained momentum in strong uptrends.

The BTCC research team notes, "This isn't just technical - it's fundamentally different from 2021. Back then, leverage fueled the rally. Now, we're seeing actual coins being pulled off exchanges at a record pace." Indeed, exchange balances have dwindled to just 18.8M ETH, the lowest since 2018. When you combine this supply shock with the fact that institutional players like BitMine Immersion have gobbled up over 800K ETH this year alone, the technical picture gains fundamental credence.

The Institutional ETH Accumulation Game

Corporate treasury buying has emerged as a major theme in 2025. Public filings reveal that companies now hold over 3M ETH ($11.8B), representing 2.5% of total supply. BitMine leads the pack with 833K ETH ($3.26B), followed by SharpLinK Gaming's 521K ETH position. What's fascinating is how this compares to ETF flows - while spot ETH ETFs saw $5B inflows in July, corporate buying may be having an even greater impact by permanently removing coins from circulation.

Vitalik Buterin recently weighed in during a Bankless interview: "ETH as a treasury asset makes sense - it's programmable money with real yield potential." However, he cautioned about overleveraged positions creating systemic risks. This institutional adoption creates a floor under ETH's price that didn't exist in previous cycles. As one trader put it, "When companies start HODLing, the supply shock gets real."

Derivatives Market Flashing Green Lights

The options market tells a particularly compelling story. Data shows negative net gamma exposure among dealers for Deribit-listed Ether options between $4,000-$4,400. In plain English? Market makers may be forced to buy ETH aggressively if prices rise, creating a self-reinforcing upward spiral. This gamma effect could propel ETH toward $4,400 with surprising speed.

| Indicator | Value | Implication |

|---|---|---|

| Price vs 20MA | +13% | Strong bullish trend |

| MACD Histogram | +83.26 | Upward momentum |

| Exchange Balances | 18.8M ETH | Supply squeeze potential |

Key Resistance Levels to Watch

The road to $5,000 isn't without obstacles. Several key levels demand attention:

- $4,200-4,300: Current local top where profit-taking emerges

- $4,400: Gamma squeeze trigger point in options market

- $4,867: All-time high from November 2021

- $5,000: Psychological milestone

Interestingly, liquidation heatmaps show relatively thin resistance until $4,500, suggesting ETH could make quick work of the $4,300-4,400 zone if momentum holds. The BTCC team observes, "The $6,800 target remains plausible if ETH holds above $4,000, though traders should watch for derivatives overheating signals at $4,400."

Ethereum Price Prediction FAQ

What is the Ethereum price prediction for 2025?

Based on current technicals and market structure, analysts project ETH could reach $5,000 by late 2025, with some models suggesting $6,800 as a cycle top. The path depends on maintaining above $4,000 support and institutional demand persistence.

Why is Ethereum price rising?

Three primary factors: 1) Supply shock (exchange balances at 6-year lows), 2) Institutional accumulation (corporate treasuries buying), and 3) Bullish derivatives positioning (negative gamma creating upward pressure).

Is now a good time to buy Ethereum?

While the trend remains strongly bullish, short-term traders might wait for a pullback to the $3,900-$4,000 support zone. Long-term investors could consider dollar-cost averaging given Ethereum's strong fundamentals.

What could stop Ethereum's rally?

Potential roadblocks include macroeconomic shocks (recession, Fed policy changes), regulatory crackdowns, or excessive leverage in derivatives markets leading to cascading liquidations.

How does Ethereum's current rally compare to 2021?

The 2021 rally was largely retail-driven with high leverage. The 2025 MOVE features more institutional participation, actual coin accumulation (not just futures), and occurs amid regulatory clarity - making it potentially more sustainable.