Ethereum (ETH) Price Prediction: $4.5K Support Holds Firm—Is This the Last Chance to Accumulate Before the $10K Surge?

Ethereum bulls dig in as ETH defends critical $4.5K support level—fueling speculation this could be the final accumulation zone before a parabolic rally toward five digits.

The Make-or-Break Level

Traders are treating the $4.5K price floor like a financial airbag—either it cushions the fall or gets shredded on impact. So far, it's holding.

The $10K Endgame

Technical analysts point to historical fractal patterns suggesting ETH could 2x from current levels—if it clears overhead resistance. 'If' being the operative word in crypto land.

Wall Street's Ironic FOMO

Traditional finance institutions now scrambling to build ETH positions after dismissing it for years—because nothing screams 'sound investment strategy' like chasing 100% gains after a 10,000% move.

Despite recent volatility and short-term bearish signals, institutional inflows, treasury accumulation, and declining exchange supply suggest the $4,500 zone may serve as the foundation for Ethereum’s potential MOVE toward the $6,000–$10,000 range.

Ethereum Price Today and Market Context

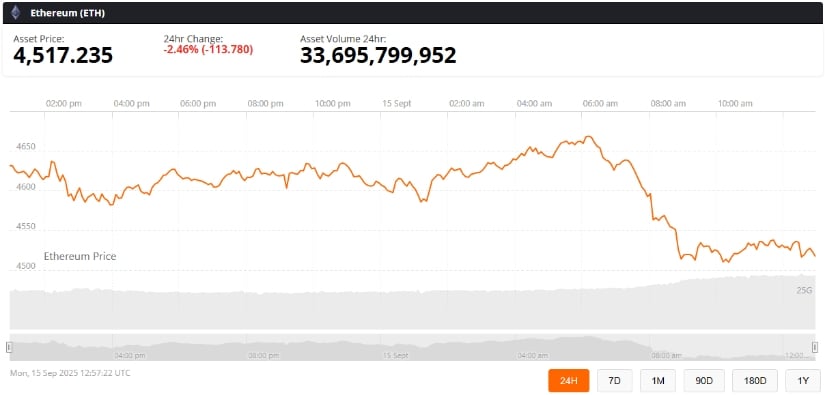

According to Brave New Coin, the current ETH price stands at $4,517, marking a 2.46% daily decline with 24-hour trading volume at $33.7 billion. Despite the pullback, analysts highlight that Ethereum continues to hold the crucial $4,500 support level, which many view as a key accumulation zone before a potential rally.

Ethereum remains above $4.5K, with rising inflows signaling potential for a multi-month surge to $10K. Source: @cas_abbe via X

Crypto strategist Cas Abbé believes ethereum could “go to $10,000 within the next three to four months,” citing technical chart patterns, rising institutional inflows, and upcoming treasury buying. His outlook is supported by data showing Ethereum’s exchange supply ratio has dropped to a multi-year low of 0.13, indicating reduced selling pressure.

Technical Analysis: $3,800–$4,500 as a Support Range

Short-term volatility has not gone unnoticed, as ETH recently saw a sharp decline that signaled bearish near-term sentiment. Even so, traders remain optimistic that the $3,800–$4,500 support zone can act as a strong base for the next move higher.

ETH holds strong around $4K, a key buying zone for Ethereum and discounted altcoins. Source: @TedPillows via X

Market participants such as analyst Ted Pillows have highlighted this level as a key accumulation zone, suggesting that many are preparing to buy heavily in this range. At the same time, Binance’s technical analysis points to a possible rally toward $6,140–$9,000 in the coming months if Ethereum manages to hold these support levels, with forecasts aligning closely with Elliott Wave patterns.

ETF Inflows and Institutional Interest

Institutional demand continues to play a central role in Ethereum’s price outlook. BlackRock’s iShares Ethereum Trust ETF (ETHA) has attracted more than $3.7 billion in inflows since launch, while broader spot Ethereum ETFs have collectively drawn over $11 billion year-to-date.

