Dogecoin (DOGE) Price Prediction: Triangle Breakout Pushes DOGE Toward $0.31 Target—What’s Next?

Dogecoin smashes through resistance—the meme coin's technical breakout signals potential surge toward $0.31.

The Pattern That Changed Everything

Triangles don't lie. DOGE's consolidation formed a classic symmetrical pattern before bulls ripped through upper trendlines. That breakout now fuels momentum toward the $0.31 target—a level that could redefine Dogecoin's position in the crypto hierarchy.

Market Mechanics in Motion

Trading volume spiked 40% during the breakout, confirming genuine buyer interest rather than just another pump. Resistance levels at $0.28 and $0.29 loom as intermediate hurdles, but the technical setup suggests they won't hold for long.

What Traders Aren't Saying

While everyone watches the $0.31 target, smart money watches the $0.25 support level. A break below that invalidates the entire setup—because in crypto, what goes up fast tends to come down faster. Just ask anyone who bought the last 'sure thing' at the top.

The Real Test Ahead

Dogecoin faces its ultimate credibility test. Hitting $0.31 would mark a 150% recovery from July lows—proving even joke assets can have serious legs when the market catches the right narrative. Or as Wall Street would call it: another day at the office where fundamentals take a backseat to hype.

The breakout follows a symmetrical triangle pattern, signaling renewed bullish momentum. Analysts note that Fibonacci retracement levels and technical indicators suggest further upside potential if Doge maintains support above key levels.

ETF Hype and Market Tailwinds Fuel Momentum

Beyond chart patterns, sentiment surrounding Dogecoin has strengthened due to expectations of ETF launches and growing institutional interest in cryptocurrency.

Dogecoin (DOGE) has broken out of a triangle pattern, targeting $0.31 with bullish momentum. Source: Ali Martinez via X

Traders are also pointing to macroeconomic factors, such as Optimism over potential Federal Reserve rate cuts, which continue to lift risk assets. Together with rising futures open interest, these drivers are adding strength to the breakout setup.

Corporate Accumulation Adds Buying Pressure

Adding to bullish momentum, CleanCore Solutions has now amassed over 500 million DOGE in its treasury, placing it halfway toward its ambitious goal of acquiring 1 billion DOGE within 30 days.

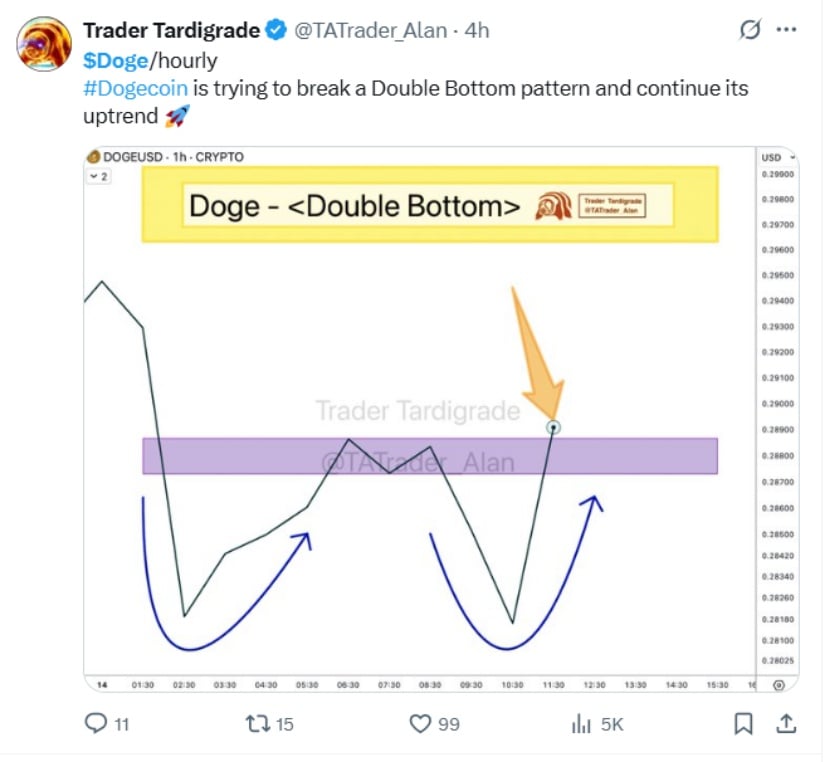

Dogecoin is attempting to break a double bottom pattern, signaling a potential continuation of its uptrend. Source: Trader Tardigrade via X

Marco Margiotta, CleanCore’s CIO and CEO of House of Doge, explained that reaching the 500 million DOGE milestone highlights the speed and scale at which ZONE is executing its treasury strategy. The company aims to position dogecoin as a leading reserve asset while enhancing its utility across payments, tokenization, staking-like products, and global remittances.

This large-scale accumulation coincides with DOGE trading between $0.26 and $0.29, making the recent 20–25% price rally particularly notable and underscoring growing market momentum.

Risks and Key Levels to Watch

While the bullish case is strong, several risks remain.

-

A breakdown below $0.25 support would challenge the thesis of the triangle breakout.

-

Volume confirmation is essential, as sustained momentum relies on strong trading activity.

-

ETF delays or regulatory uncertainty could dampen enthusiasm.

Support around $0.25 remains the first key floor. Resistance at $0.31 is the level to watch, with a clean close above potentially setting the stage for higher targets.

Outlook: Where Does DOGE Go From Here?

If DOGE can continue to hold support at $0.31, then there exists potential for the next leg higher up to $0.35–$0.40. With institutional buying and corporate demand fueling demand, a longer-term squeeze up to $0.60 cannot be ruled out if market sentiment continues to remain robust.

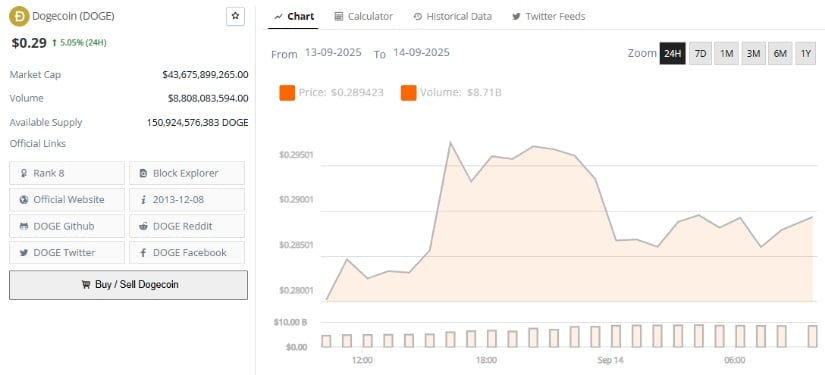

Dogecoin was trading at around $0.29, up 5.05% in the last 24 hours at press time. Source: Brave New Coin

Simultaneously, failure to hold on to this breakout can result in follow-up retests of lower support levels. Volume patterns and momentum will be keenly observed in the next couple of sessions by traders.

Final thoughts

Dogecoin’s surge to $0.29 is the result of a convergence of technical resilience, institutional buying, and new optimism fueled by ETF speculation. While risks persist, the $0.31 breakout potential will signify the growing confidence in Dogecoin’s near-term prospects, making it one of the most closely watched cryptocurrencies in the current market cycle.