Ethereum (ETH) Price Prediction: ETH Defends $4,500 Support as Megaphone Breakout Targets $7,000 Surge

Ethereum isn't just holding ground—it's building a launchpad. The $4,500 support level has become a fortress, defying sell-offs and setting the stage for what could be the next major leg up.

Pattern Recognition: The Megaphone Breakout

Technical analysts are buzzing about the megaphone pattern completion. These formations typically signal increased volatility followed by powerful directional moves. This one's pointing north.

The $7,000 Target: More Than Hope

That rally projection isn't pulled from thin air—it's measured from the pattern's width applied to the breakout point. Traders are watching for a confirmed close above resistance to validate the move.

Market Dynamics: Beyond the Charts

Network upgrades and institutional adoption are providing fundamental support to match the technical picture. Even traditional finance veterans are taking notice—though they'll probably still call it 'that crypto thing' at cocktail parties.

Timing the Move: Patience Required

Breakouts need confirmation. Watch for sustained volume increases and follow-through above key levels. False breaks happen—especially in crypto, where 'to the moon' sometimes means 'to the basement'.

Risk Management: The Professional's Play

Smart money places stops below recent support. The $4,500 level isn't just psychological—it's become technical bedrock. Lose that, and the megaphone might just amplify losses instead of gains.

While Wall Street debates P/E ratios, Ethereum's proving that in crypto, sometimes the best fundamental is people actually using the damn thing.

Analysts say a confirmed megaphone breakout and growing institutional adoption could position ethereum for a rally toward $7,000 in the coming months.

Market Overview: Ethereum Holds Key Levels

Ethereum recently surged to $4,960 before a swift $180 reversal shook out overleveraged traders. Despite the intraday correction, ETH is maintaining crucial support NEAR $4,500. Market analysts highlight this level as a strong base that could fuel the next upward leg.

Ethereum’s $4,270 retest confirms the breakout, eyeing $6,800–$7,000 next with $4,800 resistance. Source: @CryptoGodJohn via X

“Ethereum’s breakout and clean retest of $4,270 has validated the megaphone structure,” said Sheila Belson in a Coinotag analysis. “Measured extensions now point to $6,800–$7,000, with $4,800 as the immediate resistance.”

At press time, Ethereum trades around $4,630, down nearly 3% on the day but still up more than 8% over the past week.

Technical Analysis: Megaphone Breakout and MACD Support

Chart analysts note Ethereum has broken a four-year bullish megaphone pattern, with technical indicators reinforcing bullish potential. A weekly MACD crossover, alongside strong volume during the breakout, suggests momentum is shifting in favor of buyers.

ETH breaks a 4-year megaphone, retests clean—yet panic sellers still think every dip means doom, while the chart screams $7K! Source: @Axel_bitblaze69 via X

Axel Bitblaze, a market commentator, wrote on X: “ETH broke a 4-year bullish megaphone, retested clean, and the structure points to $6,800–$7,000 next. This setup just screams higher.”

Historical data also supports the bullish thesis. In both 2017 and 2020, Ethereum logged significant year-end gains after strong August closes, a pattern traders are now watching closely.

Institutional Demand and Ethereum ETF News

Institutional appetite continues to grow as Ethereum ETFs attract large inflows. U.S. spot Ethereum ETFs have strengthened confidence in ETH as an investable asset, with companies like BitMine Immersion accumulating massive holdings.

