Cardano Whale Exodus Tests Bullish Resolve: ADA Consolidation Sets Stage for $1.00 Breakout

Whales are dumping—but Cardano's foundation holds firm.

While major holders take profits, ADA's consolidation pattern suggests accumulation beneath the surface. The cryptocurrency refuses to break below key support levels, indicating stronger hands are stepping in where whales step out.

Technical Setup Favors Bulls

Every dip gets bought faster than a Wall Street banker's apology. The $1.00 target isn't just hopeful thinking—it's the next logical resistance level based on current momentum patterns. Retail traders are accumulating positions while institutions rebalance—classic bull market behavior.

Market Psychology at Play

Whale selling often creates temporary fear—but smart money knows this is normal profit-taking after solid gains. The real story? ADA's network activity continues growing while traditional finance still can't agree on how to regulate something that actually makes sense.

Target Locked: $1.00

All roads lead to the psychological barrier. Breaking through requires sustained volume—but the consolidation phase suggests energy building for exactly that move. When it comes, it'll come fast—because crypto waits for no one, especially not committee meetings.

So while whales count their paper profits, the real money's being made by those who understand: in crypto, sometimes the best trade is holding through the noise—even when the big players make splashy exits.

Cardano is starting to catch the market’s eye again, as analysts point to a mix of bullish technical signals and rising on-chain activity that could hint at a stronger MOVE ahead.

ADA Cardano Price Showing Signs of a Bottom

Cardano is holding around the $0.81 region, building what looks like a potential bottoming structure after a steady retracement from recent highs. The chart highlights a key support level at $0.68, which remains critical for bulls to defend. Price action has shown a gradual slowdown in selling pressure, with the latest candles suggesting stabilization before a possible reversal attempt.

Cardano’s ADA holds firm NEAR $0.81 as bullish divergence on the MACD hints at a potential reversal. Source: Mr Brownstone via X

Analyst Mr Brownstone points out that the MACD is flashing a bullish divergence, with momentum indicators trending upward. This divergence signals weakening bearish strength and further strengthens the recovery narrative. If ADA maintains support above $0.68 and pushes through near-term resistance around $0.85, it could open the path for a stronger move back towards the $1.00 zone.

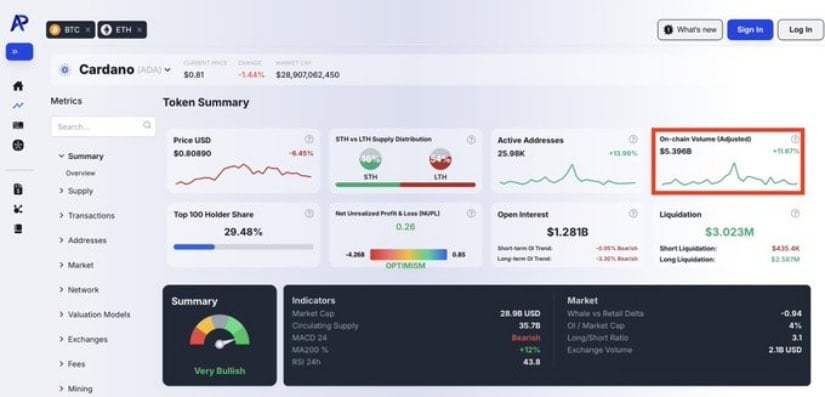

Cardano On-Chain Activity Hits Record Levels

Cardano just posted one of its strongest weeks in 2025, recording over $5.3 billion in on-chain volume within seven days. This sudden rise in activity highlights how quickly network participation is expanding, with transaction flows and liquidity both trending higher. Such spikes in volume often precede larger market moves, as they show renewed interest and confidence from both retail and institutional participants.

Cardano’s on-chain volume surges to $5.3B in a week, signaling rising participation and stronger network engagement. Source: Mintern via X

Analyst Mintern notes that alongside this surge, Cardano’s active addresses and open interest have also climbed, reflecting stronger user engagement across the ecosystem. The combination of higher participation and deeper liquidity could set the stage for a breakout if momentum carries forward. While price remains in a consolidation phase, these on-chain signals add weight to the argument that ADA may be gearing up for a stronger move ahead.

Cardano Completes a Clean Retest

Cardano is trading near $0.81 after executing a textbook breakout followed by a retest of prior resistance, now flipped into support. This structure often signals the completion of a consolidation phase and sets the groundwork for a stronger upward move. Technically, holding above the $0.78 to $0.80 zone will be key, as it aligns with both horizontal support and the breakout line. If ADA can sustain this level, the chart points towards a potential bounce targeting $0.95 to $1.00 in the near term.

Cardano secures support at $0.80 after a clean breakout retest, strengthening its setup for a potential move towards $1.00. Source: CryptoGem Athos via X

Analyst CryptoGem Athos highlights that this retest adds further validation, as the price is showing signs of stability rather than rejection. With momentum indicators stabilizing and broader on-chain activity picking up, ADA looks in good shape for a bullish price prediction.

Cardano Broader Technical Outlook

Cardano has maintained a constructive trend as it continues to trade above major moving averages, including the EMA55, EMA89, and the MA200, for seven straight weeks. This trend, highlighted by MasterAnanda, signals underlying strength, with buyers defending key zones while bearish pressure remains subdued. Technically, the price is still moving within a broad ascending channel, with support from the MA200 offering a strong base. As long as ADA holds above $0.80, momentum remains favorable for continuation to the upside.

Cardano continues to trade above key moving averages, reinforcing bullish momentum within its long-term ascending channel. Source: MasterAnanda via X

Consistent closes above these long-term averages, paired with volume spikes during upward pushes, suggest accumulation is ongoing. The chart also outlines a potential path towards the upper end of the channel, with targets stretching to $2.90 and beyond if momentum builds.

Whale Outflows Challenge ADA’s Recovery

Cardano has faced some selling pressure as whale activity shows a notable exit of 30 million ADA over the past week. This kind of movement often signals short-term caution, as large holders can influence liquidity and create temporary downward pressure on price. The chart reflects how these outflows align with ADA’s recent difficulty in building sustained upside momentum, keeping price action choppy around the $0.80 level.

Cardano sees 30M ADA in whale outflows, creating short-term caution despite a stable long-term outlook. Source: Ali Martinez via X

Ali Martinez highlights that such heavy whale selling doesn’t necessarily shift the long-term structure but can stall near-term recovery attempts. For bulls, defending key support zones around $0.75–$0.78 will be essential to prevent deeper retracement.

Final Thoughts

Cardano has been showing signs of resilience despite mixed signals from whale outflows and recent consolidation around the $0.80 mark. On-chain activity remains one of its strongest positives, with record transaction volumes and rising engagement hinting at a growing ecosystem foundation. If ADA can continue defending its support zones while volume sustains, the groundwork for another upward push towards $1.00 is already in place.