Analysts Predict BNB’s Meteoric Rise to $160 Billion Market Cap After Consolidation Phase

BNB breaks consolidation—analysts target staggering $160 billion valuation.

The Consolidation Breakout

After weeks of sideways movement, BNB's chart pattern suggests explosive upside potential. Technical analysts point to textbook consolidation completion—typically a precursor to major price movements.

Market Cap Mathematics

That $160 billion figure isn't just random speculation. It represents a calculated projection based on current supply metrics and historical performance patterns during similar market conditions. Because nothing says 'sound investment' like extrapolating past performance into future gains—what could possibly go wrong?

Institutional Eyes Watching

Major players monitor BNB's infrastructure developments and ecosystem growth. The token's utility within the Binance ecosystem continues driving fundamental value—while traders watch for that breakout confirmation.

Remember: analysts also predicted perpetual bull markets right before the last three crashes. But this time it's different—right?

Analysts closely observe continuing consolidation around key support levels that could pave the way for the next surge, with targets aiming as high as $160 billion.

Market Cap Shows Strong Uptrend with Solid Support

In a recent X-post, the chart posted by analyst crypto King displays BNB’s market cap climbing steadily to $120 billion, with a recent consolidation around $117.65 billion providing a critical support zone.

This accumulation phase suggests that investors are positioning themselves for further upside, underpinning the uptrend with solid buying interest. The consistent upward movement indicates that the coin is primed for a renewed bullish run if it can hold above this support.

Source: X

Traders are keeping watch on resistance near the $120 billion level, as surpassing this WOULD likely trigger accelerated gains and draw increased market participation. The current consolidation is viewed as healthy, offering a base for market strength to build momentum before pushing toward new highs.

Price Action Reflects Narrow Consolidation with Strong Liquidity

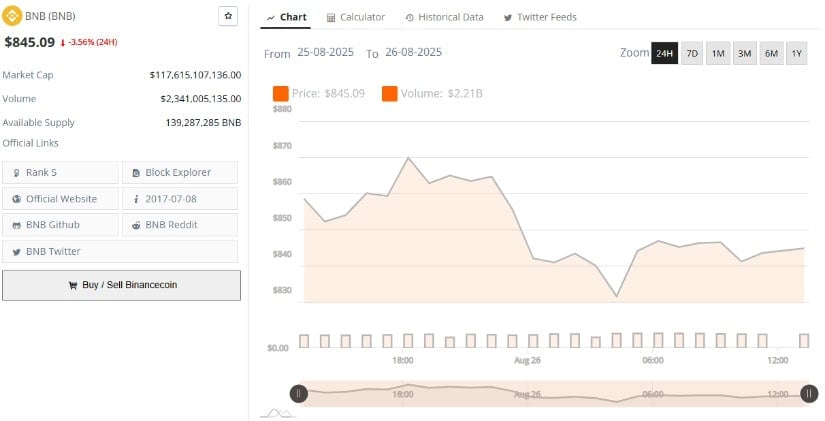

According to BraveNewCoin 24-hour price chart shows BNB trading NEAR $845.09, a slight decline of around 3.56%, within a narrow, well-defined range. Price fluctuations between $840 and $860 illustrate a consolidation phase where traders test support and resistance, refining short-term market direction.

The proximity to the daily high around $860 indicates ongoing interest, while $840 is emerging as an important support area.

Source: BraveNewCoin

Volume remains significant at $2.34 billion, underscoring liquidity that can sustain price movements in either direction. Traders interpret the recent dip as a possible short-term correction or consolidation before a potential bullish resumption. Price levels near $850 and $840 will be key indicators to watch for breakout confirmation or deeper pullbacks.

Technical Indicators Signal Bearish Momentum with Breakout Potential

TradingView’s Bollinger Bands and MACD analysis place BNB trading near the middle of the Bollinger range, between the upper band at $896.05 and the lower band at $779.59. This positioning suggests the token is consolidating without a defined breakout yet, awaiting clearer directional cues.

Source: TradingView

The MACD shows a bearish crossover with the line below the signal at 23.62 versus 26.12, indicating some weakening in momentum. However, the histogram’s declining bearish intensity hints at a possible reversal if bullish pressure returns. A decisive breakout above $896 could ignite bullish momentum toward the upper band, while a fall below $779 could enhance downward risks.

In summary, the token market cap breakthrough of $120 billion highlights growing market confidence, but the token currently contends with near-term consolidation and mixed momentum signals. Traders should monitor support near $117–$118 billion, price action around $840–$860, and momentum indicators for signs of the next major move. This would potentially push the market cap toward a $160 billion milestone.