Bitcoin Price Forecast 2025: Can BTC Sustain Above $100,000 With Current Market Dynamics?

- Technical Analysis: Bullish Structure With Warning Signs

- Institutional Activity: The Double-Edged Sword

- Macroeconomic Tailwinds: Fed's $29.4B Liquidity Injection

- Emerging Threats: Quantum Computing Concerns

- Retail Retreat vs. Whale Activity

- Mining Sector Transformation

- Regulatory and Political Developments

- Liquidation Events and Market Structure

- Price Prediction: Sustainability Above $100K

- Bitcoin Price Prediction 2025: Your Questions Answered

Bitcoin's price action in November 2025 presents a fascinating paradox - the cryptocurrency has already surpassed the psychological $100,000 barrier (currently trading at $104,479.81), yet market participants remain divided about its sustainability. The BTCC research team analyzes mixed technical signals, institutional shifts, and macroeconomic factors shaping BTC's trajectory. While bullish fundamentals like Fed liquidity injections ($29.4B) and mining infrastructure transitions provide support, bearish pressures emerge from whale selling and quantum computing concerns. This deep dive examines whether Bitcoin can maintain its premium valuation or faces imminent correction.

Technical Analysis: Bullish Structure With Warning Signs

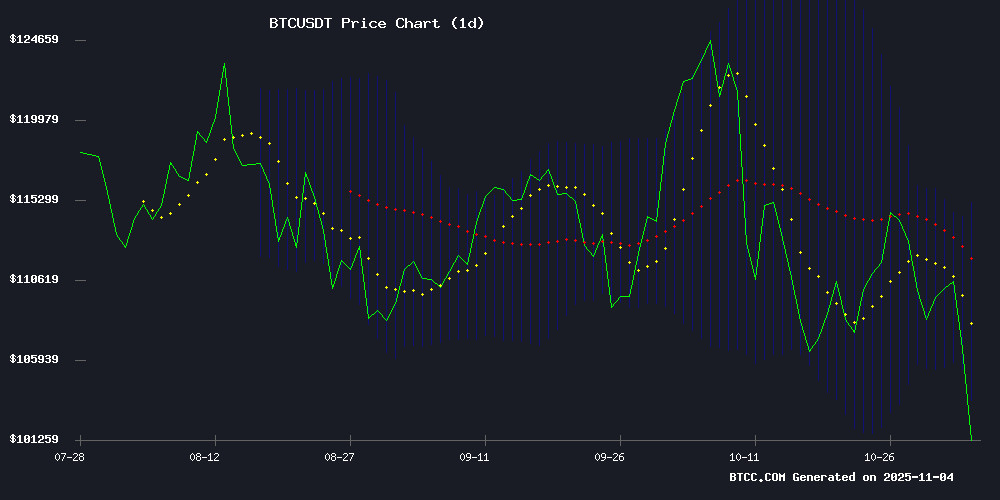

The BTCC technical analysis team observes bitcoin currently trades in a precarious position - above the $100,000 milestone but below the critical 20-day moving average ($109,539.98). The Bollinger Bands (104,523.39 - 114,556.57) suggest room for upside, while the MACD's bearish reading (-1276.4337) indicates weakening momentum. "This divergence creates a trader's dilemma," notes our senior analyst. "The price needs to hold above $104,500 support to maintain bullish structure, but requires volume to challenge the moving average resistance."

Source: BTCC TradingView

Institutional Activity: The Double-Edged Sword

November 2025 reveals dramatic institutional participation reshaping Bitcoin's market dynamics. While MicroStrategy slowed purchases to 200 BTC/week (their lowest since 2020), mining companies like IREN surged 580% by pivoting to AI infrastructure. "The institutional narrative has fundamentally changed," observes a BTCC market strategist. "We're seeing capital rotate from pure crypto plays to hybrid tech-crypto models." Exchange data shows 208,000 BTC left platforms over six months - suggesting accumulation by long-term holders despite recent volatility.

Macroeconomic Tailwinds: Fed's $29.4B Liquidity Injection

The Federal Reserve's October 31st $29.4B Standing Repo Facility operation - the largest since pandemic measures - created ripples across risk assets. Historical patterns suggest such liquidity injections precede capital flows into alternative stores of value. "The Fed's action essentially backstops short-term market stability," explains our macro analyst. "For Bitcoin, this could mean reduced downside volatility even if upside catalysts remain unclear."

