Sei Crypto Defies Market Pressure: $0.30 Support Holds Strong Through Pullback

Sei's $0.30 floor proves unbreakable as traders flock to defend critical support level.

Market Mechanics At Play

The digital asset demonstrates remarkable resilience, bouncing precisely at the psychological $0.30 barrier that's become the line in the sand for bulls. Trading volumes spike each time price approaches this zone—clearly someone's paying attention beyond just watching charts while pretending to work.

Technical Fortitude

Every test of support strengthens the foundation. Sellers exhaust themselves against what's rapidly becoming one of crypto's most watched price levels. The $0.30 hold isn't just technical—it's turning into a statement of conviction in an ecosystem where most 'fundamentals' are just Twitter threads with rocket emojis.

Looking Ahead

Defended support often becomes launchpad material. If this level holds, the path clears for another run at recent highs. Of course, in crypto, 'fundamental analysis' mostly means hoping the next person believes harder than you did—but sometimes the charts actually cooperate.

Buyers recently pushed the token toward higher ranges, but sellers have stepped back in, forcing a pullback and raising uncertainty about short-term direction.

The $0.30 level now stands out as a decisive support that could determine whether momentum continues upward or fades into deeper correction territory.

Key Levels Define Market Sentiment

In a recent X post, James highlighted that the token was unable to maintain momentum and had fallen back below its descending trendline. He suggested that $0.29 could be a reasonable level for a potential bounce, should current support zones fail to hold.

Source: X

The daily chart confirms this pressure, showing SEI testing the trendline multiple times without breaking higher. Each rejection has reinforced seller dominance, suggesting that momentum remains weak as the token struggles to sustain bullish advances.

While the asset had earlier shown signs of reclaiming strength, the failure to close above resistance indicates hesitation from buyers at higher levels. This aligns with broader market consolidation patterns, where many mid-cap tokens are facing renewed selling pressure after recent rallies.

Short-Term Price Action Points to Crucial Support Zone

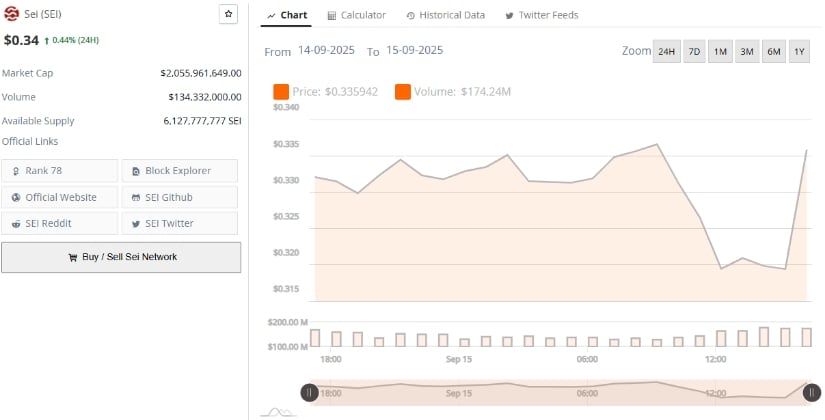

On one hand, BraveNewCoin data reflects the coin’s current price at $0.34, representing a 0.44% increase over the past 24 hours. The token maintains a market capitalization of $2.05 billion, ranking 78th overall, with trading volumes of $134.33 million during the same period. Circulating supply stands at 6.12 billion SEI, underscoring its broad distribution across the market.

Source: BraveNewCoin

The chart data also highlights notable volatility. The asset has been fluctuating between $0.315 and $0.338 in recent trading sessions, showing that price compression is occurring around short-term support and resistance levels.

This sideways movement reflects indecision among market participants, where buyers are attempting to defend support while sellers continue to test higher ranges.

Momentum Indicators Signal Mixed Outlook for Buyers

At press time, the coin was trading at $0.3181, marking a 4.01% daily decline after hitting an intraday high of $0.3382. The price retracement followed an earlier climb that saw SEI test resistance NEAR $0.39 this month, but sellers quickly stepped in to cap further upside.

Despite this correction, the asset remains significantly above its recent low of $0.13, underscoring the progress achieved during its ongoing multi-month recovery.

Source: TradingView

Technical indicators present a mixed outlook. The Chaikin Money FLOW (CMF) is positive at 0.04, suggesting that capital inflows are still supporting the market.

This points to underlying buyer confidence, as inflows continue to counterbalance profit-taking. Sustained CMF strength may enable the asset to stabilize above $0.30, paving the way for another challenge of the $0.35–$0.39 resistance range.