XRP Price Prediction 2025: Can the Digital Asset Reach $3.60 and Beyond?

- Technical Analysis: Is XRP Positioned for Further Gains?

- Fundamental Factors Driving XRP's Momentum

- Market Sentiment and Institutional Interest

- XRP's Historical Performance and Future Potential

- Security Developments: XLS-86 Firewall Update

- XRP Versus Emerging Alternatives

- Frequently Asked Questions

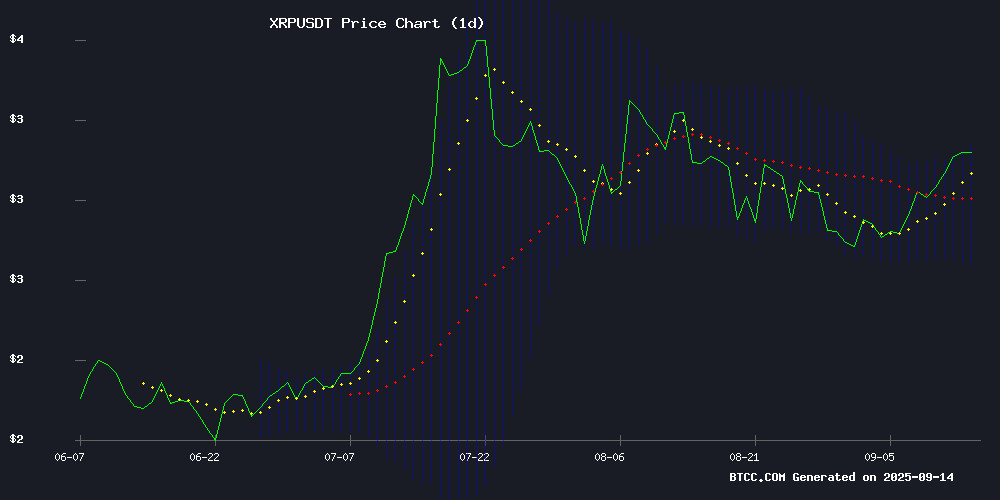

XRP has been making waves in the cryptocurrency market, currently trading at $3.0443 with bullish momentum that could potentially push it toward $3.60. This analysis dives deep into the technical indicators, fundamental drivers, and market sentiment shaping XRP's trajectory. From BRICS central bank strategies to Ripple's European expansion, multiple factors suggest sustained growth potential - though traders should watch for signs of consolidation amid declining volume. Let's unpack what's driving this digital asset and whether it can maintain its upward trajectory.

Technical Analysis: Is XRP Positioned for Further Gains?

XRP's current price action paints an interesting picture. Trading comfortably above its 20-day moving average of $2.9166, the digital asset shows underlying strength. The MACD indicator presents mixed signals with readings of -0.0448 | 0.0407 | -0.0855, suggesting we might see some near-term consolidation before the next potential MOVE upward.

What's particularly noteworthy is how XRP has maintained its position within the Bollinger Band range of $2.6970 to $3.1362. The ability to hold above the psychologically important $3.00 level demonstrates strong buyer interest. As one analyst from TradingView noted, "The middle Bollinger Band acting as support rather than resistance indicates the bulls are in control for now."

Fundamental Factors Driving XRP's Momentum

The fundamental case for XRP has strengthened considerably in recent months. Two major developments stand out:

First, the BRICS central banks have quietly been building a multi-year strategy around XRP Ledger technology. Documents reveal these financial institutions have Leveraged XRPL's escrow and automation features as foundational elements in their de-dollarization efforts. The New Development Bank has reportedly been spearheading technical implementations since at least early 2024.

Second, Ripple's European expansion through strategic partnerships, including a notable custody collaboration with BBVA, has reinforced institutional confidence. This move comes at a crucial time as regulatory clarity improves following Ripple's resolution of SEC litigation.

Market Sentiment and Institutional Interest

Sentiment analysis shows overwhelmingly positive news Flow surrounding XRP. The combination of technical breakouts and substantial fundamental developments has created a favorable environment. However, there's an interesting divergence emerging:

While open interest in XRP futures contracts on the Chicago Mercantile Exchange (CME) reached a 10-day high of 384,500 XRP (indicating strong institutional participation), trading volume has declined by 12.61% even as prices edged higher. This volume-price divergence presents a classic consolidation pattern that traders will be watching closely.

| Indicator | Value | Significance |

|---|---|---|

| Current Price | $3.0443 | Above key psychological level |

| 20-day MA | $2.9166 | Price trading above support |

| Bollinger Upper | $3.1362 | Next resistance level |

XRP's Historical Performance and Future Potential

The journey from XRP's early days to its current position has been remarkable. A $1,000 investment in 2014, when XRP traded at $0.002686, WOULD be worth over $1 million today. While such exponential gains may not repeat, the asset's performance following its regulatory clarity has been impressive.

Looking ahead, predictions vary widely. Some models suggest a breakout above $3.40-$3.50 could fuel further gains toward $5, while more conservative estimates project gradual growth. The divergence in long-term predictions underscores XRP's volatile nature and the many variables that could influence its trajectory.

Security Developments: XLS-86 Firewall Update

The upcoming XLS-86 Firewall amendment for the XRP Ledger represents a significant security enhancement. Announced by dUNL Validator 'Vet', this update introduces:

- Customizable transaction restrictions

- Whitelisting capabilities for trusted accounts

- Time-based and value-based limits on outgoing transactions

This development could significantly boost confidence among retail investors who have historically been vulnerable to wallet drain scams. The ability to create a buffer against unauthorized withdrawals even if private keys are compromised addresses a critical pain point in the ecosystem.

XRP Versus Emerging Alternatives

While XRP dominates discussions about cross-border payments, new entrants like PayFi's Remittix token are gaining attention. Having raised $25.4 million at $0.1080 per token, Remittix's remittance-focused model presents an interesting contrast to Ripple's infrastructure approach.

Some traders are drawn to these newer, lower-cap alternatives seeking asymmetric growth opportunities. However, XRP's established position and institutional backing give it distinct advantages in terms of liquidity and network effects.

Frequently Asked Questions

What is XRP's current price and key support level?

As of September 14, 2025, XRP is trading at $3.0443 with key support at the 20-day moving average of $2.9166.

How has institutional interest in XRP evolved recently?

Open interest in XRP futures on CME reached a 10-day high of 384,500 XRP, indicating growing institutional participation despite some technical bearish signals.

What are the major fundamental developments supporting XRP?

Key developments include BRICS central banks' multi-year XRP strategy and Ripple's European expansion through partnerships like the BBVA custody collaboration.

What security improvements are coming to the XRP Ledger?

The XLS-86 Firewall amendment will introduce customizable transaction restrictions and whitelisting to protect against wallet drain scams.

How does XRP's current performance compare to its history?

XRP has appreciated significantly from its 2014 price of $0.002686, with early investments showing million-dollar returns, though future gains may be more moderate.