SEI Defies Market Volatility: Solidifies Above $0.29 with Robust Volume and Sustained Strength

SEI bucks the trend—holding firm above key psychological level while others wobble.

Volume Tells the Real Story

Trading activity remains consistently strong, signaling genuine investor confidence rather than pump-and-dump speculation. Unlike traditional assets that fluctuate on CEO tweets, SEI's movement reflects actual market dynamics.

The $0.29 Foundation

That support level isn't just a number—it's a battleground where bulls continue to defend against downward pressure. Every hold above this threshold builds stronger footing for the next leg up.

Market Strength Isn't Luck

Sustained momentum requires more than hype. It demands liquidity, participant commitment, and that rare crypto quality: actual utility. Meanwhile, traditional finance still thinks 'blockchain' is just a buzzword for annual reports.

Watch what happens when stability meets opportunity—the combination rarely lasts long in these markets.

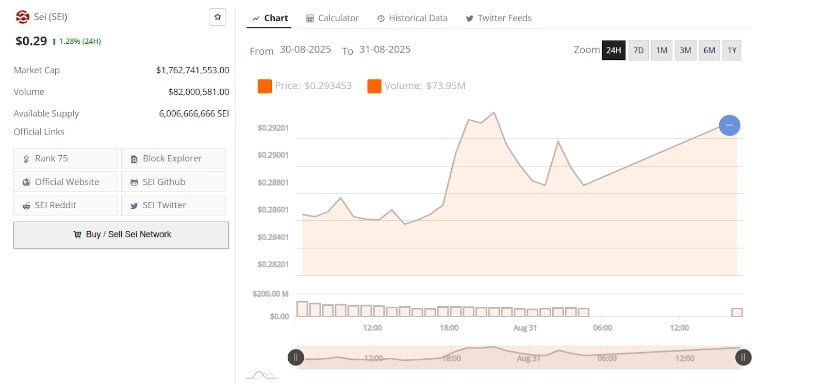

The token’s market capitalization stands at $1.76 billion, supported by an $82 million trading volume that reflects strong liquidity and consistent market activity. The altcoin’s available supply of 6 billion tokens underscores stable distribution, adding to its appeal for traders tracking sustainable growth opportunities in the altcoin market.

Over the last 24 hours, its price action has ranged between $0.284 and $0.293, with bullish pressure pushing it toward the higher end. A brief spike NEAR $0.292 around the 18:00 mark highlighted active accumulation before consolidation, signaling growing confidence among buyers. Holding above $0.29 may fuel further upside momentum if trading activity remains steady.

Price Action Holds Steady Above Key Support

The asset maintained steady momentum in the past 24 hours, trading close to $0.29. The token recorded a 1.28% daily gain, supported by a market capitalization of $1.76 billion.

SEIUSD 24-Hr Chart | Source: BraveNewCoin

Trading activity showed stability, with daily volume at $82 million. This consistent liquidity indicates sustained market engagement. The coin’s circulating supply of 6 billion tokens provides clarity in distribution and contributes to an orderly trading environment.

Range-Bound Trading and Market Response

According to the chart data, the token fluctuated within a narrow range of $0.284 to $0.293 during the observed period. The movement reflected consolidation, where price stability was maintained despite intraday fluctuations.

A brief spike near $0.292 occurred around 18:00, followed by consolidation. Analyst iWantCoinNews noted that the token’s reaction to increased pressure showed active accumulation. The short surge reinforced buying interest at lower levels, preventing a breakdown from the established range.

Analyst Perspectives on Current Market Structure

Analyst Spacebyte emphasized that its fundamentals are strengthening alongside its technical position. He observed that the token’s ability to maintain clean signals during diagnostics confirms improving conviction among holders. This perspective aligns with the token’s gradual rise from intraday lows, indicating structured accumulation.

In addition, iWantCoinNews pointed out that its steady upward tests of resistance zones demonstrate controlled participation. According to his analysis, holding above $0.29 provides the basis for renewed short-term strength. These insights show agreement among analysts that it is maintaining its market resilience through measured growth.

SEI Chart | Source:x

Short-Term Outlook Supported by Stable Liquidity

Volume remains a central element in market stability. Trading activity at $82 million reflected consistent participation rather than sharp inflows or declines. Analyst Spacebyte noted that this balance helps reduce volatility risks, creating conditions where the token can sustain gradual advances.

SEIUSDT Chart | Source:x

If momentum continues, analysts expect the token to attempt a stronger MOVE above its consolidation zone. However, they add that the sustainability of such a move depends on maintaining support at $0.29. With responsive liquidity observed throughout the session, the market structure suggests that it remains positioned for steady performance in the short term.