Sui (SUI) Price Prediction: Defending $3.20 Support Sets Stage for $4.50 Breakout

Sui isn't asking for permission—it's building momentum at a critical technical level that could trigger the next major move.

The $3.20 Floor Holds Strong

Traders watched closely as Sui tested the $3.20 support level repeatedly. Each bounce confirms what technical analysts suspected: this isn't just another dip. The consolidation pattern suggests accumulation rather than distribution.

Breakout Mechanics in Play

Volume patterns indicate institutional interest building beneath the surface. When resistance finally breaks, the path to $4.50 opens up—a move that would represent nearly 40% upside from current levels. Market structure favors the bulls here.

What Traders Are Watching

Key resistance sits just above current prices. A decisive close above $3.50 would confirm the breakout thesis. Meanwhile, traditional finance veterans are still trying to figure out how to short something that doesn't sleep.

After a period of consolidation and minor declines, sui has stabilized above its key support zone. Technical indicators suggest buyers are stepping in consistently, forming an ascending triangle pattern that could signal the next upward move. Analysts highlight that maintaining this level is crucial for sustaining momentum and targeting higher resistance levels.

Technical Analysis: Ascending Triangle Formation

On the daily chart, Sui has been forming higher lows, a key indicator of an uptrend. The ascending triangle pattern is emerging, marked by a horizontal upper resistance NEAR $3.90–$4.50 and a rising lower trendline.

SUI is forming a strong bullish pattern, and a breakout could lead to a continuous series of higher highs. Source: Mark.eth via X

Historically, such formations suggest accumulation phases, where buyers gradually push the price higher while sellers defend key resistance points. A confirmed breakout above this resistance could pave the way for a significant upward movement toward $4.50 and potentially higher.

Support Levels and Risk Management

The $3.20 support zone remains pivotal for maintaining the bullish momentum. Each test of this level has been met with renewed buying pressure, suggesting strong confidence among traders.

However, a breach below $3.00 could signal a potential shift in market sentiment from bullish to neutral or bearish, triggering further downside risk. Analysts recommend using stop-loss strategies just below $3.00 to protect against unexpected market swings.

Trading Plan and Price Targets

For traders aiming to take advantage of Sui’s current momentum, the ideal entry zone is between $3.20 and $3.30. This range aligns with the key support level, where buying interest has consistently stepped in. Entering this zone allows traders to position themselves strategically while maintaining a favorable risk-to-reward ratio.

SUI is maintaining its ascending trendline with strong support at $3.2–$3.3, suggesting continued bullish momentum toward $4.0 and $4.5 as long as support holds. Source: BULLSTAR1 on TradingView

Key price targets for Sui include $4.00 as the first resistance and $4.50 as the secondary resistance. These levels correspond to historical supply zones where sellers have previously taken profits. To manage risk effectively in volatile crypto markets, traders should adhere to stop-loss levels and maintain discipline, ensuring potential losses are minimized while aiming to capture gains from the expected upward movement.

Market Sentiment and Broader Context

Near-term market developments, including China’s release of a regulated CNH-pegged stablecoin in September 2025, may impact altcoin dynamics and trigger further SUI momentum if cross-border crypto sentiment improves.

SUI has also seen steady trading volumes, which is indicative of strong market engagement. Market analysts point out that triangular structures tend to lead to significant price action, with volume validation raising the prospects of an effective breakout.

Price Projections and Analyst Views

Should the ascending triangle pattern materialize fully, Sui’s price could surpass its current resistance levels and aim for new highs. Some market analysts project that if bullish conditions persist, the token could reach and even exceed $4.50 in the short term, with longer-term projections extending higher depending on broader market factors.

While Sui exhibits strong fundamentals and technical signals, the cryptocurrency market remains inherently volatile, and investors should approach trades cautiously.

Final Thoughts

In summary, Sui’s price action currently reflects a cautiously bullish outlook, provided it holds above the $3.2 support zone and challenges resistance near $4.5. Traders and investors should monitor these critical levels closely, maintaining proper risk management strategies.

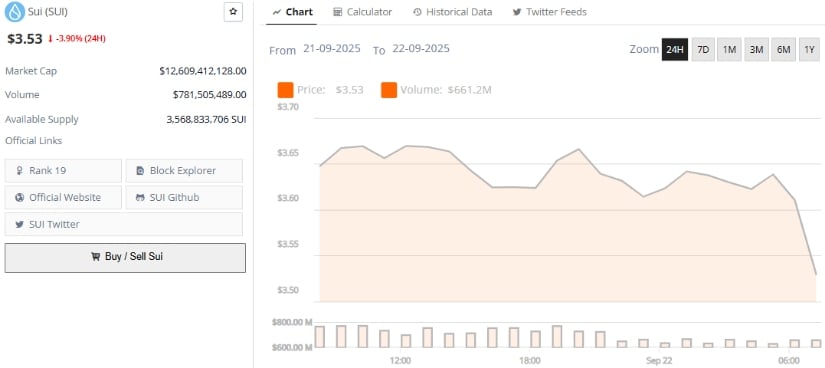

Sui was trading at around $3.53, down -3.90% in the last 24 hours at press time. Source: Brave New Coin

A confirmed breakout could signal another upward leg for Sui, offering potential profit opportunities, while a breach below $3.0 WOULD warrant caution.