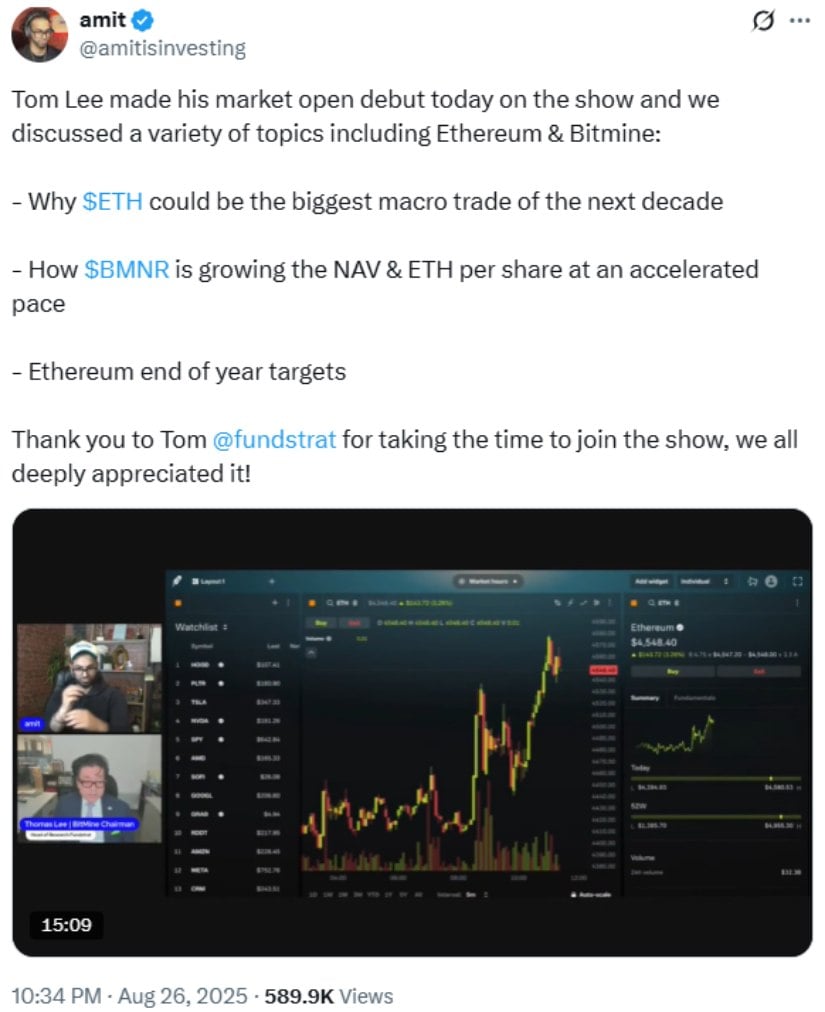

Tom Lee says Ethereum could be the decade’s biggest macro trade, with bold end-of-year targets in sight. Source: @amitisinvesting via X

Tom Lee, Head of Research at Fundstrat, sees Ethereum as one of the most important long-term macro trades. In a recent interview, Lee predicted ETH could rally to $5,500 in the coming weeks and potentially reach $10,000–$12,000 by year-end.

“Most of the moving crypto does come in the fourth quarter,” Lee said. “If you’re up 35% year-to-date, well, if you’re going to be up 200%, it’s going to all happen in the next few months.”

Lee added that Wall Street’s gradual pivot toward blockchain rails could drive Ethereum’s network value to $60,000 per token over the next decade.

Layer 2 Growth and On-Chain Catalysts

Beyond ETFs and institutional positioning, Ethereum’s Layer 2 ecosystem is expanding rapidly. Platforms like Arbitrum, Optimism, and zksync are seeing growing transaction volumes, helping reduce Ethereum gas fees and improving scalability.

On-chain data shows that validators and staking services are also gaining momentum. With staking rewards generating steady yields, institutional players are increasingly viewing Ethereum not just as a speculative asset but as a yield-bearing infrastructure play.

Short-Term Volatility vs. Long-Term Outlook

While Ethereum remains volatile in the short term, most analysts view the pullbacks as part of a broader uptrend. The rapid reversal from $4,960 to $4,780 highlighted market fragility, but the multi-month breakout structure remains intact.

“Despite sharp intraday swings, Ethereum’s technical outlook continues to lean bullish,” analysts at CryptoBriefing noted. “The broader trend suggests higher targets, with $6,000–$8,000 in play if breakout levels sustain.”

Ethereum Price Prediction: Can ETH Hit $7,000?

The combination of strong technical signals, ETF inflows, and institutional accumulation is creating a supportive backdrop for Ethereum’s price trajectory. If ETH maintains its foothold above $4,500 and reclaims $4,800 resistance, the path toward $6,800–$7,000 becomes increasingly likely.

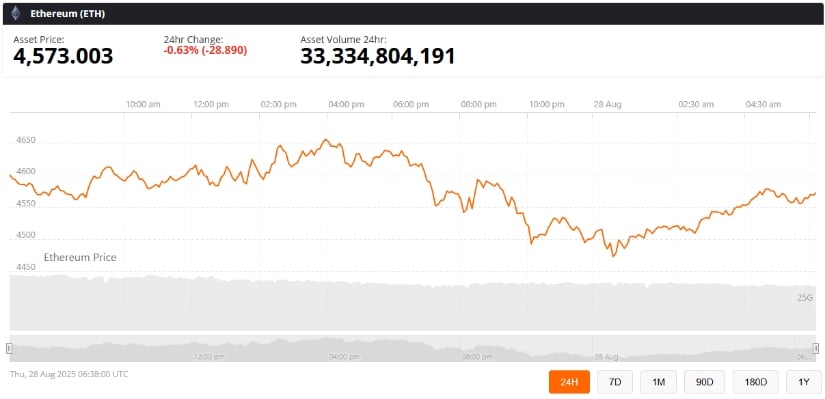

Ethereum (ETH) was trading at around $4,573, down 0.63% in the last 24 hours at press time. Source: ethereum price via Brave New Coin

In the longer term, experts like Tom Lee envision Ethereum reaching five-figure territory as financial infrastructure migrates to blockchain rails. For now, traders are closely monitoring whether Ethereum can convert its bullish megaphone breakout into a sustained rally.