Chainlink Poised to Shatter 4-Year Resistance – $30 Target in Sight as Bulls Charge

Chainlink’s grinding consolidation may finally pay off as the oracle giant eyes a breakout from a multi-year trendline. If the bulls hold their ground, $30 could be the next stop—assuming the whales don’t dump for "risk management" (read: profit-taking) first.

Key Levels to Watch

The $30 target isn’t just hopium—it aligns with historical resistance flips. A clean break here could open the floodgates for a run toward 2021’s ATH. But let’s not pretend the road won’t be littered with leveraged longs getting liquidated on the way up.

Why This Move Matters

Chainlink’s price action isn’t just about traders. A sustained rally would validate its entrenched position as the go-to oracle solution—even if half the partnerships announced in 2021 still haven’t shipped.

Bottom Line: The setup looks tasty, but in crypto, even "sure things" tend to crumble faster than a shitcoin’s whitepaper. Trade accordingly.

This trendline serves as a crucial barrier, and a confirmed breakout above it could indicate a potential shift in market dynamics, ushering in a new phase of price appreciation. Analysts and investors are closely monitoring this development as it may set the stage for the cryptocurrency to target the $30 level in the medium term.

Interaction with Long-Term Resistance Level

The current price of chainlink is near a descending trendline formed from its all-time highs several years ago. This trendline has repeatedly acted as resistance, limiting upward momentum and marking a significant technical hurdle for the cryptocurrency. Historical price tests have seen the asset unable to sustain gains beyond this barrier, leading to prolonged periods of consolidation or declines.

Source: X

Recent price action suggests that the Coin may be poised to test this resistance more aggressively. Successful penetration of the trendline could signal a structural change in the market sentiment around the memecoin, potentially transforming a long-standing bearish pattern into a renewed bullish trend.

After a breakout, a common occurrence is a short-term pullback or brief consolidation as the market reassesses. Such behavior often provides strategic buying opportunities ahead of further upward movement, especially if the breakout is confirmed by continued increases in volume and stronger price action.

Price Movement Supported by Volume and Market Activity

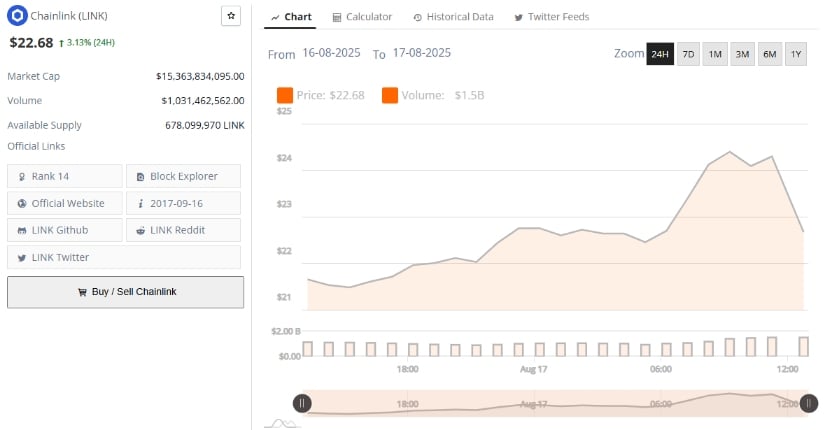

Trading at approximately $22.68, Chainlink has experienced a moderate 3.13% price increase over the last 24 hours. Notably, this price rise is accompanied by a surge in trading volume, indicating higher levels of market participation and investor interest.

Volume is an important indicator in technical analysis as it validates the strength behind price movements; higher volume during gains is generally perceived as a sign of conviction by market participants.

Source: BraveNewCoin

The price action shows resilience with the token maintaining support levels, building momentum as it approaches a key resistance point at around $24. Movement beyond this resistance is necessary to sustain the upward trend and could open the door for the price to make attempts toward the psychological $30 mark, which has been identified as a potential medium-term target.

The steady increase in both price and volume reflects a gradual shift in market sentiment, with more traders and investors engaging in buying activities.

Technical Momentum Indicators Highlight Bullish Potential

Examining technical momentum indicators provides additional insight into Chainlink’s current position. The Moving Average Convergence Divergence (MACD) is displaying a bullish crossover, a condition where the MACD line surpasses the signal line, frequently interpreted as an indicator of growing upward momentum. The accompanying positive readings on the MACD histogram reinforce this signal and suggest that buyers are gaining control.

Source: TradingView

Moreover, the Chaikin Money FLOW (CMF) indicator, which measures the flow of capital into or out of an asset, is currently positive at 0.17. This figure signifies more money moving into the token than out, implying accumulation and investor confidence. A CMF value above 0.10 is typically associated with a bullish market environment, which supports the argument that buying pressure could continue to push prices higher.

Together, these indicators complement the price and volume analysis, suggesting that the coin is situated in a favorable technical position to extend its rally. Market participants might observe pullbacks to established support levels as opportunities to build or enter positions in anticipation of further price gains.