XRP Price Today: Defends $2.80 Support as ETF Hype and Whale Buying Fuel Bullish Momentum

XRP bulls dig in at critical support level as institutional interest surges

ETF Speculation Heats Up

Rumors of an XRP exchange-traded fund swirl through trading desks—because what says 'mature asset class' like wrapping volatility in a regulated wrapper? Wall Street's latest attempt to package crypto for mass consumption gains traction while purists groan about centralization.Whale Accumulation Pattern Emerges

Big money moves behind the scenes as large holders stack more XRP at these levels. The $2.80 support isn't just holding—it's becoming a battleground where retail meets institutional appetite. When whales feed, the entire ecosystem feels the ripple.Technical Foundation Solidifies

That $2.80 level isn't just psychological—it's become technical bedrock. Holding here suggests stronger hands than the typical crypto casino crowd. Forget moonboys; this is about establishing a foothold for the next leg up.Market Sentiment Shifts

The combination of ETF potential and whale accumulation creates a self-reinforcing cycle of optimism. Traders who once viewed XRP as regulatory roadkill now see it as a comeback story—proof that even the most battered assets find redemption in crypto's endless narrative cycle. Maybe traditional finance finally understands crypto—or maybe they just found a new way to charge 2% management fees on digital scarcity. Either way, XRP rides the wave.

The cryptocurrency is showing strength after a choppy start to September, supported by growing institutional interest and on-chain activity that mirrors pre-breakout setups from previous market cycles. Traders are now closely watching key levels that could determine XRP’s next big move.

XRP Price Holds Strong Near $2.80

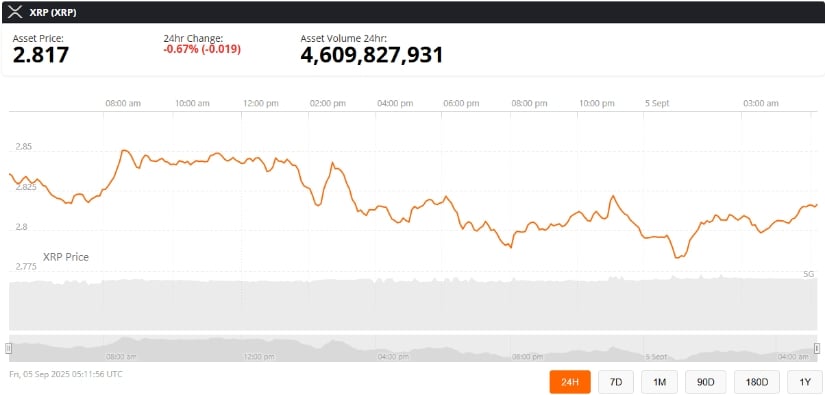

As of today, XRP trades between $2.78 and $2.86, down about 0.6% over the last 24 hours but still above major support. Its market capitalization sits NEAR $167 billion, with daily trading volume between $4.4 and $4.9 billion. Despite short-term weakness, analysts note that XRP remains in a consolidation phase, which could set the stage for a bigger move if resistance near $3 is cleared.

XRP was trading at around $2.81, down 0.67% in the last 24 hours at press time. Source: xrp price via Brave New Coin

Market data suggests whales—large holders of XRP—have been actively accumulating. Over the past week, their collective holdings have grown by 340 million XRP, now totaling 7.84 billion tokens. This accumulation is typically seen as a signal of confidence in future price appreciation.

Growing Speculation Around an XRP ETF

One of the biggest catalysts on the horizon is the potential approval of a spot XRP exchange-traded fund (ETF). Industry analysts, including data shared by Cryptopotato on August 30, place the probability of SEC approval at 87%. Such a MOVE could open the doors to institutional investors, with some short-term price targets going as high as $3 and more, with estimates ranging as high as $10 in the long run.

Approval of an XRP ETF could be a major turning point for the market, offering institutions a regulated and accessible way to gain exposure to XRP.

On-Chain and Technical Signals Flash Bullish

On-chain signals show that movement is gathering on the XRP Ledger (XRPL), with network transactions creating patterns similar to the 2017 pre-breakout formation. Settlement speeds remain 3–5 seconds, and the price is a few cents—factors that further support XRP as among the most economical payment assets in crypto.

XRP whale holdings climbed to 7.84B tokens as ETF approval odds near 87% and an expected Fed rate cut strengthened bullish momentum. Source: Fama crypto via X

Technical analysts observe that the price structure of XRP remains intact. As long as the $2.75–$2.78 area holds, traders hope for a retest of the $3 level, which may position the cryptocurrency for a move towards its 2021 highs.

Regulatory Landscape and Macro Factors

Although Ripple’s legal battle with the U.S. Securities and Exchange Commission (SEC) was settled in August 2025, lingering regulatory uncertainty in the United States is still a factor. But the ruling that XRP itself is not a security when listed on public exchanges has removed a substantial overhang.

At the macro level, speculation over a potential 50 bps Federal Reserve rate cut later this year can bring additional tailwinds for risk assets like XRP. With lower rates, liquidity tends to rise and stimulate flows into digital assets.

Outlook: Cautious Optimism Ahead

XRP is among the most actively traded cryptocurrencies as it clings closely to critical support zones. Whale buying, increasing institutional buying, and ETF speculation provide a sufficient bearish base, but speculators need to be careful of volatility, previously in excess of 40% at times in some quarters.

Bulls are defending support but losing momentum, leaving XRP poised for either a breakout above the downtrend line or a drop below $2.35 that could extend the sell-off. Source: ProR35 on TradingView

If XRP is able to maintain ground above $2.80 and surge past $3, momentum should begin to increase, opening the way for a push towards $3.50 or higher in the coming weeks.