Litecoin (LTC) Price Prediction: Clinging to $108 Support, Eyes $200 Breakout—Can LTC Maintain Momentum?

Litecoin digs in at critical $108 support level as bulls target explosive $200 breakthrough.

The Silver to Bitcoin's Gold

LTC refuses to surrender the $108 floor—traders watch for the make-or-break moment. Every dip gets bought, every rally gets tested. This isn't speculation; it's digital trench warfare.

Breaking Through the Noise

Market momentum builds toward that elusive $200 target. Technical patterns suggest consolidation precedes explosion. Forget the hype—price action tells the real story.

The Institutional Whisper

While traditional finance still debates 'digital gold,' Litecoin quietly processes transactions at a fraction of Bitcoin's cost. Sometimes efficiency speaks louder than pedigree.

Will momentum hold or will support crack? One thing's certain: in crypto, even the 'safe' bets require nerves of steel—and a healthy disregard for traditional portfolio theory.

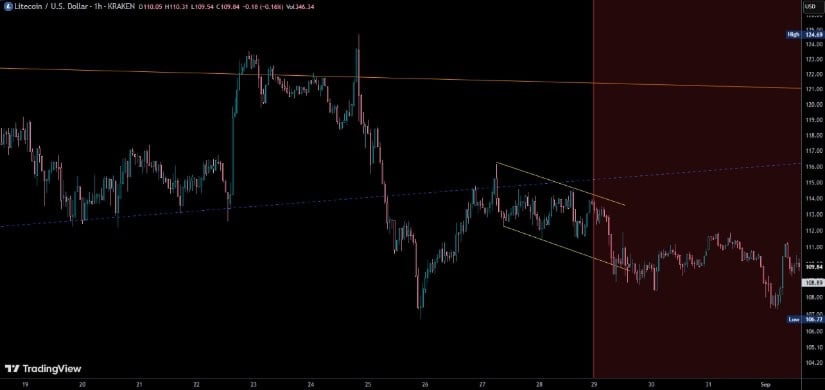

The decline reflects technically driven selling rather than any major news about Litecoin, with traders closely watching chart levels for direction.

Current trading has been volatile, fluctuating between $107.24 and $111.90, with a daily ATR of $5.80 underscoring the heightened swings. Analysts believe these moves highlight short-term positioning based on chart signals rather than fundamental catalysts.

Litecoin Technical Analysis: Bearish but Watching Support

From a technical standpoint, the Litecoin chart points to short-term weakness. The RSI at 42.87 signals neutral momentum but leans bearish, while the MACD remains negative with values at -1.4822. This combination reflects waning buying power.

LTC is forming a bull flag that could enable a low-volatility breakout, positioning the price for an accelerated MOVE toward resistance in the coming sessions. Source: mr_uponly on TradingView

At the same time, the price of Litecoin trades below both its 7-day ($111.07) and 20-day ($116.18) simple moving averages. Despite this, Litecoin remains above its 200-day SMA at $98.25, a level that helps preserve a broader bullish Litecoin outlook.

The stochastic indicators, with %K at 10.35 and %D at 15.13, suggest that Litecoin is nearing oversold territory. This has drawn attention from short-term traders looking for a potential bounce.

