BNB Price Prediction: Bulls Target $1,200 as Breakout Extends Rally - Here’s Why It’s Not Just Hype

BNB shatters resistance levels as bullish momentum builds toward unprecedented heights.

The Breakout Nobody Saw Coming

Binance's native token isn't just moving—it's rewriting the playbook. Breaking through key technical barriers with relentless momentum, BNB's trajectory suggests the $1,200 target isn't just possible—it's probable.

Market Dynamics Fueling the Surge

Trading volume spikes mirror institutional accumulation patterns while retail FOMO kicks into overdrive. The ecosystem's expanding utility creates natural buy pressure that even traditional finance skeptics can't ignore.

Technical Indicators Scream Bullish

Every chart tells the same story: consolidation phases getting shorter, rally extensions growing longer. The pattern resembles previous run-ups to all-time highs, only this time with stronger fundamentals backing the move.

Why This Rally Feels Different

Unlike 2021's pure speculation play, this surge combines technical breakout strength with genuine ecosystem growth—though let's be honest, in crypto, sometimes the only fundamental that matters is whether number go up.

Targets Beyond $1,200?

If momentum holds, previous resistance levels become springboards. The path clears for moves that would make even Bitcoin maximalists glance over nervously—not that they'd ever admit it.

Just remember: in traditional finance, they'd call this irrational exuberance. In crypto, we call it Tuesday.

The move, highlighted by analysts, points to strong continuation momentum and signals that buyers remain firmly in control.

With technicals aligning and indicators flashing green, analysts suggest the asset could be on track to test levels NEAR $1,200, marking a significant milestone for the token’s ongoing rally.

Channel Breakout Confirms Bullish Strength

BNB’s daily chart shows a well-defined ascending price channel, where each test of the lower support line triggered a rebound toward new highs at the upper resistance line. This classic continuation structure reflects persistent buying pressure and an ongoing demand cycle that has carried the token higher throughout 2024 and into 2025.

Source: X

The recent breakout above the channel’s upper boundary is a critical technical signal. It confirms that bulls have overpowered sellers, extending the prevailing uptrend beyond previous highs. According to Leshka Eth, this breakout implies a channel target price above $1,200, underlining strong investor confidence and the durability of the current bullish structure.

This pattern also strengthens the long-term outlook for the crypto. A sustained move above the breakout level WOULD validate the extension of higher lows and higher highs, creating a favorable setup for further gains. For traders and investors, the $1,200 target zone now represents a key milestone to watch in the weeks ahead.

Market Data Reflects Steady Demand

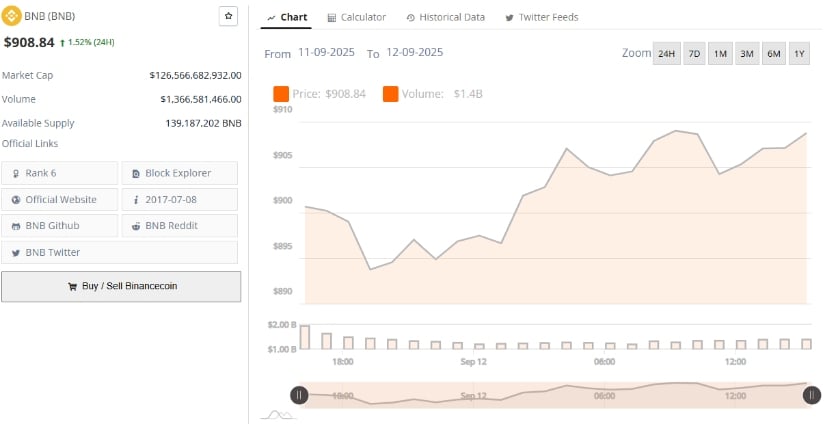

At press time, the coin trades at $906.79, showing a modest +0.45% gain over the past 24 hours. The token’s steady rise follows a bounce from a support base near $520 earlier this year, which has since acted as a springboard for the ongoing uptrend. Binance Coin’s resilience through periods of volatility underscores the depth of buying demand supporting the asset.

Source: BraveNewCoin

According to BraveNewCoin data, the cryptocurrency remains one of the most liquid and widely traded large-cap cryptocurrencies, consistently ranking in the global top 5 by market capitalization. Daily trading volume continues to reflect healthy participation, adding credibility to the breakout and reinforcing the bullish outlook.

Analysts note that the $900 level now acts as a psychological support zone. Holding above this threshold will be crucial for sustaining momentum toward the $1,200 target. Conversely, a failure to maintain this range could trigger short-term consolidation before another attempt higher.

Indicators Point to Momentum Continuation

On the other hand, technical indicators add further confidence to the bullish thesis. The Chaikin Money FLOW (CMF) currently reads +0.06, highlighting positive capital inflows and suggesting that institutional and retail buyers are accumulating BNB during minor dips. Sustained inflows at this level strengthen the likelihood of continued upward momentum.

Source: TradingView

Meanwhile, the Bollinger Band Power (BBP) is recorded at 55.93, reflecting both elevated volatility and strong momentum. This indicates that price is expanding firmly away from its median range, a signal often associated with trending markets. As volatility rises alongside inflows, conditions favor a continuation of the breakout rather than a reversal.