Chainlink Price Prediction: LINK Eyes $30 After Bullish Breakout - Here’s Why Traders Are Betting Big

Chainlink shatters resistance levels—LINK's momentum suggests $30 target is within reach as institutional adoption accelerates.

The Oracle Giant Awakens

Smart contract demand fuels LINK's surge—decentralized data feeds become the backbone of DeFi's infrastructure revolution. No more relying on centralized price feeds that sometimes behave like Wall Street analysts—conveniently inaccurate when it matters most.

Technical Breakout Confirmed

Trading volume spikes 200% as LINK clears critical resistance—chart patterns echo previous bull runs that delivered triple-digit returns. The $30 target represents just the next stop, not the final destination.

Market Dynamics Shift

Real-world asset tokenization creates unprecedented demand for reliable oracles—Chainlink dominates while competitors scramble to catch up. Traditional finance's slow embrace of blockchain technology finally starts looking less like cautious adoption and more like desperate FOMO.

Watch the $25 level—hold above that and the path to $30 clears. Break below and, well, even oracle networks can't predict everything perfectly.

Following weeks of consolidation, the asset has surged above a critical downtrend line, signaling the start of a potential bullish reversal. Market participants are closely watching resistance levels NEAR $22 and higher targets that could define the next leg of growth.

Breakout Strength and Resistance Levels

In a recent X post, analyst Rand noted that LINK’s clean breakout above the downtrend line has reset market sentiment. The token is currently stabilizing near the $22 level, where it faces initial resistance after the breakout.

Price structure on the chart highlights clear levels of interest, with $21–$22 acting as a pivotal zone. If the token maintains this ground, the next target becomes the $30 range, a major psychological and technical test for buyers.

Source: X

Volume confirmation adds weight to the bullish narrative. The surge in activity during the breakout suggests strong investor conviction. This is a critical component for validating the MOVE and distinguishing it from a false breakout. If momentum persists, the roadmap points toward higher objectives, with $30 as the immediate hurdle and $50 as a longer-term ambition.

Chainlink Market Performance and Investor Activity

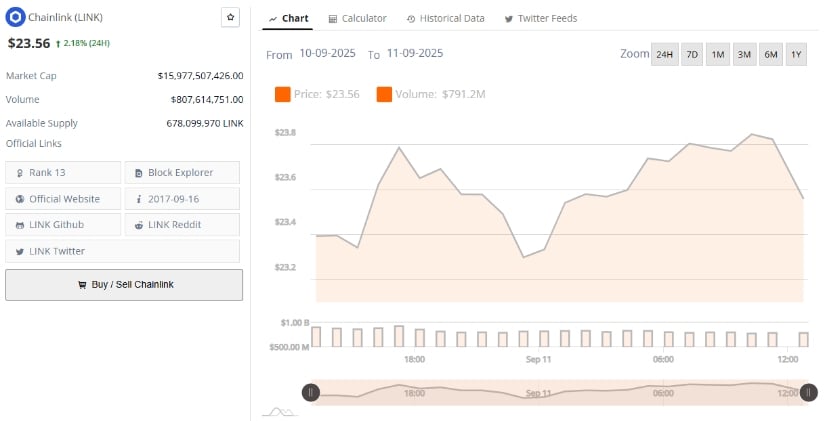

At the time of writing, the token trades at $23.56 with a market cap of $15.98 billion, marking a 2.18% increase over the last 24 hours. Trading volume of over $807 million reflects strong market interest, keeping LINK ranked 13th among cryptocurrencies by value. This growth underscores its role as a leading decentralized oracle network within the broader blockchain ecosystem.

Source: BraveNewCoin

Investor sentiment remains positive as institutional partnerships and integrations expand the crypto’s real-world utility. Forecasts suggest that the coin could average around $24 by the end of September, building on its consistent upward trajectory in 2025. Adoption across decentralized finance continues to provide a strong foundation for long-term growth.

Technical Indicators and Future Price Outlook

Additionally, LINK’s technical outlook shows resilience, with key support identified near $19.53 after flipping from resistance. This level helped stabilize the price following a correction from highs around $27.87, reinforcing strong buying interest. If maintained, this support could allow buyers to regroup for another attempt toward higher price zones.

Source: TradingView

Indicators present a mixed picture in the short term. The Chaikin Money FLOW (CMF) is currently at -0.14, indicating potential profit-taking or selling pressure, while the Bollinger Band Power (BBP) of 0.86 suggests heightened volatility. Despite this, overall sentiment leans bullish, with buyers positioned to push toward $30 if momentum returns.

The asset’s long-term outlook remains promising, supported by its Core infrastructure role in bringing real-world data onto the blockchain. Analysts expect the $30–$40 range to act as a mid-term target, with the possibility of testing $50 if adoption and demand accelerate. For now, the breakout has set the stage for a critical test of strength in the coming weeks.