Avalanche (AVAX) Price Prediction: Weekly Breakout Paves Way for $50 Surge

Avalanche shatters resistance levels as bullish momentum builds—traders eye the $50 threshold as next major target.

Technical Breakout Confirmed

AVAX's weekly chart shows a decisive breakout pattern that's got the entire crypto space talking. The move signals potential for significant upward movement, with technical indicators aligning for continued gains.

Market Sentiment Shifts

Traders are flipping bullish as Avalanche demonstrates strength against major counterparts. The $50 target isn't just hopeful thinking—it's becoming a technical probability based on current momentum patterns.

Institutional Eyes Watching

While retail traders chase the pump, smart money's already positioned—because nothing gets Wall Street's attention like a chart that actually does what technical analysts predict for once.

Market watchers are pointing out a constructive setup that could pave the way for a strong breakout. After weeks of steady accumulation and a sharp rise in on-chain activity, AVAX has managed to push above key resistance levels, hinting at growing momentum.

AVAX On-Chain Momentum Picks Up

Avalanche’s C-Chain is showing a sharp uptick in on-chain activity, with weekly transactions climbing 70% to 6.42 million and active addresses surging nearly 30% to over 208K. This rise signals that user participation on the network is expanding quickly, supported by higher throughput and consistent adoption across DeFi and application layers. With TVL crossing $2 billion, the data points to a healthy ecosystem where liquidity and usage are rising in tandem.

AVAX records a 70% surge in weekly transactions and a 30% jump in active addresses, signaling rapid on-chain growth. Source: Arsalan.avax via X

From an adoption perspective, such on-chain growth in transactions and active wallets suggests that Avalanche is not only retaining existing users but also attracting new activity at scale. Strong on-chain performance often acts as a leading indicator for long-term momentum, as it reflects genuine demand rather than speculative flows.

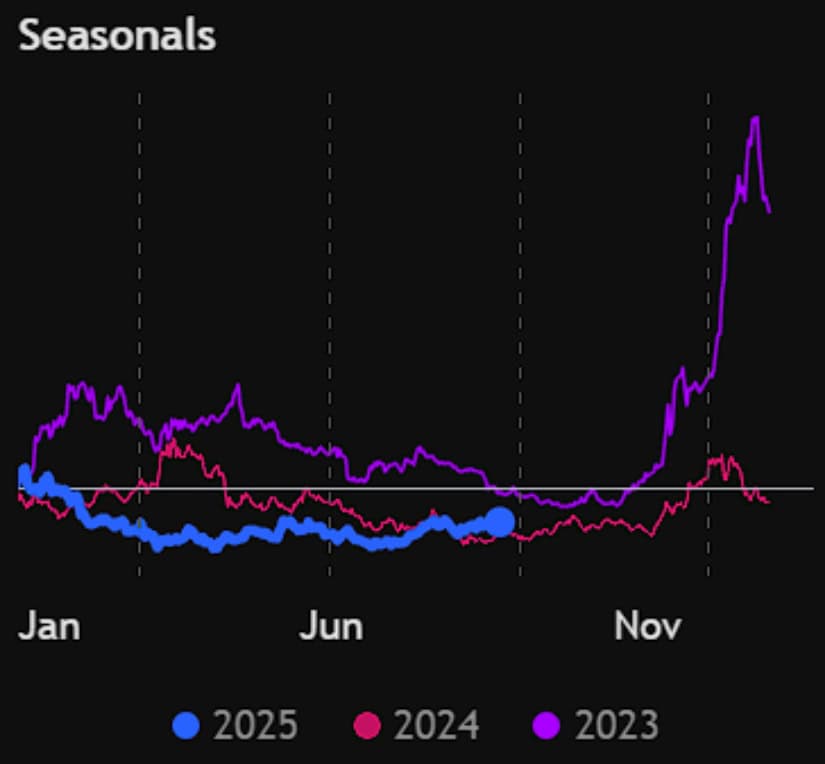

AVAX Historical Patterns Favor Q4 Strength

Looking at the past three years, Avalanche has shown a strong tendency to rally in the final quarter of the year. The seasonal chart shared by LHBCrypto highlights how both 2023 and 2024 experienced sharp upside momentum beginning in late Q3, with price expansions carrying into November and December. Now in 2025, AVAX is tracing a similar setup, gradually recovering through mid-year and positioning itself for a potential repeat of its historic end-of-year strength.

AVAX has historically rallied in Q4, with seasonal charts hinting at another strong year-end push in 2025. Source: LHBCrypto via X

What makes this pattern notable is that it’s not just a single instance, but a repeated trend that adds weight to the idea of Q4 being a favorable season for AVAX. If the historical rhythm holds, the next few months could see increased buying pressure, especially as on-chain growth aligns with technical seasonality.

AVAX Price Structure Targets Higher Levels

Avalanche is showing signs of strength after breaking above the $25 resistance zone and holding firmly around $26.5. The chart highlights how price has consistently respected higher lows since bottoming at $14.65, forming a constructive base that suggests accumulation. Moving averages (MA7, MA25, MA99) are now aligned in bullish order, with the shorter-term MA providing support as momentum builds. Analyst Mentor outlines a clear plan, breakout, retest support, and then continuation toward a $37 target.

Avalanche holds firm above $25, with bullish moving averages and rising volume pointing towards a potential climb to $33–$37. Source: Mentor via X

From a technical perspective, the $26 to $27 region remains the immediate pivot. A successful retest here WOULD confirm it as new support, reinforcing the broader bullish trend. Volume has also been expanding on green candles, signaling conviction behind the move. If bulls defend this zone, the next upside checkpoints come at $33, followed by $37.

Avalanche DeFi TVL Breaks a Key Barrier

Avalanche’s DeFi ecosystem has pushed its total value locked (TVL) back above $2 billion, with analyst Mash noting that this level may never be lost again. Current data shows TVL at $2.04B, supported by a $1.7B stablecoin market cap, strong chain fees, and over $500M in daily DEX volume. This recovery highlights how capital is steadily returning to the ecosystem, reinforcing Avalanche’s credibility as one of the more resilient Layer-1 networks in the space.

Avalanche’s DeFi TVL climbs back above $2B. Source: Mash via X

AVAX Price Prediction: Weekly Breakout to Open $50 Target

Avalanche is pressing against a critical weekly resistance zone NEAR $27, a level that has repeatedly capped upside attempts in recent months. The chart shared by analyst DeFi Sabali highlights how a confirmed breakout above this band could flip the structure bullish, with an extended target of around $50 in play.

AVAX Avalanche price eyes a decisive breakout above $27, with bullish structure pointing toward $33, $37, and a potential $50 target. Source: DeFi Sabali via X

From a technical angle, the $25 to $27 region is now the key pivot. A weekly close above it would confirm buyers’ strength and open the path toward $33 and $37 in the short term, with $50 as a medium-term target. Volume has been steadily increasing on green candles, while momentum indicators remain neutral, leaving room for expansion.

Final Thoughts

Avalanche is lining up multiple bullish signals at once, on-chain activity is growing, DeFi liquidity is expanding, and technicals are flashing a constructive structure. When fundamentals and charts MOVE in sync, it often marks the early phase of a stronger cycle. Holding the $25 to $27 range as new support could be the real turning point, transforming months of grind into the start of a sustained uptrend.

History also leans in AVAX’s favor, with Q4 rallies becoming a repeating theme over the past three years. If the same seasonal rhythm plays out, and it’s reinforced by the current wave of adoption and liquidity growth, Avalanche could be setting up for one of its most important runs yet.