Grayscale Files for Spot Avalanche ETF as Crypto Fund Competition Intensifies

Grayscale just dropped another bomb on the crypto ETF arena—filing for a spot Avalanche fund as the digital asset management war goes nuclear.

The Avalanche Play

Grayscale's move isn't just expansion—it's strategic encroachment. While BlackRock and Fidelity scramble for Bitcoin and Ethereum dominance, Grayscale targets the next layer of institutional adoption. Avalanche, with its scalable architecture and growing DeFi footprint, represents a calculated bet on the 'alt-L1' narrative.

Competition Heats Up

This filing signals more than just ETF diversification—it's a power grab. With multiple asset managers now elbowing for shelf space, the crypto fund landscape is shifting from monopoly to brutal free-market competition. Expect fee wars, aggressive marketing, and maybe—just maybe—better deals for investors. (Unless you're into paying 2% management fees for the privilege of holding digital gold.)

Why It Matters

Another spot crypto ETF approval could further legitimize altcoins in the eyes of regulators and traditional finance. It also pressures the SEC to clarify its stance on non-Bitcoin digital assets. Grayscale isn't just filing paperwork—it's forcing the issue.

Let's see how long it takes the suits to realize crypto moves faster than their quarterly reports.

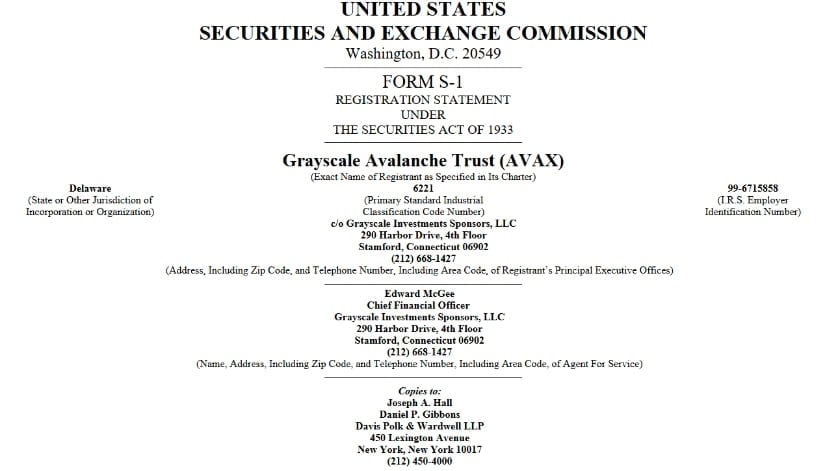

The digital asset manager filed its S-1 registration statement with the Securities and Exchange Commission on August 22, 2025, seeking to convert its existing Avalanche Trust into a publicly traded ETF on Nasdaq.

The proposed fund would trade under the ticker symbol “AVAX” and provide direct exposure to Avalanche’s native cryptocurrency through regular brokerage accounts. This filing represents the completion of a two-step regulatory process that began when Nasdaq submitted its initial application in March 2025.

Second Major AVAX ETF Application

Grayscale faces competition from VanEck, which filed its own Avalanche ETF application in March 2025. The SEC acknowledged VanEck’s filing in April but has since delayed its decision until July 15, 2025. This delay reflects the regulator’s cautious approach to approving ETFs for cryptocurrencies beyond Bitcoin and Ethereum.

Both applications follow similar structures, with funds holding AVAX tokens directly and tracking the cryptocurrency’s price performance. VanEck’s proposed ETF WOULD use the MarketVector Avalanche Benchmark Rate, which combines pricing data from the five largest AVAX trading platforms.

Source: Sec.Gov

The SEC has not yet approved any spot cryptocurrency ETFs for assets other than bitcoin and Ethereum, making these Avalanche applications significant tests for the broader altcoin ETF market.

Fund Structure and Operations

Grayscale’s proposed AVAX ETF builds on its existing Avalanche Trust, which launched in August 2024 and currently manages approximately $15 million in assets. The trust operates with a net asset value per share of 12.20%, though this figure has declined from a high of 27% in December 2024.

Coinbase Custody will serve as the fund’s custodian, handling the storage and security of AVAX tokens. BNY Mellon has been selected as the administrator and transfer agent, responsible for daily operations and shareholder services.

The ETF will operate through a creation and redemption system using “baskets” of 10,000 shares. Authorized participants can purchase or redeem these baskets directly with the trust using cash, while a separate liquidity provider will handle the actual AVAX token transactions.

An interesting feature of Grayscale’s proposal includes potential staking rewards. The fund may stake up to 85% of its AVAX holdings to earn additional tokens, which would be reflected in the ETF’s value if certain conditions are met.

Avalanche Network Sees Record Growth

The timing of these ETF applications coincides with significant growth in Avalanche’s network activity. The blockchain now processes over 20 million transactions daily, representing a 20-fold increase compared to its 2021 figures.

Monthly active addresses across the Avalanche ecosystem have reached 7.3 million as of July 2025, maintaining levels above 6 million since May. This sustained user activity indicates growing real-world adoption rather than temporary speculative interest.

Despite strong network fundamentals, AVAX has struggled with price performance. The token currently trades around $24.25, down 9% over the past year and 55% below its all-time high of $54.11 reached in December 2024.

Growing Institutional Interest

Several major financial institutions have begun incorporating Avalanche into their operations. Anthony Scaramucci’s SkyBridge Capital announced a $300 million tokenization project on Avalanche, while the network ranks second in BlackRock’s BUIDL Fund with over $53.8 million in tokenized assets.

Visa has also integrated Avalanche into its stablecoin settlement system, and the launch of the Avalanche Visa Card allows users to spend AVAX and stablecoins like USDC directly for purchases.

These institutional developments provide additional context for the ETF applications, as they demonstrate growing enterprise adoption of the Avalanche platform beyond speculative trading.

Regulatory Timeline and Market Impact

The approval process for both Grayscale and VanEck’s AVAX ETFs remains uncertain. The SEC has shown caution with altcoin ETF approvals, citing concerns about market manipulation and investor protection for smaller digital assets.

Grayscale’s filing is part of a broader expansion strategy that includes applications for XRP, Dogecoin, Solana, and Litecoin ETFs. The company currently manages $25 billion across its ETF portfolio, including its flagship Bitcoin Trust ETF (GBTC) with approximately $20 billion in assets and its ethereum funds totaling around $8.5 billion.

If approved, an AVAX ETF would represent a significant milestone for both Avalanche and the broader cryptocurrency ETF market. It would provide traditional investors with regulated exposure to a major smart contract platform without requiring direct cryptocurrency ownership or storage.

Market Outlook and Next Steps

The potential approval of spot Avalanche ETFs could increase institutional adoption and provide more accessible investment vehicles for retail investors. However, approval remains uncertain given the SEC’s cautious stance on altcoin ETFs.

Technical analysts suggest AVAX faces key resistance levels between $22-$26, with potential targets reaching toward $54 if the cryptocurrency can break above current resistance zones and maintain momentum.

The outcome of these ETF applications may set precedents for future altcoin ETF approvals and indicate how regulators plan to address the growing number of cryptocurrency fund applications in 2025 and beyond.