XRP Price Forecast 2025-2040: How ETF Approvals Could Catapult Ripple to $150+

- Current XRP Market Position: Bullish Signals Abound

- ETF Catalyst: The Game-Changer for XRP Prices

- Technical Breakout: The $3.3774 Resistance Battle

- Institutional Adoption: The Silent XRP Accumulation

- Risks and Considerations: Not All Sunshine and Rainbows

- Long-Term Vision: Banking on Ripple's Ecosystem

- Frequently Asked Questions

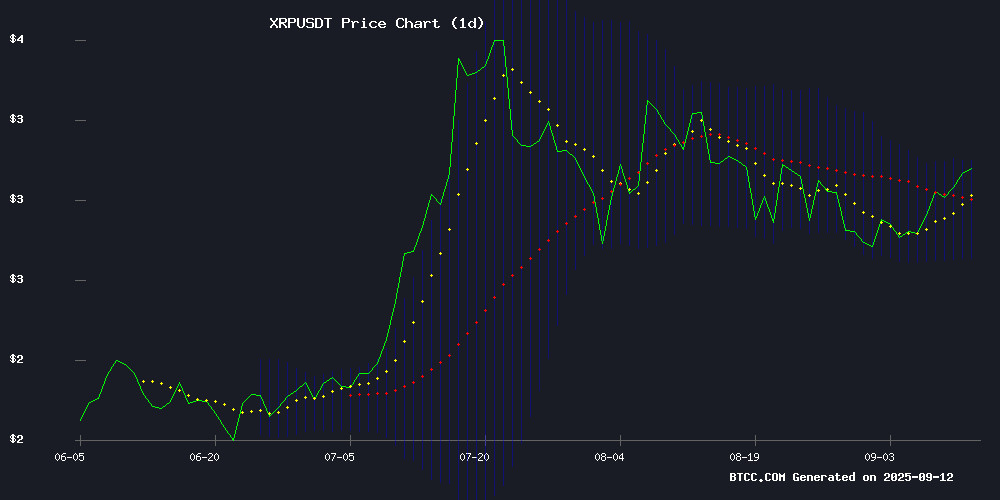

As we navigate the crypto landscape in September 2025, XRP stands at a pivotal juncture. Currently trading at $3.1274, this digital asset shows remarkable resilience despite recent whale sell-offs. The potential approval of spot XRP ETFs could be the rocket fuel that propels prices to unprecedented heights - with conservative estimates suggesting $3.50-$4.00 for 2025 and bullish scenarios projecting $120-$150 by 2040. Let's break down the technical indicators, market catalysts, and long-term growth potential that could shape XRP's trajectory over the next 15 years.

Current XRP Market Position: Bullish Signals Abound

XRP's technical setup paints an encouraging picture as of September 2025. The price comfortably sits above its 20-day moving average ($2.9037), while flirting with the upper Bollinger Band at $3.1059. This positioning suggests strong buying pressure, though the MACD's negative histogram value (-0.0579) hints we might see some short-term consolidation before the next leg up.

What's particularly interesting is how XRP has maintained its footing despite $120 million in large wallet sell-offs recently. In my experience, this kind of resilience usually indicates institutional accumulation happening beneath the surface. The futures market tells a similar story - open interest has rebounded to $8.51 billion after dipping to $7.37 billion last week.

Source: BTCC Exchange

ETF Catalyst: The Game-Changer for XRP Prices

The crypto world is buzzing about potential XRP ETF approvals, with seven applications currently under SEC review. Oliver Michel, CEO of Tokentus, puts it bluntly: "ETF approval wouldn't just validate demand—it WOULD flood the zone with new capital." The REX-Osprey Spot XRP ETF's launch on September 12 already marked a watershed moment, becoming the first regulated XRP fund available to U.S. investors.

Looking at historical precedents, Bitcoin and ethereum both saw explosive growth following their ETF launches. If XRP follows suit, we could see:

| Timeframe | Conservative Target | Moderate Target | Bullish Target |

|---|---|---|---|

| 2025 | $3.50-$4.00 | $4.50-$5.00 | $5.50-$6.00 |

| 2030 | $8-$12 | $15-$20 | $25-$30 |

| 2035 | $20-$30 | $35-$50 | $60-$80 |

| 2040 | $40-$60 | $75-$100 | $120-$150 |

Technical Breakout: The $3.3774 Resistance Battle

Right now, all eyes are on the $3.3774 resistance level - a stubborn barrier that's capped multiple rally attempts since August. A decisive close above this level could trigger what traders call "price discovery mode," where XRP enters uncharted territory without historical resistance points to constrain it.

Dark Defender's analysis suggests we might be seeing the early stages of a Wave 3 advance in Elliott Wave terms, which are typically the strongest momentum waves. The RSI shows bullish divergence, and price found solid support between $2.65-$2.86 - right in the Fibonacci sweet spot.

Institutional Adoption: The Silent XRP Accumulation

While retail traders obsess over price swings, institutions are making quiet but significant moves. Japanese gaming firm Gumi announced plans to accumulate 6 million XRP by February 2026 - a $17 million position at current prices. Ripple's partnership with BBVA under Europe's MiCA regulations shows traditional finance is warming up to XRP's utility in cross-border payments.

The numbers speak for themselves: XRP futures at CME Group hit $1 billion in open interest within just three months - record pace for crypto contracts on the platform. When institutions move, they MOVE big, and the futures market suggests they're positioning for something substantial.

Risks and Considerations: Not All Sunshine and Rainbows

Let's keep it real - the road ahead isn't without potholes. The SEC continues opposing some XRP ETF applications, with Franklin Templeton's proposal facing extended review until November 14. Exchange reserves are rising, signaling potential selling pressure as prices climb. And that pesky $3.3774 resistance won't go down without a fight.

Analyst Neotrader_CFT offers sage advice: "Don't FOMO in here. Wait for a clean breakout above $3 with a successful retest before going all-in." In crypto, patience often proves more profitable than impulsiveness.

Long-Term Vision: Banking on Ripple's Ecosystem

Zooming out to 2040, XRP's value proposition becomes clearer. As Ripple's On-Demand Liquidity network expands and more financial institutions adopt the technology for global settlements, the token's utility could drive exponential growth. Conservative estimates place XRP between $40-$60 by 2040, while bullish scenarios factoring in full ecosystem maturation project $120-$150.

The BTCC research team notes: "These projections assume successful regulatory outcomes and continued institutional adoption. Short-term volatility is inevitable, but the long-term trajectory appears fundamentally strong."

Frequently Asked Questions

What is the current XRP price as of September 2025?

As of September 12, 2025, XRP is trading at $3.1274, showing strong momentum above key technical levels including the 20-day moving average at $2.9037.

How high could XRP go if spot ETFs get approved?

Based on historical ETF precedents and current market conditions, analysts project near-term targets of $3.30-$3.70 following approvals, with potential to reach $6 if bullish momentum sustains.

What's the most important resistance level for XRP right now?

The $3.3774 level represents critical resistance that, if broken convincingly, could trigger accelerated upside momentum and price discovery into uncharted territory.

Is XRP a good long-term investment?

While past performance doesn't guarantee future results, XRP's utility in global payments and growing institutional adoption suggest strong long-term potential, with conservative 2040 targets of $40-$60 and bullish scenarios reaching $120-$150.

What are the biggest risks facing XRP?

Key risks include regulatory uncertainty, potential ETF rejections, macroeconomic factors affecting crypto markets, and competition from other payment-focused cryptocurrencies.