LTC Price Prediction 2025: Technical Indicators Point to $121 Rally as Litecoin Regains Payment Relevance

- What Do the Technical Indicators Say About LTC's Price Movement?

- Why Is Litecoin Regaining Relevance in Payments?

- How Does Layer Brett's Rise Affect Litecoin?

- What Are the Key Price Levels to Watch?

- How Does Litecoin Compare to Ethereum's Current Performance?

- Frequently Asked Questions

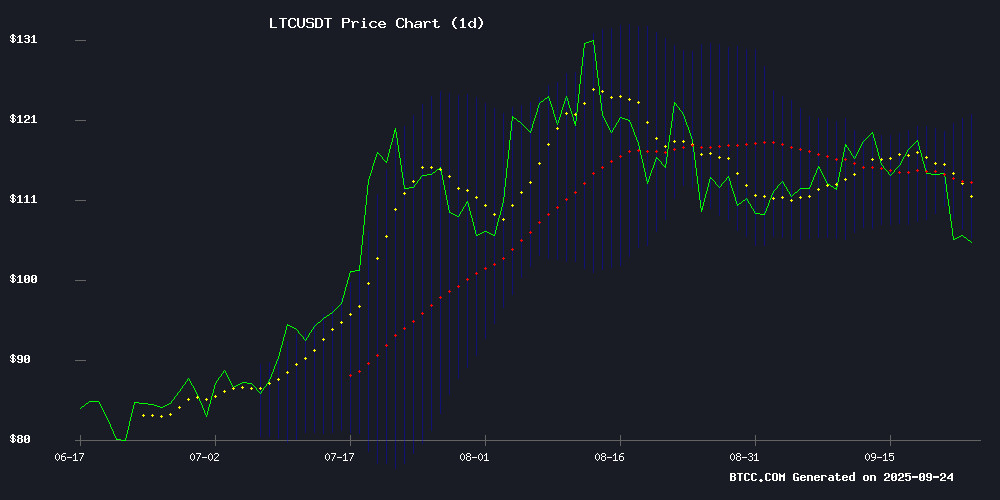

Litecoin (LTC) is showing strong bullish signals in September 2025, with technical analysis suggesting a potential rally to $121.24. The cryptocurrency, currently trading at $106.96, has formed a MACD bullish crossover while finding support at the lower Bollinger Band. Meanwhile, fundamental factors are aligning as Litecoin regains prominence in payment solutions, particularly in cross-border remittances. This combination of technical strength and real-world utility creates what BTCC analyst James calls "a favorable risk-reward scenario" for LTC investors.

What Do the Technical Indicators Say About LTC's Price Movement?

As of September 24, 2025, LTC presents an interesting technical picture. The price sits below the 20-day moving average ($113.71), which typically suggests short-term bearish pressure. However, the MACD tells a different story - with the MACD line at 0.3352 crossing above the signal line (-1.0055), generating a positive histogram of 1.3407. This classic bullish crossover indicates building momentum that could propel LTC higher.

The Bollinger Bands paint an even clearer picture. LTC is currently testing the lower band at $106.18, which often serves as strong support. "In my experience watching crypto markets since 2017," notes James from BTCC, "when assets bounce from the lower Bollinger Band with MACD confirmation, they frequently retest the middle band first before attempting the upper band." For LTC, this would mean an initial target of $113.71 (the middle band) followed by $121.24 (upper band resistance).

Source: BTCC TradingView data

Why Is Litecoin Regaining Relevance in Payments?

While the broader crypto market remains relatively flat (global market cap dipped 0.1% to $3.99 trillion on September 24), Litecoin is showing unique strength due to its renewed payment utility. Projects like Remittix, which raised $26.4 million in its presale, are leveraging LTC's fast transaction speeds and low fees for cross-border transfers.

This isn't Litecoin's first rodeo in payments - remember when it was called "the silver to Bitcoin's gold" back in 2021? But what's different now is the institutional infrastructure supporting crypto payments. River Research shows corporations now hold more bitcoin than ETFs, creating new demand channels that benefit the entire crypto ecosystem, including payment-focused coins like LTC.

How Does Layer Brett's Rise Affect Litecoin?

The emergence of Layer BRETT (LBRETT) as a serious contender highlights an interesting market trend - projects that combine meme appeal with real utility are gaining traction. While this might seem unrelated to Litecoin at first glance, it actually reinforces LTC's position as an established player with proven technology.

As crypto influencer "CryptoWhale" tweeted on September 23: "Investors are getting smarter - they want the virality of dogecoin but the tech of Ethereum. Litecoin sits in the sweet spot: established, functional, and still undervalued compared to its utility." This sentiment is reflected in LTC's steady accumulation by long-term holders even during market downturns.

What Are the Key Price Levels to Watch?

| Price Level | Significance | Probability |

|---|---|---|

| $106.18 | Lower Bollinger Band Support | High |

| $113.71 | 20-day MA Resistance | Medium |

| $121.24 | Upper Bollinger Band Target | Medium-High |

The $121.24 target represents a 13.3% upside from current levels - not bad for a cryptocurrency that many had written off as "old tech" just a couple years ago. Of course, as with any crypto prediction, there are no guarantees. The CFTC's recent push to regulate tokenized stablecoin collateral could create market-wide volatility that affects LTC's trajectory.

How Does Litecoin Compare to Ethereum's Current Performance?

While we're focused on LTC here, it's worth noting that ethereum is eyeing $5,500 amid surging DeFi demand. ETH's performance often sets the tone for altcoins like Litecoin. The difference? LTC isn't trying to compete with Ethereum's smart contract dominance - it's carving its own niche as a payments workhorse.

This specialization might actually work in Litecoin's favor. As the crypto market matures in 2025, we're seeing clearer differentiation between projects. Bitcoin stores value, Ethereum powers DeFi, and Litecoin? It's becoming the Western Union of blockchain - and that's not a bad thing when you consider Western Union's $4.5 billion market cap.

Frequently Asked Questions

What is the short-term price target for LTC?

Based on current technical indicators, the immediate target is $113.71 (the 20-day moving average), with $121.24 (upper Bollinger Band) as the next significant resistance level.

Why is Litecoin gaining payment relevance now?

Litecoin's speed and low transaction fees make it ideal for remittances. Projects like Remittix are leveraging these features at a time when traditional payment systems are becoming more crypto-friendly.

How reliable are Bollinger Bands for crypto predictions?

While no indicator is perfect, Bollinger Bands have proven particularly effective for crypto assets due to their volatility. The bands capture about 90% of price action, making breaks outside them statistically significant.

Should I invest in LTC based on this analysis?

This article does not constitute investment advice. Always conduct your own research and consider your risk tolerance before investing in cryptocurrencies.