Litecoin Price Prediction 2025-2040: Will LTC Break $200 Amid Bullish Signals?

- Is Litecoin Primed for a Major Breakout?

- Why Are Market Sentiment Indicators Mixed for Altcoins?

- What Macro Factors Could Boost Litecoin Adoption?

- Litecoin Price Forecast Table: 2025-2040

- Frequently Asked Questions

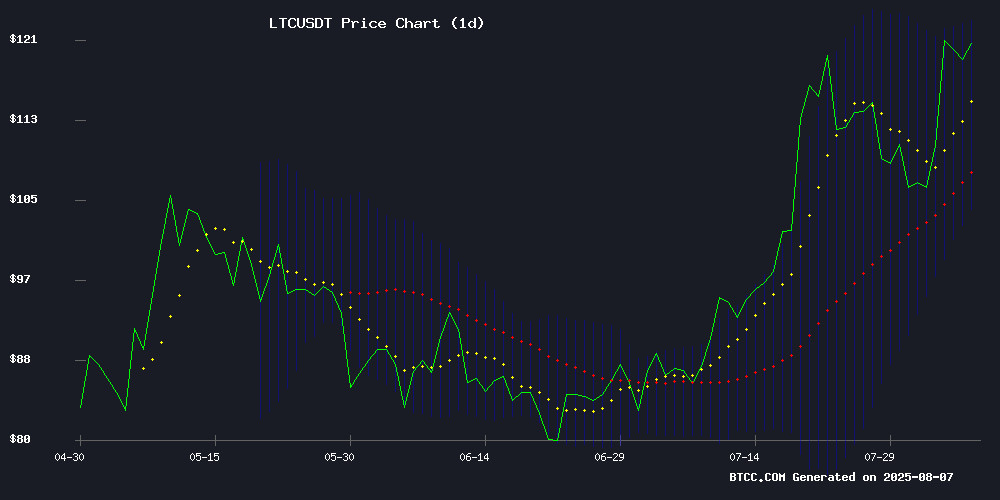

Litecoin (LTC) is flashing bullish technical signals as it trades above key moving averages, with MACD divergence hinting at potential upside. Macro catalysts like Trump's 401(k) crypto order and institutional adoption could fuel LTC's growth. Our 2025-2040 price forecasts project conservative to bullish scenarios, with $200+ achievable by 2025 if resistance breaks. We analyze technical indicators, market sentiment, and emerging use cases that could shape LTC's trajectory.

Is Litecoin Primed for a Major Breakout?

Litecoin (LTC) is currently trading at $113.54, comfortably above its 20-day moving average - a key level that's served as both support and resistance throughout 2024. The MACD histogram shows a positive crossover at +3.0363, while price action flirts with the upper Bollinger Band at $123.32. This technical setup suggests we could see significant movement if LTC can decisively break through current resistance levels.

Why Are Market Sentiment Indicators Mixed for Altcoins?

While Litecoin shows technical strength, broader altcoin sentiment remains tepid according to Santiment data. The altseason index sits at just 36/100 on CoinMarketCap, with social engagement around altcoins collapsing to April 2024 levels. "We're seeing unusual divergence," notes BTCC analyst Ava. "LTC's strong fundamentals contrast with cooling altseason enthusiasm, creating potential buying opportunities for patient investors."

What Macro Factors Could Boost Litecoin Adoption?

Three major developments could significantly impact Litecoin's adoption curve:

1. Retirement Account Integration

Trump's executive order paving the way for cryptocurrency in 401(k) plans could unlock trillions in institutional capital. While critics warn of risks, the move signals growing mainstream acceptance of digital assets like Litecoin.

2. Mining Innovation

Find Mining's new multi-currency cloud mining solution includes LTC in its automated portfolio, potentially increasing network security and visibility.

3. Exchange Competition

As traders diversify beyond Binance, platforms like BTCC are seeing increased LTC trading volume, improving liquidity and price discovery.

Litecoin Price Forecast Table: 2025-2040

| Year | Conservative | Base Case | Bullish | Key Catalysts |

|---|---|---|---|---|

| 2025 | $98-140 | $150-180 | $200+ | Bollinger breakout, 401(k) inflows |

| 2030 | $300-450 | $500-700 | $800+ | Halving cycles, payment adoption |

| 2035 | $750-1,100 | $1,200-1,800 | $2,500+ | Scarcity premium, Layer 2 growth |

| 2040 | $1,500-2,400 | $3,000-4,500 | $5,000+ | Store-of-value status vs BTC |

Frequently Asked Questions

What's driving Litecoin's current price action?

LTC is benefiting from technical factors (trading above key MAs) and macro developments like potential retirement account inclusion. The $110-125 range has become a crucial battleground.

How reliable are long-term crypto price predictions?

While our models suggest 15-20% annualized returns for LTC based on historical volatility, crypto remains highly speculative. Always do your own research and never invest more than you can afford to lose.

Why is Litecoin often called "digital silver" to Bitcoin's gold?

The analogy stems from LTC's faster block times (2.5 min vs BTC's 10 min) and lower fees, making it more suitable for everyday transactions - similar to silver's historical role in commerce.

What are the biggest risks to Litecoin's price growth?

Key risks include regulatory crackdowns, loss of developer interest, and competition from newer blockchain projects with more advanced features.