🚀 Ethereum (ETH) Price Prediction: $5,000 Target in Sight as Bullish Cross Collides with FED Rate Cut Hype

Ethereum's chart flashes its most bullish signal in months—just as Wall Street starts betting on a dovish Fed pivot. The stars might finally be aligning for ETH's long-awaited moonshot.

The Golden Cross That Could Unlock the Floodgates

ETH's 50-day moving average just sliced through the 200-day like a hot knife through butter. Textbook bullish confirmation—if you ignore the three times this pattern failed during 2024's 'crypto winter.'

Rate Cut Fantasies Meet Crypto Realities

Traders are pricing in 75 basis points of cuts by Q1 2026. Never mind that Powell hasn't actually said that—when did facts ever stop a good crypto rally? The mere whiff of cheaper money has altcoin degens salivating.

The $5,000 Psychological Battleground

Breaking $3,000 was easy compared to what comes next. The real test begins when ETH taps at that magic number—where profit-taking meets institutional FOMO. Watch the derivatives market for clues; perpetual swap funding rates will reveal whether this is organic demand or just leveraged speculation.

Will Ethereum finally deliver its promised 'flippening'? Or is this just another setup for the 'buy the rumor, sell the news' crowd? One thing's certain—the Fed's printer won't stay quiet forever, and crypto's always first in line when the liquidity spigot opens. Even if half these 'institutional adopters' are just hedge funds recycling 2021 playbooks.

With Ethereum’s recent price hovering NEAR $4,500, market participants are closely monitoring both on-chain activity and the upcoming Federal Open Market Committee (FOMC) meeting, which could trigger short-term volatility.

Ethereum Technical Analysis Points to Bullish Momentum

A recent post by @Zynweb3 highlighted a “bullish cross” on Ethereum’s price chart, where the 50-day moving average surpassed the 200-day moving average. Historically, such crossovers have preceded significant short-term rallies. According to Investopedia (2025), these technical patterns can indicate potential upward momentum, though a 2023 study in the Journal of Financial Economics cautions that moving average crossovers only achieve a 50–60% success rate in predicting gains.

Ethereum bullish cross signals potential surge above $5,000 after historic 60% July and 24% August gains. Source: @Zynweb3 via X

Past data supports the bullish scenario: ETH experienced surges of 60% in July and 24% in August following similar signals. Analysts note that Ethereum’s upgrade to ethereum 2.0 in 2022, which improved scalability and energy efficiency, adds further optimism, providing a stronger foundation for sustained upward movement.

BlackRock Sells ETH Amid Market Volatility

Institutional activity has also influenced the ethereum price today. On September 17, 2025, BlackRock sold 4,489 ETH worth $20.3 million, according to on-chain analytics shared by Whale Insider. While this sale coincided with a dip below $4,500, it represents less than 0.01% of BlackRock’s $12 billion ETH ETF holdings.

BlackRock sells 4,489.62 Ethereum (ETH) worth $20.3M amid market volatility. Source: @WhaleInsider via X

A report in the Journal of Finance (2024) suggests that ETF flows often favor established assets, which may explain BlackRock’s simultaneous $209 million Bitcoin purchase. Market experts note that given Ethereum’s daily trading volume exceeding $15 billion, this move is unlikely to trigger a whale-induced crash.

Price of Ethereum Could Respond to FED Rate Decisions

Adding to market uncertainty, the FED FOMC will be live in 8 hours, and traders are weighing the potential impact on Ethereum. The FOMC meeting, set for 2 PM ET (8 PM CEST), is expected to discuss interest rates. Market data indicates a 95% probability of a 25-basis-point rate cut, reflecting economic indicators such as a 6.13% mortgage rate—the lowest since 2022—and a softening jobs market, which added only 22,000 jobs in August.

FOMC meeting today could spark market moves with a likely 25-basis-point rate cut, as economic data points to softer job growth and lower mortgage rates. Source: @DeFiTracer via X

Historical context suggests that the Fed has previously cut rates aggressively following weak employment data. For instance, a 50-basis-point cut occurred in 2024, indicating that a similar move could support risk assets like Ethereum. The gamified ETH giveaway—$2,500 to predict the FOMC decision—has further heightened attention among crypto traders.

Ethereum Forecast 2025: Potential Rally to $5,000 and Beyond

Blockchain data from Glassnode shows a 15% increase in ETH held by long-term investors since mid-2024, indicating growing market confidence. Meanwhile, @CryptooELITES predicts that Ethereum could reach $10,000 by November–December 2025, comparing current accumulation trends with the 2021 pre-rally sideways movement. TradingView’s one-week technical analysis rates ETH as a “buy,” reinforcing the bullish outlook despite recent short-term volatility.

Ethereum could surge to $10,000 by late 2025 as long-term accumulation and historical price patterns fuel bullish momentum despite recent dips. Source: @CryptooELITES via X

Market analysts remain cautiously optimistic, noting that Ethereum’s recent bullish cross, combined with strong accumulation and a supportive macro environment, could pave the way for a $5,000 price target if market conditions remain favorable.

Looking Ahead: Watch for Technical Signals and FOMC Outcomes

Ethereum’s trajectory over the coming weeks will likely be influenced by both technical factors and macroeconomic developments. Traders should monitor the Ethereum price prediction 2025, upcoming FED rate decisions, and on-chain activity for insights.

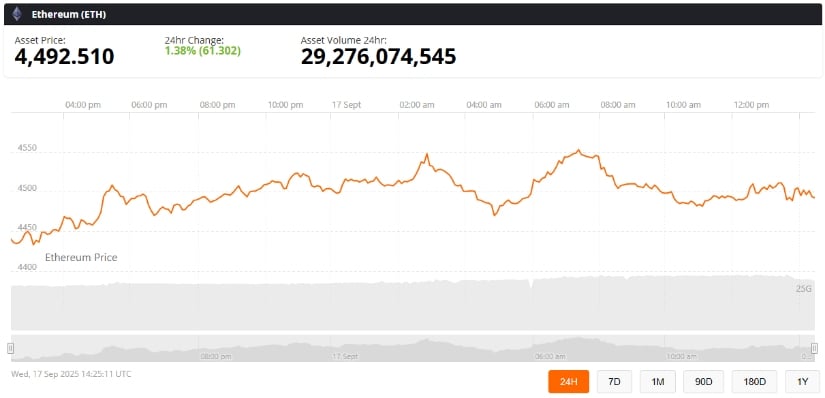

Ethereum (ETH) was trading at around $4,492, up 1.38% in the last 24 hours at press time. Source: Ethereum price via Brave New Coin

While historical patterns suggest potential gains, market participants are advised to remain vigilant, given the inherent volatility of ETH crypto price movements.