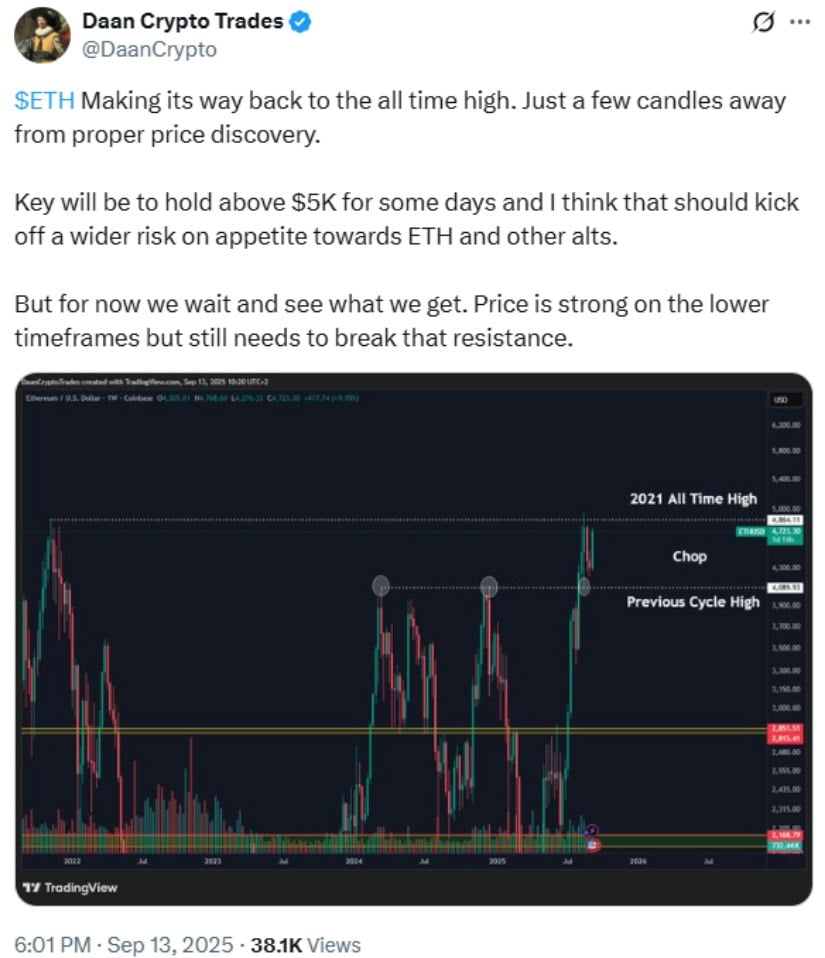

ETH is approaching its all-time high, with $5K as a key level—holding above it could spark broader risk-on momentum for ETH and other altcoins. Source: @DaanCrypto via X

Market analyst Daan crypto Trades emphasized on X that ETH is “just a few candles away from proper price discovery,” adding that holding above $5,000 for several days could “kick off a wider risk-on appetite towards ETH and other altcoins.”

Macro Tailwinds: Fed Policy and Market Sentiment

Beyond crypto-native drivers, macroeconomic shifts could also influence Ethereum’s trajectory. Expectations of Federal Reserve rate cuts may boost risk appetite, which historically supports both equities and digital assets.

Standard Chartered recently updated its Ethereum forecast, projecting a potential rise to $7,500, with longer-term targets of $12,000 and up to $25,000, citing institutional adoption and Ethereum’s deflationary token model.

Looking Ahead: Support Levels Define the Next Rally

On-chain data shows daily outflows of 56,000 ETH from exchanges, underscoring reduced selling pressure. If Ethereum continues to defend the $4,500 support zone, analysts suggest it could FORM the foundation for a broader multi-month rally.

Ethereum (ETH) was trading at around $4,517, down 2.46% in the last 24 hours at press time. Source: ethereum price via Brave New Coin

While the Ethereum price prediction ranges widely—from $6,000 to $10,000—market consensus highlights the importance of holding the current support. As Fidelity Digital Assets noted, historical volatility in Ethereum mirrors gold’s post-1970s price discovery, where strong support zones often acted as launchpads for future rallies.