Ethena (ENA) Price Prediction 2025: Can It Build Enough Support to Smash Through $1.37?

Ethena's grinding toward a critical resistance level—will 2025 be the year it finally punches through?

The $1.37 Barrier: More Than Just a Number

Traders eye that key mark like hawks. Hitting it isn’t just psychological—it’s a signal. A breakout here could trigger fresh momentum, drawing in sidelined capital waiting for confirmation.

Building Support: The Make-or-Break Factor

Strong foundations matter. ENA’s gotta cement buyer interest at higher lows—no shaky hands. Without that, even the most optimistic predictions are just… well, predictions. Another ‘trust me bro’ from crypto Twitter.

Market Sentiment & Macro Winds

Crypto doesn’t live in a vacuum. Broader market cycles, regulatory noise, and let’s be honest—occasional pure vibes—will play a role. Because nothing says ‘sound investment’ like an asset class that moon-tweets on a Tuesday.

So, will ENA break $1.37 this year? Maybe. But in crypto, expecting rational price action is like expecting a banker to wear sneakers to a meeting—possible, but deeply unsettling.

However, the token has still gained more than 30% over the past month, showing resilience despite recent volatility.

Market data highlights weakening speculative activity. According to CoinGlass, ENA open interest slipped by over 3% to $1.26 billion, while derivatives volume declined nearly 27% in a day. Analysts interpret this as a signal that traders are stepping back until the market establishes a clearer direction.

Fundamental Strength: Ethena Revenue and Growth

Despite price uncertainty, Ethena crypto news remains positive on the fundamentals. The protocol announced on August 21 that it has surpassed $500 million in cumulative gross interest revenue, with $13.4 million generated in the last week alone.

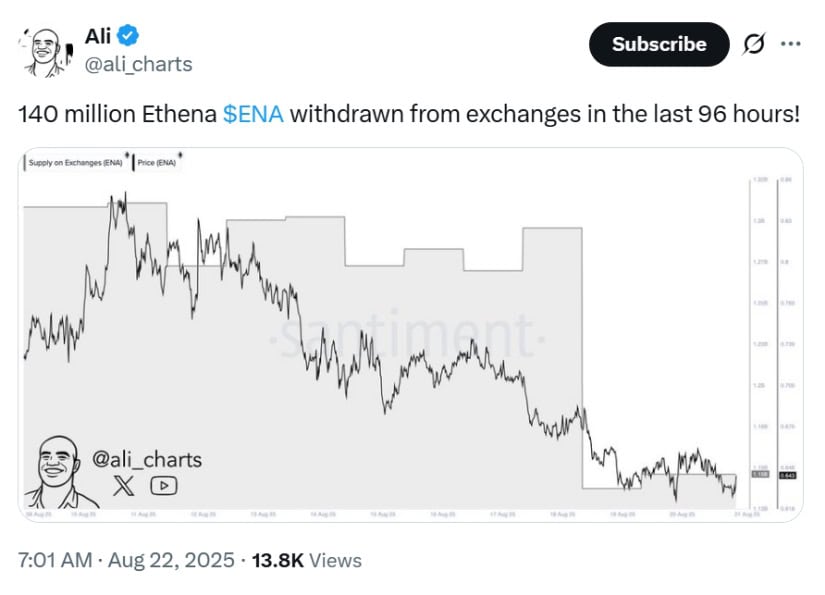

140M Ethena (ENA) withdrawn from exchanges in 96 hours, indicating investor accumulation. Source: Ali Martinez via X

Supply of Ethena USDe, its synthetic stablecoin, also surged by 670 million in the past week, reaching a record $11.7 billion. Staking yields remain attractive, with sUSDe offering an APY near 9%. According to DeFiLlama, the Ethena DeFi protocol has seen its total value locked almost double in a month, climbing from $5.5 billion in July to $11.9 billion by late August.

Investor behavior is shifting, too. Analyst Ali Martinez noted that over 140 million ENA tokens were withdrawn from exchanges within four days. Such exchange outflows are typically interpreted as accumulation, suggesting that holders prefer long-term storage over near-term selling.

Technical Indicators: ENA Support and Resistance Levels

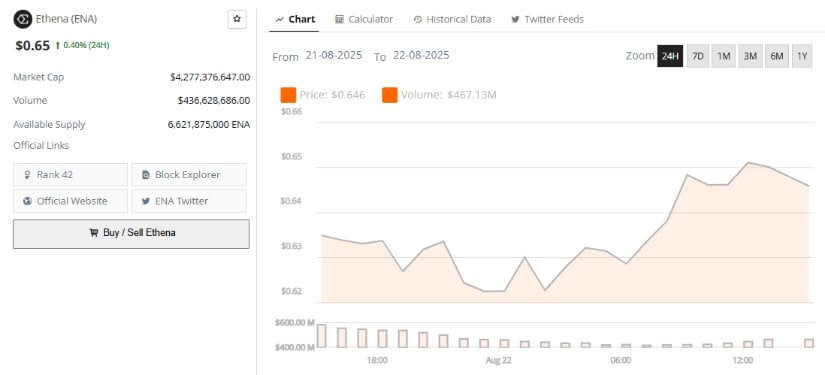

Ethena price analysis points to mixed signals. The token is consolidating NEAR its $0.65 support, with narrowing Bollinger Bands hinting at a potential breakout. On the daily chart, ENA is trading close to its lower band, which could indicate oversold conditions.

Ethena tops $500M revenue; last week: $13.4M earned, 670M USDe minted, supply $11.7B, sUSDe APY ~9%. Source: Ethena Labs via X

Momentum indicators, however, remain cautious. The Ethena MACD signal has flipped negative, while the RSI stands at 51, reflecting neutral momentum. Short-term moving averages lean bearish, but longer-term EMAs continue to support an upward trajectory.

If ENA holds above $0.65, analysts believe it could rebound toward $0.70–$0.74. A breakout above that range may set up a run toward ENA breakout targets near $0.83 or higher. Conversely, failure to hold support could trigger a decline toward $0.62, widening downside risks.

ENA Price Prediction 2025: A Divided Outlook

Forecasts for ENA price prediction 2025 are split between bullish optimism and bearish caution.

-

Bullish Scenario: DigitalCoinPrice projects that ENA could reclaim levels between $1.31 and $1.37, with the possibility of retesting its previous peak near $1.52 if sentiment improves.

-

Bearish Scenario: Coincodex models predict ENA could drop as low as $0.49–$0.62, highlighting downside risk if market support weakens.

-

Technical Analysts: Experts such as CryptoPulse point to ENA’s rejection at the 0.5 Fibonacci retracement level as the cause of recent corrections. However, they believe a bounce could materialize if Fibonacci support holds, targeting $0.83–$0.97 in the coming weeks.

Investor Sentiment and Market Outlook

The uncertainty in the ENA coin forecast reflects broader volatility in the crypto sector. While strong fundamentals, growing ENA trading volume, and robust staking rewards point to long-term promise, technical patterns show that short-term risks remain.

Ethena was trading at around $0.65, up 0.40% in the last 24 hours at press time. Source: Brave New Coin

For now, Ethena crypto prediction depends heavily on its ability to defend the $0.65 support and regain momentum. A successful rebound could renew investor confidence and strengthen the case for ENA reaching the $1.37 mark this year. But if support falters, bearish scenarios cannot be ruled out.