Hedera Oversold Signals Flash Bullish Reversal as Price Defends Critical $0.22 Support

Hedera's oversold bounce ignites trader frenzy as it claws back from the brink.

Technical Turnaround

HBAR bulls dig trenches at the $0.22 support line—refusing to surrender ground to the bears. Oversold signals scream buy opportunity across trading screens, hinting at a potential reversal that could catch shorts off-guard.

Market Mechanics

The cryptocurrency defies broader market jitters, holding firm while traditional assets wobble. Trading volume spikes as speculators pile in, betting on a classic crypto comeback story. Because nothing says 'sound investment' like buying the dip after a 40% slide—what could go wrong?

Next Resistance Levels

Watch for a break above $0.25 to confirm momentum. Failure to hold $0.22? That opens the trapdoor to lower supports. Either way, volatility guarantees someone's going to make money—and it's probably not the retail trader.

While some momentum and volume measures reflect ongoing selling pressure, the key price levels and oscillators suggest the market may be preparing for a rebound. Traders and investors are advised to watch the $0.22 support zone closely as it could define the next directional move.

Price Action Highlights Critical Support and Resistance Zones

Analysis of recent price charts reveals that HBAR is trading within a vital support range between $0.22 and $0.23, a historically significant floor during previous consolidation phases. The token has recently corrected from higher levels, and holding above this zone is essential to sustain any hopes of a recovery.

Source: X

Should buyers successfully defend this area, it could provide a platform for renewed momentum targeting resistance levels clustered between $0.31 and $0.35.

However, a firm break below $0.22 WOULD undermine the bullish case, potentially triggering deeper declines toward the next psychological support at $0.20. This makes the current price behavior around $0.22 a pivotal battleground that market participants should monitor to gauge the strength of buyer commitment.

Technical Indicators Hint at a Bullish Reversal

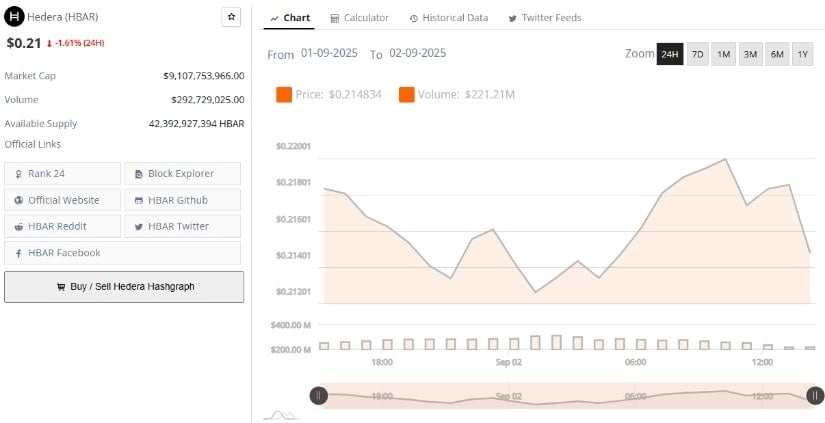

Additionally, BraveNewCoin data shows that Hedera is currently trading at $0.21, reflecting a 1.61% decline in the past 24 hours. The token’s market capitalization stands at $9.1 billion, with a trading volume of approximately $292.7 million and an available supply of 42.39 billion tokens.

Source: BraveNewCoin

Technical indicators such as the Moving Average Convergence Divergence (MACD) and Bollinger Bands paint a nuanced picture. The MACD remains below its signal line, with a negative histogram confirming that bearish momentum still influences price action. Nonetheless, the histogram bars show signs of contraction, suggesting that selling pressure may be easing.

Oscillators and Volume Flow Reveal Market Indecision

According to TradingView data, the token’s price resting NEAR the lower Bollinger Band further reinforces the oversold premise, as this band often acts as dynamic support during extreme downward moves. Historically, an approach to the lower band precedes a short-term price rebound toward the mean, setting the stage for potential gains in the near future

Source: TradingView

The Chaikin Money FLOW (CMF) indicator has reached lows unseen in the last two months, signaling that capital outflows currently surpass inflows. This negative volume trend points to lingering selling pressure and fragile market interest, dampening the bullish enthusiasm derived from momentum oscillators.

This divergence highlights the current market indecision and consolidation. While momentum indicators favor a bounce, volume flows caution that the rally’s strength depends heavily on renewed buying activity.

Overall, HBAR’s proximity to the key $0.22 support, combined with oversold technical readings, suggests that a bullish reversal could be forthcoming if buyers maintain control. Yet, conflicting volume signals underscore the uncertainty, advising market participants to watch incoming price and volume confirmations carefully before making decisive moves.