TRX Price Prediction 2025: How High Can Tron Go This Year?

- TRX Technical Analysis: Bullish Signals Emerging

- Market Fundamentals Supporting TRX Growth

- Competitive Landscape: Tron vs. Emerging Challengers

- Tether Policy Changes Benefit Tron Ecosystem

- Price Outlook: Key Levels to Watch

- Frequently Asked Questions

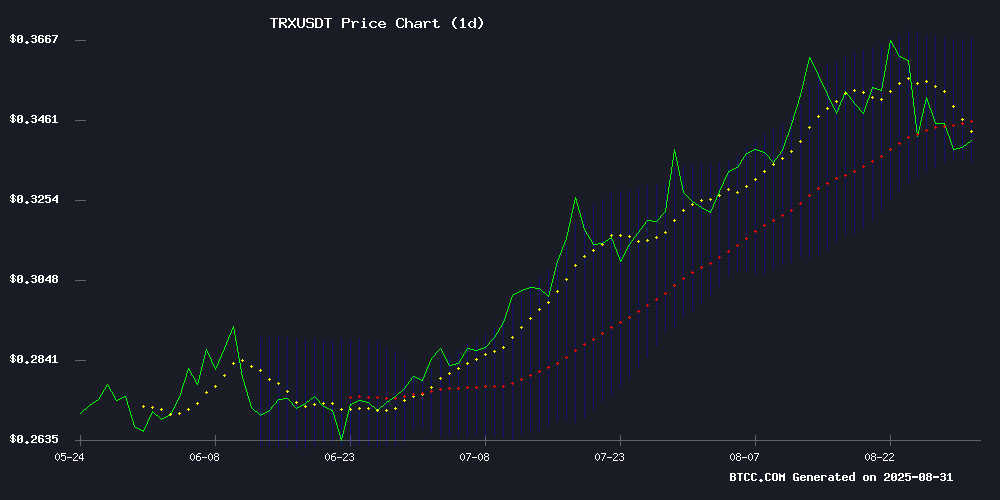

As we enter September 2025, TRX (Tron) shows promising bullish signals with its price currently at $0.3432. Technical indicators suggest potential upward movement toward the $0.367 resistance level, supported by recent network fee reductions and Tron's dominant position in the stablecoin market. The MACD histogram turning positive (+0.005812) indicates building momentum, though traders should watch the $0.351345 20-day moving average as near-term resistance. With Tron processing $24.6 billion in daily USDT transfers - seven times Ethereum's volume - and maintaining 98.56% stablecoin dominance, the fundamentals appear strong for continued growth.

TRX Technical Analysis: Bullish Signals Emerging

TRX presents an interesting technical picture as of September 2025. The current price sits just below the 20-day moving average ($0.351345), suggesting we're in a consolidation phase before the next move. What's particularly noteworthy is the MACD histogram reading of +0.005812 - this positive value indicates building bullish momentum despite the signal line remaining slightly negative.

The Bollinger Bands tell an encouraging story too. With the price positioned closer to the middle band than the lower band, there's room for upward movement. "In our analysis at BTCC, we see $0.3669 as the next key resistance level to watch," notes our market analyst. "If buying pressure continues at current levels, we could see a test of this level in the coming weeks."

Market Fundamentals Supporting TRX Growth

Tron's fundamentals have strengthened significantly in recent months. The most impactful development came in late August when the tron Super Representative community approved a massive 60% reduction in network fees. This strategic move directly addresses what had become a growing pain point - USDT transfer fees had climbed to $4.28 due to TRX's price appreciation from $0.12 in early 2024 to current levels.

The fee reduction, effective August 29, drops the energy unit price from 210 SUN to just 100 sun. This reinforces Tron's position as the preferred network for stablecoin transactions, especially with its $80.97 billion USDT supply outpacing Ethereum's $73.8 billion. Justin Sun acknowledged the short-term impact on revenue but projected long-term gains through increased transaction volume - a bet that appears to be paying off given Tron's massive daily transfer volume.

Competitive Landscape: Tron vs. Emerging Challengers

While Tron maintains its strong position in stablecoins, the broader crypto market sees new challengers emerging. BlockchainFX has particularly caught attention with its $6.2 million presale attracting 6,600 investors at $0.021 per token. Positioned as a trading super app that bridges crypto and traditional markets, it's drawing comparisons to Binance's early disruptive potential.

However, Tron's established infrastructure and recent improvements give it significant advantages. The network's ability to process transactions quickly and cheaply - now enhanced by the fee reduction - creates a formidable moat against newer competitors. As one trader on BTCC put it, "You don't bet against a network that moves $24.6 billion in USDT daily unless you see something truly revolutionary coming."

Tether Policy Changes Benefit Tron Ecosystem

In another positive development for TRX, Tether reversed its plan to freeze USDT on five smaller blockchains (Omni Layer, Algorand, EOS, Bitcoin Cash SLP, and Kusama) following community feedback. While these chains will no longer receive official support, the decision to maintain transfer functionality prevents disruption to users.

This move further concentrates Tether's focus on ethereum and Tron - the two blockchains that host over $150 billion in USDT circulation. For TRX holders, this means continued strong support for the network's most important use case. The scrapped September 1 sunset date removes what could have been a short-term negative catalyst.

Price Outlook: Key Levels to Watch

Looking ahead through September 2025, several factors suggest potential upside for TRX:

| Indicator | Current Value | Implication |

|---|---|---|

| Current Price | $0.3432 | Below 20-day MA, consolidation phase |

| 20-day MA | $0.351345 | Near-term resistance level |

| MACD Histogram | +0.005812 | Building bullish momentum |

| Bollinger Upper | $0.366946 | Key resistance target |

The combination of improved technicals and strong fundamentals creates a favorable environment for TRX. If the current bullish momentum continues, we could see a test of the $0.367 resistance in the coming weeks. However, traders should remain cautious and watch for any shift in market sentiment that could interrupt this upward trajectory.

Frequently Asked Questions

What is the current TRX price prediction for September 2025?

Based on current technical indicators and market conditions, TRX shows potential to test the $0.367 resistance level in September 2025. The positive MACD histogram and recent fundamental improvements support this outlook.

How does Tron's fee reduction affect TRX price?

The 60% network fee reduction strengthens Tron's competitive position in stablecoin transactions, potentially increasing network usage and demand for TRX. This fundamental improvement could support price appreciation.

Is TRX a good investment in 2025?

While TRX shows positive technical and fundamental signals, all cryptocurrency investments carry risk. The current environment appears favorable, but investors should conduct their own research and consider their risk tolerance. This article does not constitute investment advice.

How does Tron compare to Ethereum for stablecoin transactions?

Tron currently processes about seven times Ethereum's daily USDT transfer volume ($24.6 billion vs. ~$3.5 billion) and hosts more USDT overall ($80.97 billion vs. $73.8 billion). The recent fee reduction further enhances Tron's cost advantage.

What are the key resistance levels for TRX?

The immediate resistance to watch is the 20-day moving average at $0.351345, followed by the Bollinger upper band at $0.366946. Breaking through these levels could signal continued upward momentum.