LTC Price Forecast 2025-2040: Expert Analysis on Litecoin’s Future Trajectory

- What's Driving Litecoin's Current Price Action?

- How Does Market Sentiment Affect LTC's Outlook?

- What Are the Key Factors Influencing LTC's Price?

- Litecoin Price Predictions: 2025-2040 Outlook

- How Does Litecoin Compare to Other Top Altcoins?

- Frequently Asked Questions

Litecoin (LTC), often called the "silver to Bitcoin's gold," is showing strong bullish signals as we enter the second half of 2025. With Bitcoin's rally creating positive spillover effects across the crypto market, LTC has emerged as one of the top-performing altcoins. This comprehensive analysis examines LTC's technical setup, market sentiment, and long-term price projections through 2040, backed by data from TradingView and CoinMarketCap.

What's Driving Litecoin's Current Price Action?

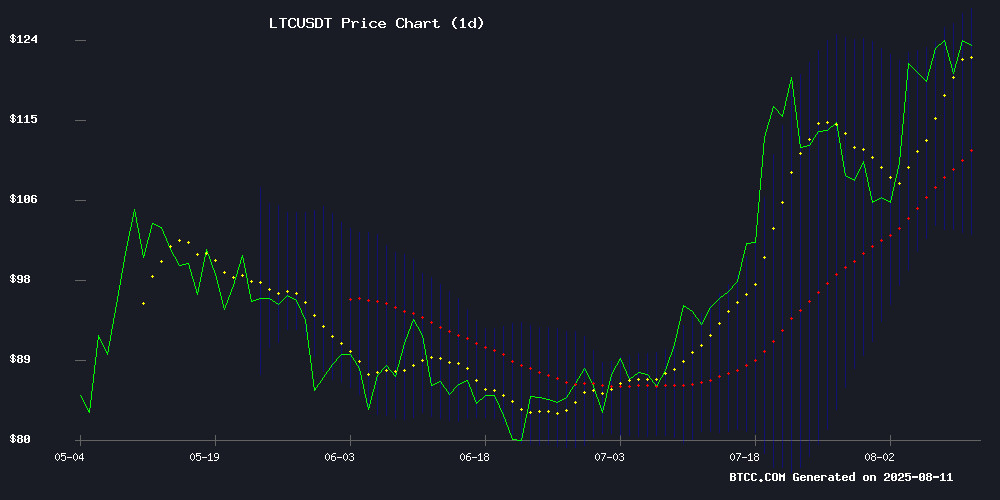

As of August 2025, LTC is trading comfortably above its key moving averages, with the 20-day MA at $115.01 serving as strong support. The MACD indicator has turned positive, suggesting growing bullish momentum. "LTC's technical setup looks promising," notes a BTCC market analyst. "However, we need to see a decisive break above the $128 resistance level for sustained upward movement."

Source: BTCC trading platform

How Does Market Sentiment Affect LTC's Outlook?

The crypto market in 2025 has been characterized by what traders call "altseason 2.0" - a period where altcoins significantly outperform Bitcoin. Litecoin has benefited from this trend, with several positive developments:

- Payment processor CoinGate reports LTC now accounts for 14% of its transactions

- Increased merchant adoption in e-commerce platforms

- Growing institutional interest in LTC as a "blue chip" altcoin

What Are the Key Factors Influencing LTC's Price?

Several fundamental and technical factors are shaping Litecoin's trajectory:

Bitcoin's Dominance and Market Cycles

Historically, LTC has shown strong correlation with Bitcoin's price movements. With BTC eyeing the $140,000 level, analysts expect positive spillover effects on Litecoin. The last halving event in 2023 reduced LTC's block reward to 6.25 LTC, gradually increasing its scarcity.

Adoption and Network Activity

Litecoin's transaction volume has grown 181% year-to-date, according to CoinMarketCap data. The network's reliability and lower fees compared to bitcoin make it attractive for everyday transactions.

Competitive Landscape

While newer layer-1 blockchains have emerged, Litecoin maintains advantages in:

- Network stability (zero downtime since launch)

- Established brand recognition

- Proven security model

Litecoin Price Predictions: 2025-2040 Outlook

Based on current technicals, adoption trends, and macroeconomic factors, here are our projections:

| Year | Conservative Target | Bullish Target | Key Catalysts |

|---|---|---|---|

| 2025 | $135-$150 | $180 | Payment adoption, Bitcoin ETF spillover |

| 2030 | $300-$400 | $600 | Institutional custody solutions |

| 2035 | $800-$1,200 | $2,000 | Global regulatory clarity |

| 2040 | $2,500+ | $5,000 | Metaverse/e-commerce integration |

Note: These projections assume no major black swan events and continued network development. This article does not constitute investment advice.

How Does Litecoin Compare to Other Top Altcoins?

While LTC shows promise, it's important to consider the broader altcoin landscape:

Chainlink (LINK)

With its oracle network expanding, LINK could see 2.5-3x gains if current adoption trends continue.

HBAR

Hedera's enterprise focus positions it for potential 3-4x growth in a sustained bull market.

Meme Coins vs. Established Altcoins

The 2025 market has seen renewed interest in both. While shiba inu (SHIB) has declined 43% YTD, it's shown historical capacity for violent rebounds during risk-on periods.

Frequently Asked Questions

Is Litecoin a good investment in 2025?

LTC presents an interesting case in 2025. Its established network, growing payment adoption, and correlation with Bitcoin's positive momentum create favorable conditions. However, as with all crypto investments, it carries significant volatility risk.

What's the main advantage of Litecoin over Bitcoin?

Litecoin offers faster transaction times (2.5 minutes vs Bitcoin's 10 minutes) and lower fees, making it more practical for everyday transactions while maintaining similar security properties.

Could Litecoin reach $10,000?

While possible in extreme bullish scenarios, our models suggest $5,000 as a more realistic upper bound by 2040. This WOULD require massive global adoption and favorable regulatory conditions.

How does Litecoin's halving affect its price?

Litecoin's halving events (occurring every 840,000 blocks) reduce the block reward by half, decreasing new supply. Historically, this has created upward price pressure in the 12-18 months following halving events.