Ethereum (ETH) Price Prediction: Whales Signal Strength Above $4,300 Support as ETH Targets $4,800 Breakout

Ethereum whales are flexing serious muscle above the $4,300 support level—sending clear signals that a major breakout toward $4,800 could be imminent.

Whale Movements Signal Confidence

Large holders aren't just holding—they're accumulating. That $4,300 floor isn't just technical; it's psychological. Breach it, and even the most cynical traders might have to admit this isn't just another 'institutional adoption' narrative.

The Path to $4,800

Momentum builds quietly before it screams. Ethereum's consolidation above key support suggests a coiled-spring scenario. Break past recent highs, and $4,800 becomes a magnet, not a dream.

Market Sentiment & Realistic Caution

Sure, traditional finance is still trying to tokenize everything from real estate to regret—but Ethereum's move feels different. Real use cases, real demand. Still, in crypto, even 'sure things' have a funny way of keeping you humble.

Large whale purchases, strengthening network activity, and institutional inflows are setting the stage for a decisive MOVE as September begins.

Market Overview: Ethereum Holds Key Support Levels

Ethereum price action remains confined between $4,200 and $4,800, with buyers consistently defending the $4,300 support region. The so-called “Powell Candle” at $4,287, highlighted by analyst TedPillows, has absorbed repeated selling pressure. He cautioned that “a loss of this level could expose ethereum to a deeper pullback toward $3,975.”

ETH has retraced the Powell-driven spike, signaling short-term caution, but $10,000 remains the long-term target. Source: @TedPillows via X

On the bullish side, momentum indicators are showing signs of recovery. Javon Marks identified a hidden bullish divergence on the RSI, noting that “Ethereum’s structure suggests a potential rebound toward $5,200–$5,500 if $4,800 resistance clears.”

The Ethereum RSI today sits at 53.1 on the 4-hour chart, signaling neutrality after cooling from overbought conditions. A push above 60 could strengthen the bullish case for a breakout.

Whale Accumulation Signals Confidence

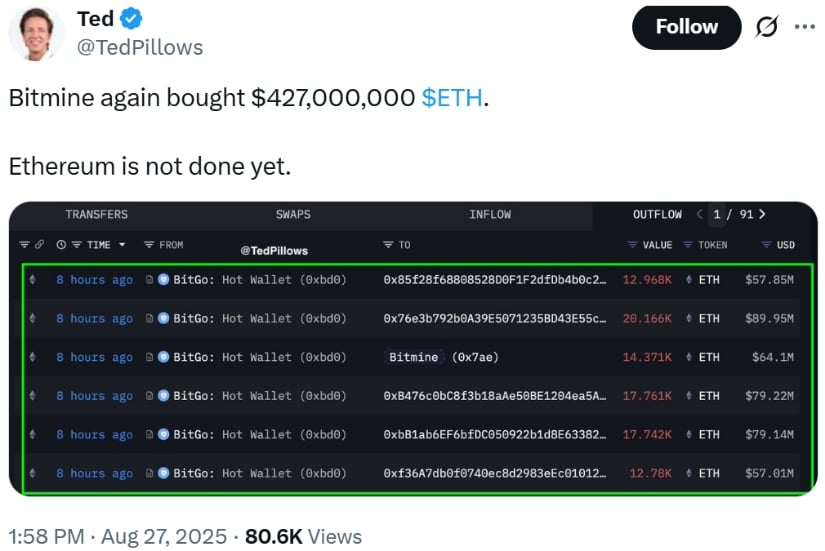

On-chain data suggests whales are quietly positioning for upside. According to Coinglass, Ethereum net inflows reached $80.9 million on August 27, reversing weeks of outflows. In one of the largest recent transactions, crypto firm Bitmine acquired $427 million in ETH, spread across multiple wallet transfers.

Bitmine buys $427M in ETH, hinting at more upside as whale accumulation fuels potential rallies. Source: @TedPillows via X

This whale-driven confidence contrasts with Bitcoin ETF outflows, where BTC has faced steady selling pressure. If these diverging flows continue, Ethereum could outperform Bitcoin in September.

Institutional Demand and Network Fundamentals

Beyond trading activity, Ethereum’s fundamentals remain robust. Cointelegraph reports that the network processed 1.8 million transactions in early August, the highest in a year. At the same time, nearly 30% of all ETH supply is now staked, underscoring long-term investor conviction in validator rewards over short-term selling.

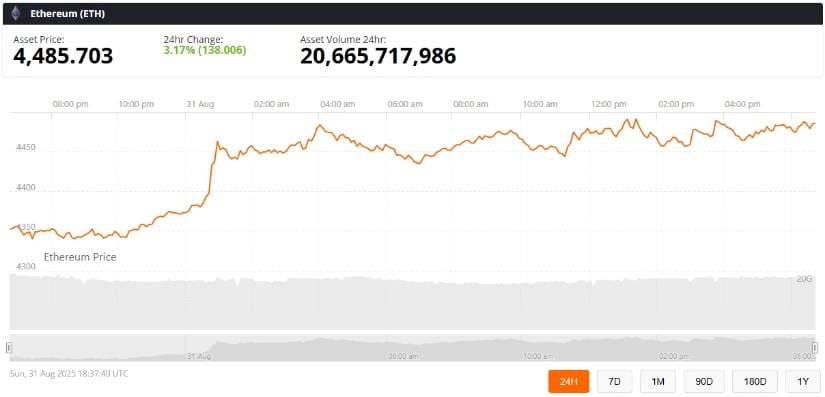

Ethereum (ETH) was trading at around $4,485, up 3.17% in the last 24 hours at press time. Source: ethereum price via Brave New Coin

Institutional adoption is also accelerating. With Ethereum spot ETFs approved, inflows from asset managers and corporate treasuries are bolstering demand. CoinCentral notes that exchange balances are shrinking, signaling reduced sell pressure. Analysts argue this shift reflects Ethereum’s transition into a blue-chip digital asset.

Technical Outlook: Eyes on the $4,800 Breakout

Ethereum remains inside an ascending parallel channel, with support at $4,525 (50-EMA) and broader trend support at $4,405 (100-EMA). Overhead, $4,800 remains the crucial resistance level that bulls need to clear for confirmation of the next leg up.

Hidden bullish divergence on ETH signals a potential breakout above $4,811, paving the way toward $8,500+. Source: @JavonTM1 via X

In the words of analyst Javon Marks, it is noted that Ethereum is poised for its next big move. Whether that move is fueled by bullish divergence or capped by resistance will decide the tone of September.”

-

Bullish scenario: A clean break above $4,800 could accelerate Ethereum toward $5,200, with extended targets near $5,400.

-

Bearish scenario: Failure to clear resistance risks a retreat to $4,400, with deeper support between $4,050–$4,100.

For now, Ethereum’s short-term price prediction is consolidation between $4,525 and $4,750. A daily close above $4,800 is the technical trigger traders are waiting for.

Ethereum’s Broader Outlook

With whales accumulating, staking participation rising, and institutional adoption strengthening, Ethereum’s fundamentals appear increasingly supportive. However, September has historically brought volatility to crypto markets, making the $4,800 resistance level a high-stakes battleground.

If bulls can secure a breakout, Ethereum’s price prediction suggests a run toward $5,200–$5,500 is possible. But if support at $4,300 falters, bearish pressure could drag ETH back below $4,100.