Litecoin Price Levels: Key Support and Resistance

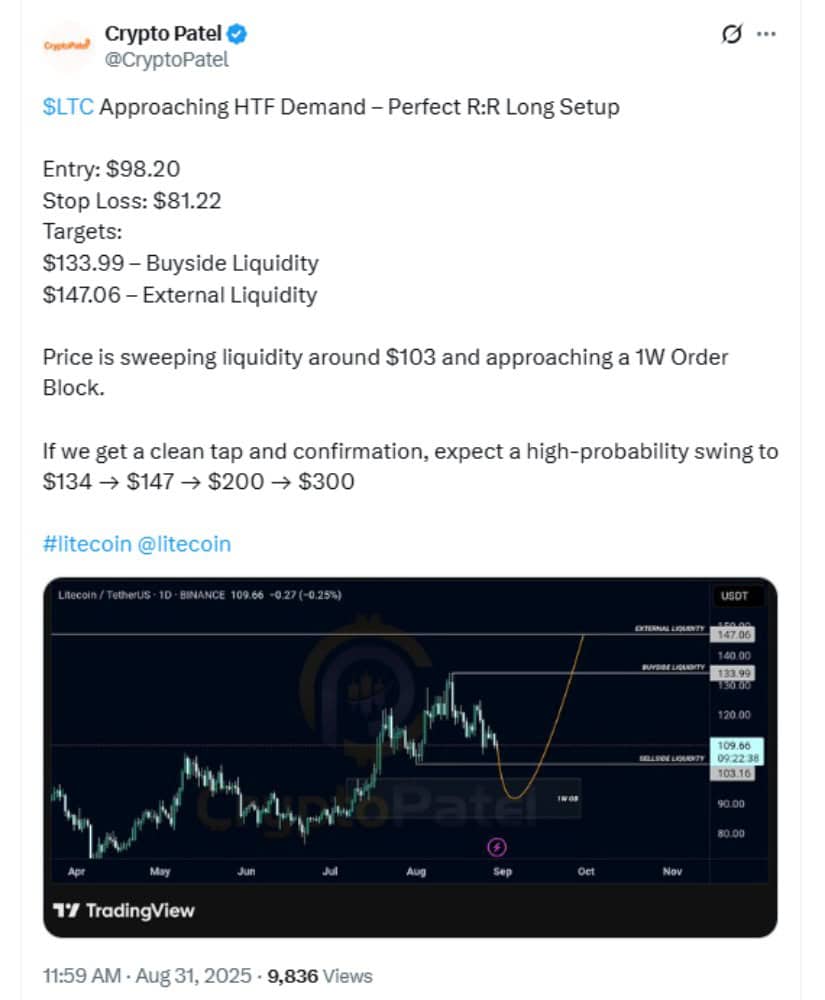

Immediate support for Litecoin sits at $108.57, a level considered vital for short-term direction. A breakdown below this could open the door to a deeper decline toward $91.20. On the other hand, upside resistance remains firm at $134.19, aligning closely with Litecoin’s 52-week high of $137.04.

LTC nears a high-timeframe demand zone, presenting a high-probability long setup with targets from $134 to $300. Source: crypto Patel via X

Intermediate resistance lies at $116.18, the 20-day SMA and middle Bollinger Band, which Litecoin must reclaim to signal a more sustainable recovery.

Long-Term Accumulation and Institutional Momentum

Beyond near-term technicals, a broader narrative is emerging. Litecoin has consolidated below $130 for more than 1,249 days, forming an extended base that many view as a sign of long-term accumulation. A decisive break above the $130 level with strong trading volume could open the door to a significant rally, with potential upside targets NEAR $272.

Litecoin shows a long-term accumulation pattern below a key monthly zone, signaling a potential breakout toward $272, positioning it as a strong contender like XRP. Source: Alex Clay via X

Supporting this view, Litecoin prediction models highlight robust on-chain activity. Metrics show network age up by 20%, address activity higher by 25%, and hash rate stability increasing 10% year-to-date. These developments point to a more secure and decentralized network, reinforcing the case for accumulation.

Institutional adoption has also strengthened sentiment. Firms such as MEI Pharma and Luxxfolio have announced multi-million-dollar allocations into Litecoin, while speculation around a potential Litecoin ETF continues to grow. Analysts suggest that an ETF approval could further boost liquidity and mainstream adoption.

Should You Invest in Litecoin Now?

The buy of Litecoin is risk-tolerance and time-horizon-based. Risk-averse investors may prefer waiting for confirmation above $111 or a definitive rebound off the $108.57 support. Aggressive traders, however, see opportunity as long as Litecoin is above the 200-day average.

For the time being, the Litecoin price prediction is one of caution. Short-term indicators are biased bearish, yet longer-term configurations are indicative of a potential rally to $190–$200 if institutional buying and supportive macroeconomic fundamentals continue.

Final Thoughts

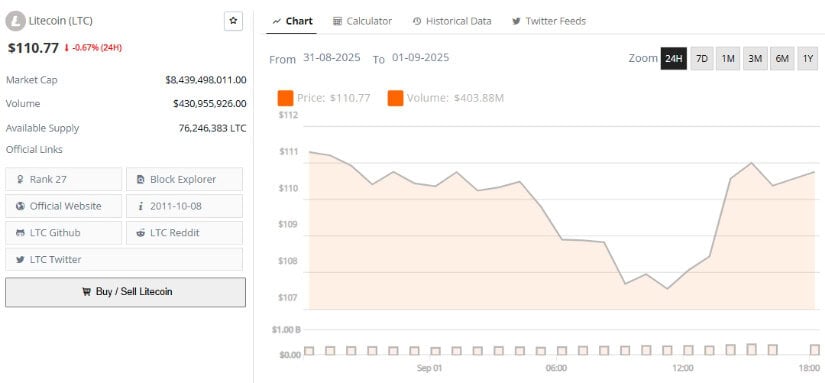

The Litecoin price today shows a market in limbo. While short-term cues indicate weakness, long-term buying, improving fundamentals, and institutional demand create a more favorable environment. If Litecoin can maintain its $108 support and retake resistance levels over $123.75, the trip to $200 remains on target.

Litecoin was trading at around $110.77, down -0.67% in the last 24 hours at press time. Source: Brave New Coin

For traders and investors, the future of Litecoin can hinge on whether it establishes a base in the short term or if bear power pushes it to lower supports.