Corporate Crypto Treasuries Are Exploding: 3 Altcoins to Watch Now

Corporate balance sheets are loading up on digital assets—and these three altcoins are leading the charge.

The Hidden Gold Rush

Forget traditional treasury management. Companies are dumping cash reserves into crypto at an unprecedented pace, chasing yields that make government bonds look like medieval relics. The movement isn't speculative—it's strategic diversification on steroids.

BNB: The Exchange Powerhouse

Binance's native token dominates corporate portfolios thanks to its utility across the world's largest crypto ecosystem. Enterprises leverage BNB for reduced trading fees, staking rewards, and participation in exclusive token sales—turning operational expenses into revenue-generating assets.

Ethereum: The Institutional Darling

Smart contract capabilities and institutional-grade DeFi protocols make ETH the bedrock of corporate crypto strategies. Companies aren't just holding—they're earning yields through lending and liquidity provisioning that would give traditional bankers heart palpitations.

Solana: The Speed Play

With transaction speeds that leave legacy networks in the dust, SOL attracts corporations needing efficiency at scale. Its growing ecosystem of enterprise-focused dApps makes it the dark horse in treasury allocation debates.

While traditional finance still debates whether crypto belongs on balance sheets, forward-thinking treasurers are already printing gains—and honestly, watching them try to explain these returns to auditors might be the best entertainment in finance since the last bank bailout.

The most recent company to make headlines is VERB Technology, which announced $780M in assets, including $713M in, and $67M in cash reserves. The firm’s goal? To capture 5% of‘s circulating supply (around $410M at current prices) by leveraging equity issuance, corporate debt, and staking strategies.

The move has fueled debate across both Wall Street and crypto circles. Some investors see the rise of corporate altcoin strategies as a bullish development.At the same time, skeptics warn of a house of cards in the making, one where, in a downturn, risks of cascading liquidations become a very real possibility.

Regardless, the playbook is evolving, and‘s breakout moment is just one piece of the puzzle. Let’s take a closer look at, and two other altcoins to watch as corporate altcoin treasuries become more popular.

Toncoin (TON): Treasury Play Goes Mainstream

VERB technology has placed a bold bet on, allocating $713M thus far, to capture around 128M tokens: roughly 5% of the altcoin’s total supply.

This MOVE comes from a $558M private placement in August, which more than doubled VERB’s share price (Nasdaq: VERB) as investors signaled support for the firm’s crypto-heavy strategy. By staking its holdings, VERB also plans to generate yield, effectively turning its crypto treasury into a passive revenue engine.

The fundamentals behind $TON help explain investor conviction in the project. Built as a high-speed blockchain with DEEP Telegram integration, Toncoin rapidly expands its ecosystem, powering everything from payments to decentralized apps (dApps).Telegram is home to over 900 million users globally, and as the largest active social LAYER in crypto, is well-positioned to benefit.

Still, as with any crypto investment, the risks remain. Analysts, including ethereum co-founder Vitalik Buterin, warned that aggressive corporate debt and equity issuance could expose companies like VERB to liquidation spirals when a sustained market downturn occurs.

For now, though,has gained a new dimension: the “corporate treasury narrative,” putting it firmly on institutional and retail investors’ radar. And it’s undoubtedly a coin worth an allocation in your portfolio, or at the very least, one worth watching.

Hyper ($HYPER): A Layer-2 Bet for Speculative Treasuries

While Toncoin dominates the headlines, smaller infrastructure projects likemay represent the high-beta opportunities that typically come next in treasury adoption cycles.

is currently still in presale, having raised over $11.3M thus far. The project is positioned as a Layer-2 rollup for the Bitcoin network, built on the Solana Virtual Machine (SVM).

This hybrid approach allowsto combine Bitcoin’s security with Solana’s speed, dApp support, and staking yields: exactly the kind of infrastructure narrative that aligns with growing institutional and corporate flows.

As large-cap crypto projects likeattract treasury allocations, history shows us that capital often rotates into smaller, more speculative altcoins that can deliver outsized returns.

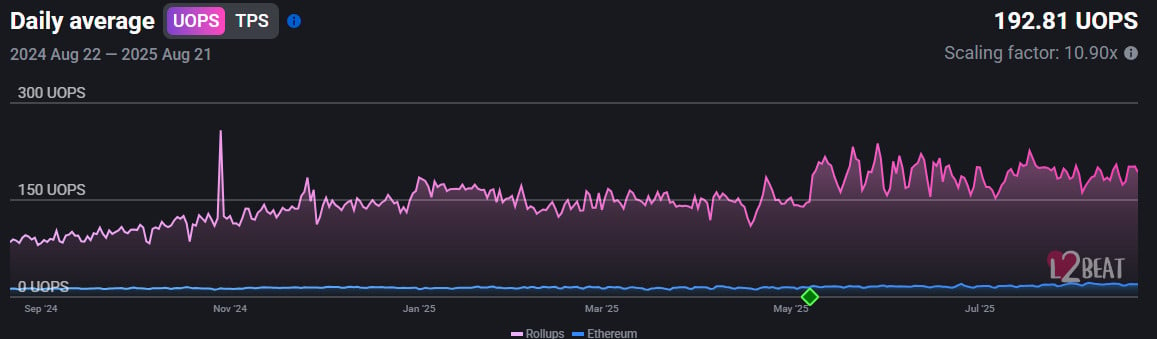

With millions already raised in presale,offers an asymmetric opportunity to bet on the emergence of a Bitcoin Layer-2 ecosystem. Given how activity on Ethereum Layer-2s, notably Base and Optimism, has been steadily ticking higher, it’s only a matter of time until a pioneering Bitcoin Layer-2 like $HYPER could take off.

The thesis is simple: if altcoin treasuries continue to become more mainstream, demand won’t stop at blue chips. Infrastructure tokens likecould be the next wave of beneficiaries, offering Leveraged upside to the same institutional adoption narrative.

Maxi Doge ($MAXI): Memecoins in the Treasury Era

It might sound crazy, but the treasury trend hasn’t stopped some companies from experimenting with memecoins. Safety Shot’s $BONK reserve play proved that even corporate treasury strategies occasionally embrace viral meme tokens; admittedly, with mixed market results.

Among the new cohort of memecoins,stands out from the pack. Built around its “Proof-of-Workout” branding and GigaChad meme culture,blends crypto-degen humor with a fitness-fueled identity tailor-made for social virality.

Its presale, which is still ongoing, has already raised over $1.4M, and its early staking programs offer 200%+ APY, attracting meme traders seeking explosive upside.

Unlike majors like,doesn’t rely on traditional utility. Instead, its growth relies on its narrative power: contests, cult-like community hype, and relentless meme output.

History shows us that once institutional flows support stable, high prices on majors, retail investors rotate into high-risk, high-reward meme plays. And that’s precisely where projects likewill excel.

While it’s unlikely to be a part of corporate treasury strategies,could capture speculative retail energy unleashed by the treasury boom, which may include more large-cap memecoins soon.

Alt Treasuries are the Rising Tide

VERB’s $780Mbet highlights how corporate treasuries are rapidly reshaping the altcoin market. While majors likegain credibility as institutional anchors, speculative plays likeand meme-fueled tokens likeare set to thrive as liquidity ripples outward.

This new treasury race presents a two-sided opportunity for investors: stability through majors and explosive upside via early-stage alts.The challenge is striking the right balance. As capital continues to flow, institutions and retail traders may be lifted by the same rising tide.

Take advantage of the early opportunities in theandpresales today!