XRP Price Prediction 2025: Technical Breakout Signals $7 Rally Potential

- What Does XRP's Current Technical Setup Reveal?

- How Are Institutional Players Positioning Themselves?

- What Are the Key Price Levels to Watch?

- How Does Market Sentiment Compare to Technicals?

- What Role Does Sustainability Play in XRP's Appeal?

- How High Could XRP Realistically Go in 2025-2026?

- XRP Price Prediction: Frequently Asked Questions

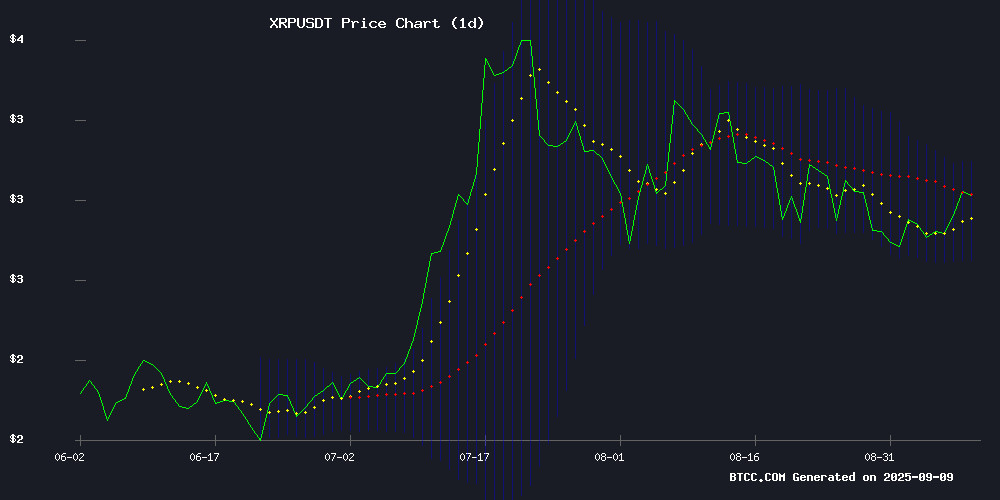

As we approach Q4 2025, XRP stands at a critical juncture with bullish technical indicators suggesting potential for significant upside. Currently trading at $3.0047, the digital asset has maintained strong support above key moving averages while institutional developments create both opportunities and challenges. This analysis examines the competing factors influencing XRP's price trajectory, from technical patterns echoing 2017's historic rally to recent exchange dynamics and emerging yield programs. With price targets ranging from $3.50 near-term to $7.00 long-term, we break down the crucial levels traders should watch in the coming weeks.

What Does XRP's Current Technical Setup Reveal?

XRP's chart presents a compelling technical story as of September 2025. The price sits comfortably above its 20-day moving average ($2.8978) while testing the upper Bollinger Band at $3.0927. The MACD indicator, though showing slight convergence at 0.0850 versus 0.1077, remains firmly in positive territory. This configuration suggests the asset is consolidating before its next directional move.

Notably, the $2.85-$2.92 zone has emerged as critical support, with a bullish trend line forming at $2.8650 on hourly charts. The BTCC research team observes that "XRP's ability to hold above the middle Bollinger Band while approaching the upper limit demonstrates underlying strength. A decisive break above $3.09 could trigger accelerated buying similar to the 2017 pattern."

How Are Institutional Players Positioning Themselves?

The institutional landscape presents mixed signals for XRP. On one hand, Nasdaq-listed VivoPower International made waves in early September with its $30 million XRP yield program through Doppler Finance, signaling growing corporate adoption. The energy solutions company plans to expand this to $200 million, citing XRP's "cornerstone treasury asset" potential.

However, exchange dynamics tell a different story. Coinbase has dramatically reduced its XRP holdings by 69% since Q2 2025, dropping from 780 million tokens to just 200 million. This rapid divestment, potentially linked to BlackRock's growing influence, has raised eyebrows across crypto markets.

| Institutional Development | Impact |

|---|---|

| VivoPower $30M yield program | Positive adoption signal |

| Coinbase 69% XRP reduction | Potential institutional outflow |

| Binance liquidity fluctuations | Market manipulation concerns |

What Are the Key Price Levels to Watch?

