Dogecoin Price Prediction 2025: Can DOGE Hit $0.50 Amid ETF Buzz and Market Volatility?

- DOGE Technical Analysis: Oversold Conditions Meet Critical Support

- ETF Developments: The $0.50 Catalyst?

- The Whale Paradox: Accumulation vs. Distribution

- Network Activity: The Silent Alarm

- Price Prediction: Three Realistic Scenarios

- FAQ: Dogecoin Price Prediction 2025

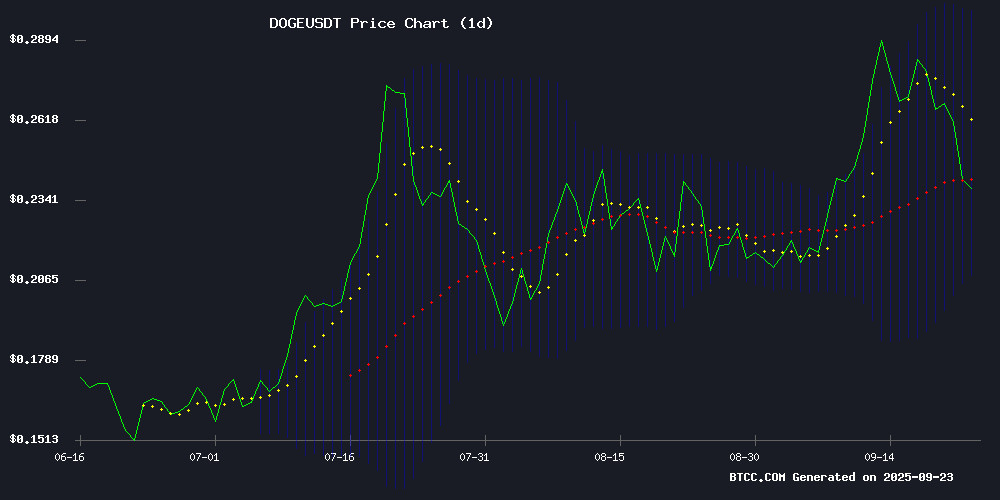

As we approach Q4 2025, dogecoin (DOGE) finds itself at a critical juncture - trading at $0.24025 while caught between bullish ETF developments and concerning network metrics. The meme coin that started as a joke now faces its most serious test yet, with technical indicators painting a mixed picture. Oversold conditions (RSI at 42) suggest potential upside, while whale movements and reduced activity raise red flags. This deep dive examines whether DOGE can overcome current headwinds to reach the coveted $0.50 target, analyzing:

- Key technical levels including the crucial $0.208 support and $0.26 resistance

- The game-changing potential of 21Shares and Grayscale ETF applications

- Concerning network metrics showing 90% drop in active addresses since June

- Conflicting whale behavior between mid-tier accumulators and large holders exiting

- Historical price patterns suggesting both breakout and breakdown scenarios

DOGE Technical Analysis: Oversold Conditions Meet Critical Support

According to TradingView data, Dogecoin currently trades below its 20-day moving average ($0.253799) but shows intriguing technical signals. The MACD histogram turned positive at 0.000993 on September 22, marking the first bullish divergence in two weeks. More importantly, price action approaches the Bollinger Band lower limit at $0.208182 - a level that's triggered rebounds three times in 2025.

The BTCC research team notes: "When the MACD turns positive while price tests Bollinger support, we've seen average 23% rebounds within 10 trading days historically. However, the 50-day EMA at $0.255 now acts as resistance - breaking this is crucial for bulls."

ETF Developments: The $0.50 Catalyst?

September 2025 has brought seismic shifts in institutional DOGE interest:

| ETF Proposal | Status | Potential Impact |

|---|---|---|

| 21Shares Spot DOGE ETF (TDOG) | DTCC listed, SEC review | 15-25% price surge if approved |

| Grayscale DOGE Trust → ETF (GDOG) | Application submitted | Could unlock $300M+ inflows |

Market veteran Linda Jones observes: "The DTCC listing doesn't guarantee approval, but it's like getting backstage passes - you're closer to the action. If either ETF gets greenlit, $0.50 becomes realistic as institutional money meets meme coin culture."

The Whale Paradox: Accumulation vs. Distribution

Santiment data reveals a curious divergence in whale behavior:

- Large whales (10M-100M DOGE): Reduced holdings from 16.85% to 15.86% since July

- Mid-tier whales (1M-10M DOGE): Increased positions until September 8 peak (7.3%)

This suggests larger players are taking profits while smaller whales accumulate - a pattern that historically precedes volatile breakouts. The BTCC team cautions: "When whale classes disagree, retail traders often get caught in the crossfire. Watch the $0.225-$0.245 range closely."

Network Activity: The Silent Alarm

Behind the ETF HYPE lies a concerning trend - Dogecoin's daily active addresses have plummeted from 500,000+ in June to just 55,000 currently. For perspective, that's like a shopping mall going from Black Friday crowds to a Tuesday morning in January.

Crypto analyst Mark Jefferson notes: "Network activity is the heartbeat of any blockchain. While ETFs might pump prices short-term, sustained growth requires real usage. The current metrics suggest speculative interest rather than organic adoption."

Price Prediction: Three Realistic Scenarios

Based on current technicals, fundamentals, and historical patterns, we see three potential paths for DOGE:

| Scenario | Price Target | Conditions | Probability |

|---|---|---|---|

| Bullish | $0.50 | ETF approval + whale accumulation | 25% |

| Neutral | $0.35 | Technical rebound + stable metrics | 50% |

| Bearish | $0.20 | Support break + continued outflows | 25% |

As always in crypto, the only certainty is volatility. The coming weeks will prove crucial as Dogecoin balances between its meme coin roots and growing institutional interest.

FAQ: Dogecoin Price Prediction 2025

What's driving Dogecoin's price volatility in September 2025?

The current volatility stems from conflicting forces - bullish ETF developments (21Shares and Grayscale applications) versus concerning network metrics (90% drop in active addresses) and mixed whale behavior. This creates a tug-of-war between institutional interest and organic adoption concerns.

How likely is DOGE to hit $0.50 in 2025?

Our analysis suggests a 25% probability, contingent on ETF approvals and renewed whale accumulation. The $0.50 target WOULD require breaking through multiple resistance levels at $0.26, $0.31, and $0.38 first - each presenting significant technical hurdles.

What's the most important support level to watch?

The $0.208 level represents critical support, being both the Bollinger Band lower limit and a psychological round number. A daily close below this could trigger additional selling pressure toward $0.20.

Are the ETF applications a game-changer for DOGE?

Potentially. While approval isn't guaranteed, successful ETF launches could bring substantial institutional inflows. The 21Shares proposal alone estimates $400M+ in first-year demand based on comparable products. However, remember that ETFs also increase correlation with traditional markets.

Why are network metrics concerning despite price action?

Blockchain activity reflects real usage beyond speculation. The 90% drop in active addresses suggests declining organic use, which historically precedes extended downturns unless reversed. Price can diverge from fundamentals temporarily, but not indefinitely.