BNB Nears $1K Milestone as Accumulation Hints at Major Breakout Ahead

BNB bulls dig in near the psychological $1,000 barrier—accumulation patterns suggest this might just be the calm before another leg up.

Signs of Strength

Despite swirling macro headwinds—the kind that typically send traditional finance scrambling for cover—BNB holds firm. Whales and retail alike keep stacking, betting that the token's utility beats out old-school yield plays any day.

What’s Driving the Momentum?

Network activity stays robust, burn mechanisms keep supply tight, and let's be real—nobody’s missing those traditional brokerage fees. While bankers debate rate cuts, BNB holders are busy writing their own rules.

Outlook: Up and Away?

If accumulation continues at this pace, resistance near $1K could soon look more like a launching pad than a ceiling. Then again, in crypto, the only thing predictable is the unpredictability—and the fact that Wall Street will still be trying to catch up next year.

Analyst Yoddha highlighted that its breakout follows a long pattern of higher highs and higher lows, similar to its 2018–2021 bull cycle.

This extended accumulation, which lasted over 1,000 days, provided the fuel for the current macro uptrend. Yoddha explained that prolonged consolidation acts as a pullback phase that strengthens market structure and drives future rallies.

Meanwhile, short-term charts reveal a minor pullback as the altcoin faces a strong sell wall NEAR $995–$1,000, according to CW. Despite brief dips to $986, BNB holds above critical supports at $970 and $940. Analysts expect a decisive break above $1,000 to trigger the next leg of the rally.

Price Discovery After Extended Consolidation

Binance Coin price has reached the $1,000 level after a prolonged accumulation phase, according to analyst Yoddha on X. He noted that the token entered price discovery mode following years of steadily higher highs and higher lows. Historical charts show that the altcoin previously rallied strongly after similar extended consolidation periods, which lasted more than 1,000 days before a breakout.

BNBUSD Chart | Source:x

Yoddha explained that such long consolidations act as a pullback, creating momentum for the next major price wave. The pattern resembles Binance’s 2018 to 2021 structure when comparable market behavior preceded a large upward move. Now, with the recent surge beyond key resistance levels, the analyst believes that it could maintain upward momentum as long as crucial support zones hold.

Minor Pullback Around the $1,000 Resistance

Binance is undergoing a slight pullback after testing the psychological $1,000 level. Market data shows that a strong sell wall has formed between $995 and $1,000, where sellers are actively defending this area. Despite these rejections, it remains well above important support levels near $970 and $940, signaling that the broader uptrend remains intact.

Analyst CW observed that clearing the $1,000 resistance with strong trading volume could renew the rally. He added that breaking psychological barriers like this often triggers rapid price discovery. Current support from $960 to $910 provides a stable base for consolidation, suggesting buyers still have control as long as the token stays above the $970 zone.

BNBUSDT 1-Hr Chart | Source:x

Active Market Participation and Short-Term Levels

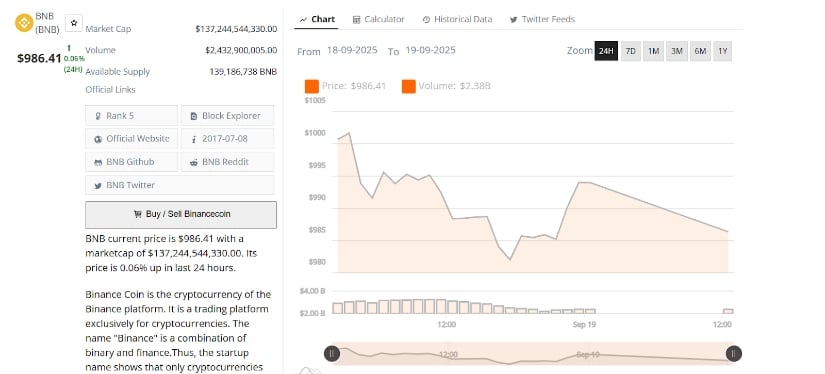

The 24-hour chart shows active trading with notable intraday swings. Price opened near $1,000, slipped toward $990, recovered briefly, and settled around $986.41 with a small daily gain of 0.06%. This pattern reflects strong initial selling pressure followed by short-lived rebounds, with trading volume reaching about $2.38 billion.

BNBUSD 24-Hr Chart | Source: BraveNewCoin

The $985–$990 range is providing near-term support while sellers dominate above $995. A decisive breakout beyond this upper range may signal a renewed MOVE higher, while a drop below $985 could accelerate short-term downside action. Market participants are closely watching these boundaries for volume spikes that could guide the next price direction.

Outlook Supported by Accumulation

Historical accumulation phases continue to underpin the current market outlook. Yoddha emphasized that lengthy consolidation not only stabilizes price but also stores energy for future advances. The current setup, with Binance Coin firmly trading in four digits, fits into this pattern of accumulation followed by upward expansion.

As long as the price remains above key support areas, technical signals suggest that the upward trend remains valid. Clearing the $1,000 resistance with strong momentum could trigger a fresh rally toward new all-time highs.