SEI Price Targets $0.33 as Buy Signals Flash on the Charts

Bullish momentum builds as technical indicators scream buy—SEI eyes $0.33 resistance breakthrough.

Chart Signals Ignite Rally

Multiple buy triggers just lit up across SEI's trading charts. The cryptocurrency's technical setup suggests growing institutional interest—rare these days when most traditional finance folks still think blockchain is something you use to secure bicycles.

Price Momentum Accelerates

SEI's recent surge isn't just retail speculation. Volume patterns show smart money positioning for the next leg up. That $0.33 target represents a key psychological barrier—break through that and things get really interesting.

Market Positioning Perfect Storm

With broader crypto markets showing strength and SEI's unique infrastructure advantages, the stars align for potential outperformance. Because nothing says 'sound investment' like chasing green candles on a screen while ignoring fundamental valuation metrics.

The TD Sequential has now triggered a fresh buy signal, hinting that sellers may be losing control. Candles have begun to compress around a narrow support zone, signaling exhaustion in downward pressure. With buyers stepping in, attention is shifting toward a possible push toward $0.33.

Buy Signals Emerge After a Steep Decline

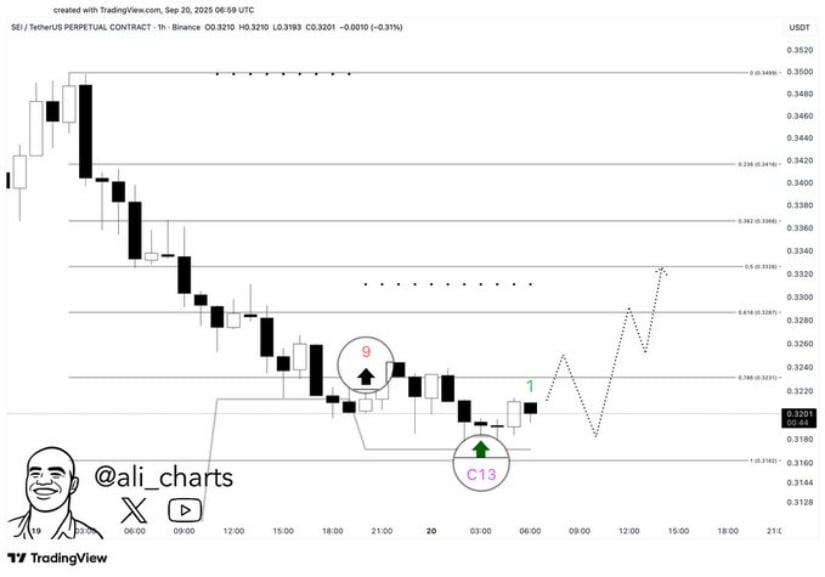

In a recent X post, analyst Ali highlighted SEI’s TD Sequential pattern, which has printed a C13 buy signal following days of sustained weakness. The token, anchored NEAR $0.32, reflects waning bearish pressure as smaller-bodied candles replace aggressive selling. A similar signal, marked as “9” earlier on the chart, led to a short-term bounce, adding weight to the bullish setup now forming.

Source: X

The price structure reinforces this view. After cascading red candles, stabilization around the $0.318–$0.320 support range shows that demand is beginning to absorb supply. This standoff between buyers and sellers is a common early sign of a reversal phase, especially when paired with repeating technical signals.

Looking forward, Fibonacci retracement levels point toward $0.326 and $0.334 as immediate hurdles. A breakout past these checkpoints would strengthen the case for a broader rebound, while failure to clear them may trap the crypto in a consolidation cycle. Either way, the $0.33 level now stands as the defining line for the cryptocurrency’s short-term outlook.

Support Levels Under Pressure

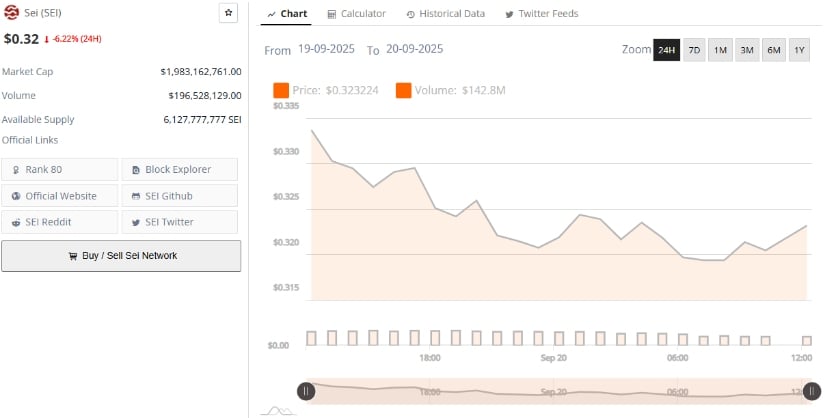

According to BraveNewCoin, SEI is currently priced at $0.32, down 6.22% in the last 24 hours, with a market capitalization of $1.98 billion. Trading volume has reached $196 million, reflecting steady activity despite the decline. The token has been moving within a narrow intraday range between $0.315 and $0.335, showing signs of consolidation after recent selling pressure.

Source: BraveNewCoin

The $0.31–$0.32 zone has emerged as a crucial support area, where buyers have stepped in to absorb downward momentum. Holding this floor could pave the way for a rebound toward $0.34–$0.35, while failure to defend it risks extending the downtrend. For now, cryptocurrency’s stability around this level will decide whether the current MOVE is just a pause or the start of a deeper correction.

Technical Indicators Signal Mixed Momentum

On the other hand, the SEI/USDT daily chart reflects a wide trading range between 0.1303 and 0.3903, with the latest price at 0.3194, slightly down 0.68% on the day. Recent candles show consolidation around the 0.32 zone, following earlier bullish momentum spikes in July and September that lifted the token toward higher levels.

Source: TradingView

The MACD offers a mildly bullish signal, with the line at 0.0066 sitting above the signal line at 0.0057, supported by a positive histogram. However, the weak bar size highlights fragile momentum, suggesting buyers lack conviction. Previous crossovers triggered short-lived moves, keeping volatility in focus.

Meanwhile, the RVI sits at 37.78, below its moving average of 47.05, pointing to bearish pressure and weak buying vigor. This indicator, paired with subdued RSI-like readings, suggests sideways or range-bound action in the near term. Unless stronger momentum emerges, the crypto appears likely to hover between its recent support and resistance levels.