Emerging Threats: Quantum Computing Concerns

While immediate risks appear contained, theoretical vulnerabilities from quantum computing advancements have entered market discourse. Research breakthroughs from Google and IBM revived "Q-Day" discussions - the hypothetical moment quantum systems could compromise Bitcoin's cryptographic security. "The psychological impact may precede actual technological capability," warns a BTCC security specialist. Recent market sensitivity was demonstrated when a $50M sell order triggered disproportionate liquidations across crypto assets.

Retail Retreat vs. Whale Activity

A striking November 2025 development is the dramatic decline in retail participation. Data shows Binance's small-holder deposits plummeted from 552 BTC/day (early 2023) to just 92 BTC currently. Meanwhile, OG whales have begun distributing portions of their holdings. "Early adopters selling deserves attention," comments former Bitwise executive Jeff Park. "These investors identified Bitcoin's potential before consensus - their moves often signal non-obvious risks."

Mining Sector Transformation

Bitcoin's infrastructure continues evolving remarkably. Iran's electricity grid struggles with 427,000 unauthorized mining devices (95% unlicensed), consuming 1,400MW continuously. Simultaneously, U.S. miners like Riot Platforms and TeraWulf gained 100-360% by repurposing assets for AI workloads. "The mining sector's reinvention demonstrates remarkable adaptability," notes a BTCC industry researcher. "This flexibility may prove crucial for Bitcoin's long-term security as block rewards diminish."

Regulatory and Political Developments

U.S. Treasury Secretary Scott Bessent recently highlighted Bitcoin's operational resilience as a model for Senate Democrats during federal budget clashes. The comments, made on Bitcoin's whitepaper anniversary, framed its 16-year uptime as a benchmark for reliable systems. Meanwhile, increased regulatory scrutiny accompanies Bitcoin's price discovery above $100K, particularly regarding exchange oversight and taxation.

Liquidation Events and Market Structure

The November 2025 market witnessed a dramatic $1.15B liquidation event when Bitcoin briefly dipped to $106,000. Long positions bore 90% of losses, with Hyperliquid, Bybit, and BTCC seeing significant outflows. "These events reveal structural vulnerabilities," analyzes our risk assessment team. "The market remains prone to cascading liquidations when leverage ratios exceed sustainable levels."

Price Prediction: Sustainability Above $100K

Considering current technicals and fundamentals, BTCC maintains a cautiously optimistic outlook. The $100,000 level has transitioned from resistance to support, but maintaining this threshold requires:

| Factor | Status | Impact |

|---|---|---|

| Institutional Adoption | Transition Phase | Neutral/Positive |

| Fed Liquidity | $29.4B Injected | Positive |

| Technical Indicators | Mixed Signals | Neutral |

| Retail Participation | Declining | Negative |

"The $100K sustainability question depends on which forces dominate in coming weeks," summarizes our lead analyst. "Institutional inflows and macro conditions suggest upside potential, but technical resistance and retail apathy create headwinds."

Bitcoin Price Prediction 2025: Your Questions Answered

Is Bitcoin currently above $100,000?

Yes, as of November 4, 2025, Bitcoin trades at $104,479.81 - surpassing the psychological $100K barrier. However, it remains below the 20-day moving average ($109,539.98), creating technical resistance.

What are the main factors supporting Bitcoin's price?

Key supports include institutional adoption (despite MicroStrategy's slowdown), Fed liquidity injections ($29.4B), and mining sector transformation. Bollinger Band positioning ($104,523.39 lower band) also provides technical support.

What risks could push Bitcoin below $100,000?

Potential downside catalysts include continued whale distribution, quantum computing security concerns, regulatory actions, and the MACD's bearish momentum reading (-1276.4337). Retail participation has also declined significantly.

How significant was the recent $1.15B liquidation event?

The October 2025 liquidation was substantial, with long positions accounting for 90% of losses. Hyperliquid, Bybit, and BTCC saw the largest outflows. Such events reveal market fragility when excessive leverage exists.

Are miners still supporting the Bitcoin network?

Yes, though the mining landscape is transforming dramatically. While Iran faces unauthorized mining surges (427,000 devices), U.S. miners are pivoting to AI infrastructure, maintaining network security through innovative business models.