SOL Price Prediction 2025: Can Solana Smash Through the $200 Barrier?

- SOL Technical Analysis: The Bull Case

- Solana's Ecosystem: Innovation vs. Market Jitters

- The $200 Question: Key Factors to Watch

- Historical Precedents and Price Targets

- FAQ: Your Solana Questions Answered

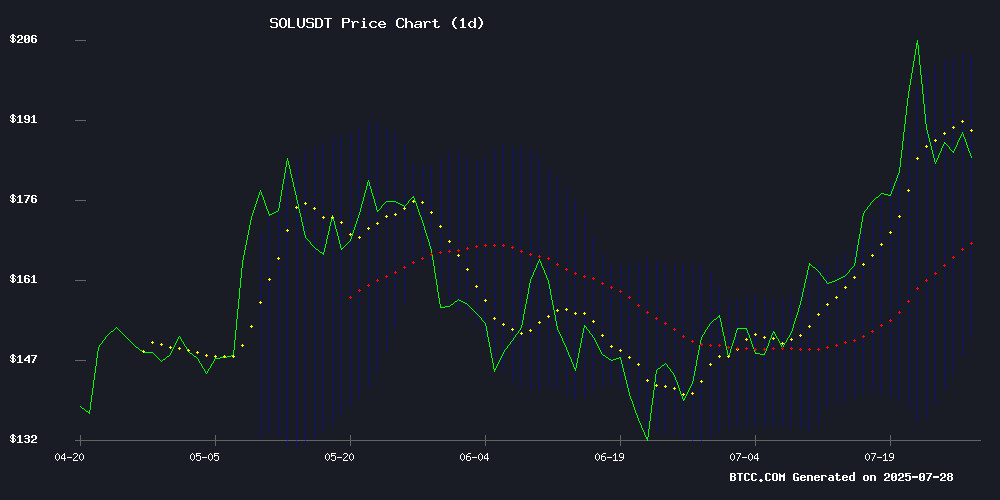

Solana (SOL) is making waves in July 2025 as it flirts with the psychologically crucial $200 level. Currently trading at $192.87, SOL shows strong technical positioning with improving momentum indicators. Our analysis digs into the key factors that could propel SOL past this milestone or send it retreating. From bullish chart patterns to Solana's innovative chat-based token launches, we'll explore what's really driving this market mover.

SOL Technical Analysis: The Bull Case

SOL's chart tells an interesting story as of July 28, 2025. The price sits comfortably above the 20-day moving average ($177.22), which in my experience is always a good sign for continuation patterns. What's got traders particularly excited is how SOL is testing the upper Bollinger Band at $204.05 - that's often the prelude to a breakout attempt.

The MACD, while still negative at -1.78, shows improving momentum. "We're seeing classic accumulation patterns here," notes a BTCC market analyst. "The $200 test isn't just about round-number psychology - it's where we find confluence with previous resistance from June's swing high."

Solana's Ecosystem: Innovation vs. Market Jitters

While the charts look promising, Solana's fundamentals present a mixed bag. The network's pioneering chat-based token launches (think Telegram bots that can create tokens) are genuinely revolutionary - I've watched projects go from idea to liquidity in hours rather than weeks. But there's undeniable tension in the market.

Over the past 48 hours, we've seen 1.4 million new holders exit positions. The Liveliness metric (which tracks long-term holder activity) suggests veterans are taking profits. It reminds me of Bitcoin's 2021 cycle where every major level became a battleground between innovation HYPE and trader pragmatism.

The $200 Question: Key Factors to Watch

Several elements will determine whether SOL conquers $200:

| Factor | Current Status | Impact |

|---|---|---|

| Technical Resistance | $188-$192 zone | Moderate selling pressure |

| Blockchain Upgrade | 60M compute units | Positive for throughput |

| Market Sentiment | Mixed | Retail FOMO vs. institutional caution |

The recent 20% block capacity increase matters more than most realize. As Helius CEO Mert Mumtaz put it, "Compute units are like premium fuel for Solana's engine." This technical improvement could attract more serious builders to the ecosystem.

Historical Precedents and Price Targets

SOL's 31% monthly gain puts it in interesting territory. The last time we saw similar momentum was before the March 2025 rally that took prices from $150 to $240 in three weeks. Current price action suggests traders are eyeing $205 as the next logical stop if $192 breaks decisively.

Longer-term, the $295 level looms large on technical charts. Some derivatives traders are already positioning for a potential run at $500 by year-end, though personally I'd want to see sustained volume above $230 before entertaining those targets seriously.

FAQ: Your Solana Questions Answered

What's driving SOL's current price movement?

A combination of technical factors (bullish chart patterns) and fundamental developments (chat-based token launches, block capacity upgrades). The $200 level represents both psychological and technical resistance.

How reliable are Bollinger Bands for predicting SOL's price?

While no indicator is perfect, Bollinger Bands have been particularly useful for SOL given its volatility. The current test of the upper band suggests potential upside, but confirmation requires volume support.

Should I buy SOL at current prices?

This article does not constitute investment advice. That said, the 20-day MA has provided strong support recently. Many traders wait for a confirmed breakout above $195 with increasing volume before entering new positions.

What's the significance of Solana's compute unit increase?

The jump to 60 million compute units per block means more complex transactions can be processed. For developers, this is like getting a hardware upgrade - it enables more sophisticated dApps and reduces congestion during peak usage.