BTC Price Prediction 2025: Decoding Market Sentiment vs. Technical Signals in Bitcoin’s Rollercoaster Ride

- Where Does Bitcoin Stand Technically in November 2025?

- Why Are Institutions Bullish When Technicals Look Bearish?

- How Thin Are Bitcoin ETF Profit Margins Really?

- What's Up With Bitcoin's Weird Funding Rate Behavior?

- Has Bitcoin Truly Become a Macro Asset?

- Why Did Fed Rate Cut Odds Collapse to 44%?

- How Does Bitcoin Fare in US Political Battles?

- What's the Realistic Price Range for Bitcoin?

- Bitcoin Price Prediction 2025: Your Questions Answered

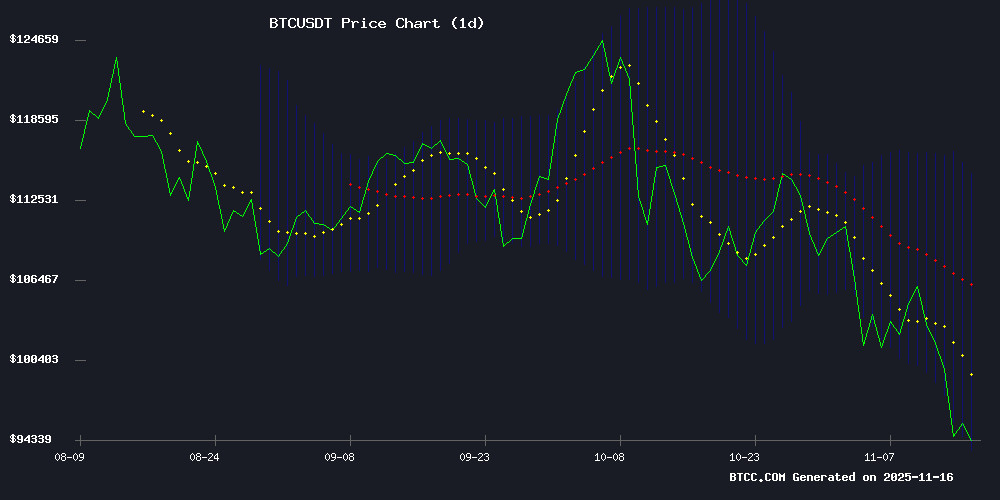

Bitcoin's price action in November 2025 presents a fascinating tug-of-war between bearish technical patterns and growing institutional adoption. Currently trading at $93,995.88, BTC sits below critical moving averages while showing bullish MACD divergence - a classic case of market crosscurrents. The BTCC team analyzes eight key factors influencing Bitcoin's trajectory, from Harvard's surprising 257% accumulation to liquidity concerns that could make or break the $90,000 support. This DEEP dive separates signal from noise in crypto's most volatile month.

Where Does Bitcoin Stand Technically in November 2025?

According to TradingView data, Bitcoin's chart paints a conflicted picture as of November 16, 2025. The cryptocurrency trades below its 20-day moving average ($103,989.69) but shows a promising MACD crossover (6,502.63 vs signal line at 4,516.42). The price hovering near the lower Bollinger Band ($93,433.15) suggests we're either at a buying opportunity or facing further downside.

Source: BTCC Trading Platform

Why Are Institutions Bullish When Technicals Look Bearish?

While retail traders panic about the looming "death cross" (last seen before January's 40% correction), smart money tells a different story. Harvard University increased its BlackRock IBIT position by 257% last quarter - now holding $443 million in bitcoin ETF shares. That's not pocket change even for a $57 billion endowment fund.

Meanwhile, the Czech National Bank launched a $1 million crypto pilot program, acquiring both Bitcoin and stablecoins. As central banks dip their toes in, it's becoming harder to dismiss BTC as purely speculative.

How Thin Are Bitcoin ETF Profit Margins Really?

Here's the concerning math: The average purchase price for spot Bitcoin ETF inflows since January 2024 sits at $90,146. With BTC at $93,995, that's just a 4.7% aggregate profit margin. Jim Bianco's analysis shows money market funds would've outperformed Bitcoin over this 22-month period.

| Metric | Value |

|---|---|

| Current BTC Price | $93,995.88 |

| ETF Average Cost Basis | $90,146 |

| Unrealized Profits | $2.94 billion |

What's Up With Bitcoin's Weird Funding Rate Behavior?

Despite prices testing $95,000 support, funding rates remain positive (0.003%-0.008%). This suggests Leveraged traders keep doubling down on longs near perceived bottoms. Historically, such divergence either precedes violent reversals or accelerates liquidations if support breaks.

Has Bitcoin Truly Become a Macro Asset?

The data says yes. BTC now moves in lockstep with Treasury flows (7-day lag) and global liquidity cycles. The current setup mirrors 2019's bottom formation during the US government shutdown. With a $300 billion Treasury cash infusion expected by mid-December, crypto markets might be priming for expansion.

Why Did Fed Rate Cut Odds Collapse to 44%?

December rate cut probabilities plunged despite the Fed's emergency meeting about potential stimulus. JPMorgan expects $300 billion in liquidity injections within 72 hours - similar to China's recent ¥1.12 trillion MOVE that briefly boosted crypto. This creates a bizarre tension between risk-off sentiment and anticipation of fresh money.

How Does Bitcoin Fare in US Political Battles?

A BTC Policy Institute study found Bitcoin gains bipartisan support when framed strategically: Democrats respond to financial inclusion narratives, while Republicans prefer energy stability arguments. Independents emerge as the most likely holders - twice as likely as Republicans and five times more than Democrats.

What's the Realistic Price Range for Bitcoin?

The BTCC team identifies two critical levels:

- Upside: Break above $103,989 (20-day MA) could target $114,546 (upper Bollinger Band)

- Downside: Failure to hold $93,433 may trigger extended declines

This article does not constitute investment advice.

Bitcoin Price Prediction 2025: Your Questions Answered

Is Bitcoin a good investment in November 2025?

With conflicting signals between institutional accumulation and technical warnings, Bitcoin presents both opportunity and risk. The 4.7% ETF profit margin leaves little room for error, while macroeconomic liquidity injections could provide tailwinds.

Why is Harvard buying so much Bitcoin?

The 257% increase in Harvard's IBIT holdings suggests elite institutions now view Bitcoin as a legitimate store of value component within diversified portfolios, alongside their $235 million Gold position.

What happens if Bitcoin breaks $93,433 support?

A sustained break below the lower Bollinger Band could trigger algorithmic selling and test the psychologically important $90,000 level where most ETF buyers entered.

How does Bitcoin's current technical setup compare to past cycles?

The MACD bullish divergence amidst price weakness resembles early 2019 conditions before Bitcoin's 300% rally, though the "death cross" pattern last preceded a 40% drop in January 2025.

Are funding rates signaling a Bitcoin bottom?

Persistent positive funding during price declines typically indicates either accumulation before a reversal or excessive leverage that will exacerbate downside if support breaks.