Technical analysts identify several crucial thresholds that could determine XRP's near-term direction:

- Immediate resistance: $3.0927 (upper Bollinger Band)

- Psychological barrier: $3.50 (next major round number)

- Critical support: $2.81-$2.85 zone (recent base formation)

- Breakdown risk: $2.70 (September low)

Crypto trader CRYPTOWZRD notes striking similarities between current price action and XRP's 2017 breakout pattern, suggesting potential for moves toward $4.50 if historical patterns repeat. Fibonacci levels outline key defenses below current prices, with $2.75 (0.618 retracement) and $2.65 (0.786 retracement) acting as potential safety nets.

How Does Market Sentiment Compare to Technicals?

Market sentiment presents a curious dichotomy. On-chain metrics like the Network Value to Transactions (NVT) Ratio flashing warning signs (spiking 441% to 168), suggesting transaction activity lags behind market valuation. Yet, derivatives markets and spot trading volumes remain robust at $7.2 billion daily.

The BTCC team observes that "while technicals paint a bullish picture, institutional adoption news will be crucial for sustaining momentum above $3.00. The market appears to be waiting for a clear breakout confirmation before committing to larger positions."

Adding to the complexity, allegations have surfaced about Binance potentially suppressing XRP's price through abnormal liquidity patterns and aggressive sell walls. These claims, while unproven, contribute to the cautious sentiment among some traders.

What Role Does Sustainability Play in XRP's Appeal?

Amid growing environmental concerns in crypto, XRP Ledger's sustainability credentials stand out. Recent data reveals the entire network emits just 63 tonnes of CO₂ annually—equivalent to one transatlantic flight. Each transaction consumes less energy than powering an LED bulb for one millisecond.

This eco-friendly profile, combined with the ledger's carbon-neutral status through EW Zero, positions XRP as a compelling option for environmentally conscious institutions. Q2 2025 saw XRPL reach $131.6 million in real-world asset market capitalization, signaling growing adoption beyond speculative trading.

How High Could XRP Realistically Go in 2025-2026?

Analyst projections vary widely based on different scenarios:

| Timeframe | Price Target | Probability | Catalysts |

|---|---|---|---|

| Near-term (Q4 2025) | $3.50-$3.75 | High | Technical breakout, Fed policy |

| Medium-term (Q1 2026) | $4.00-$4.50 | Medium | Institutional adoption, RWA growth |

| Long-term (2026) | $5.00-$7.00 | Moderate | Macro conditions, cross-border adoption |

This article does not constitute investment advice. The cryptocurrency market remains highly volatile, and investors should conduct their own research before making decisions.

XRP Price Prediction: Frequently Asked Questions

What is the current XRP price as of September 2025?

As of September 9, 2025, XRP is trading at $3.0047, according to data from CoinMarketCap. The price has shown resilience above key moving averages, with the 20-day MA providing support at $2.8978.

What are the key resistance levels for XRP?

Immediate resistance sits at $3.0927 (upper Bollinger Band), followed by psychological resistance at $3.50. A break above these levels could open the path toward $4.00-$4.50, especially if the 2017 pattern repetition thesis holds.

Why are institutions both buying and selling XRP?

The institutional landscape shows divergence—while companies like VivoPower are establishing yield programs, exchanges like Coinbase have significantly reduced holdings. This likely reflects differing strategies between long-term treasury management and short-term liquidity needs.

How does XRP's sustainability compare to other cryptos?

XRP Ledger is among the most energy-efficient major blockchains, consuming minimal energy per transaction and maintaining carbon neutrality. Its annual emissions equal just one transatlantic flight, making it appealing for ESG-conscious investors.

What would trigger XRP to reach $7?

A $7 target would require multiple catalysts: sustained institutional adoption in cross-border payments, favorable regulatory clarity, broader crypto market recovery, and successful technical breakouts above key resistance levels. The 2017 pattern analogy suggests this is possible but not guaranteed.