Bitcoin (BTC) Price Surge: Outshining Gold as Kiyosaki Crowns It ‘The People’s Currency’

Move over, gold—Bitcoin’s stealing the spotlight. Robert Kiyosaki’s latest endorsement brands BTC as ‘the people’s money,’ and the market’s eating it up. Here’s why crypto’s golden child is leaving bullion in the dust.

### The Death of Gold’s Monopoly?

Gold bugs are sweating. Bitcoin’s volatility? A feature, not a bug. Its 24/7 trading? A gut punch to commodity markets that still close for weekends. Meanwhile, Wall Street’s scrambling to retrofit legacy systems—too little, too late.

### The Retail Revolution

No vaults. No bankers. Just code. Bitcoin’s grassroots appeal cuts through the red tape of traditional finance like a hot knife through… well, butter. And the masses? They’re voting with their wallets.

### The Cynical Kick

Let’s be real—half the institutions now ‘believing’ in Bitcoin are the same ones that called it a scam in 2018. Nothing like a 10,000% rally to suddenly reveal ‘fundamental value.’

One thing’s clear: When the next crisis hits, expect more pandering headlines about ‘digital gold’… right before central bankers start buying the dip.

The world’s largest cryptocurrency continues to outperform gold, which slipped nearly 2% this week, fueling debate on whether Bitcoin is emerging as the superior hedge against inflation and market risk.

Market Overview: Bitcoin Price Today and Technical Analysis

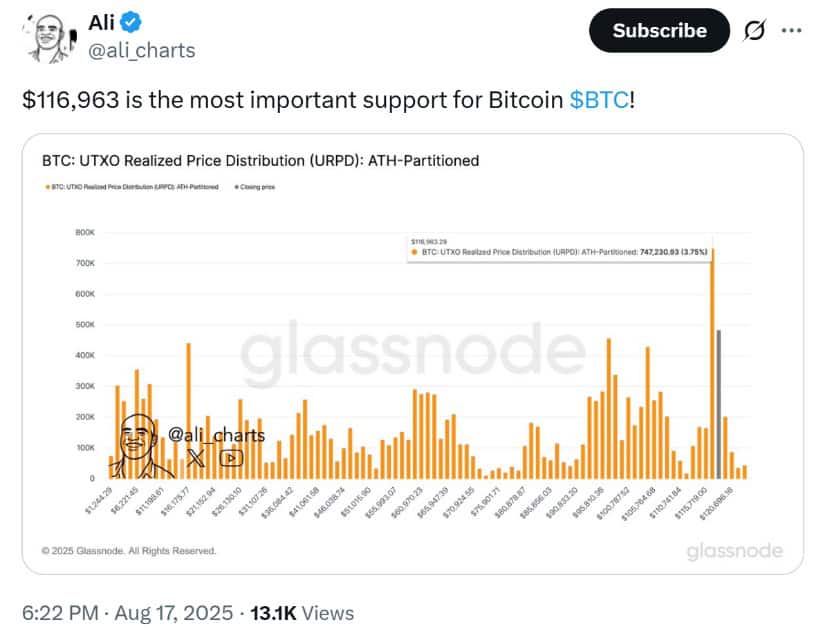

Bitcoin trades within a narrow range between $117,200 and $118,500, a compression zone that often precedes sharp breakouts. Key support lies at $116,963, highlighted by Glassnode’s UTXO Realized Price Distribution (URPD), which shows heavy buying activity at that level. If buyers defend this zone, BTC could FORM a new base for the next rally.

Bitcoin price is consolidating tightly between $117,279 and $118,445, signaling a potential breakout ahead. Source: Sallywatersbuss on TradingView

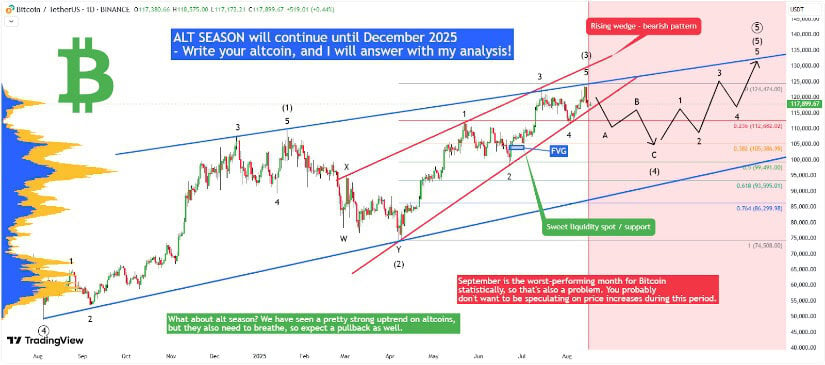

From a technical perspective, Bitcoin is shaping a bullish ascending triangle on the daily chart, with momentum supported by long-term moving averages. The RSI indicator stands at 53, leaving room for upside, while the MACD signals slight cooling in momentum. A decisive break above $123,235 would open targets at $127,300 and potentially $131,500. On the downside, a failure to hold $116,700 could expose BTC to the $112,500 level, where the 50-day SMA provides structural support.

ETF Flows and Institutional Adoption Fuel Rally

Another key factor behind Bitcoin’s resilience is the growing bitcoin ETF news. Spot BTC ETFs now manage over $158 billion in assets, narrowing the gap with gold ETFs, which hold around $198 billion. Large inflows, including several billion-dollar days recently, reflect strong institutional participation from pension funds, sovereign wealth funds, and insurers.

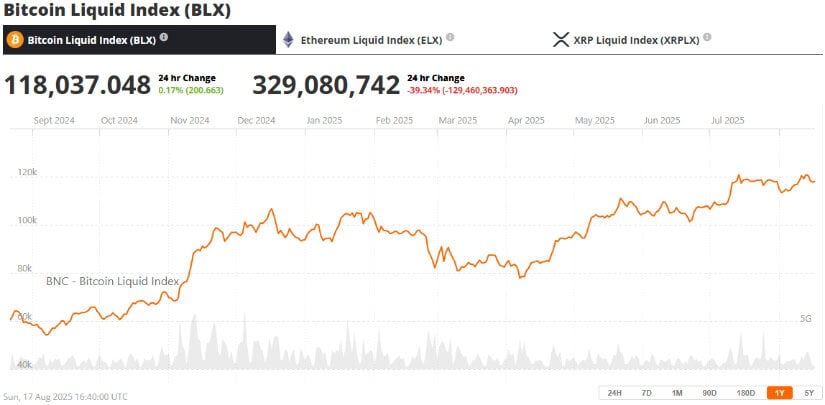

Bitcoin (BTC) was trading at around $118,037, up 0.17% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

This ETF-driven demand has become the backbone of Bitcoin’s rally in 2025, cushioning price action against macro headwinds and providing a steady bid even as retail trading volumes moderate.

Bitcoin Halving 2025 and Whale Activity

The Bitcoin halving of April 2024 continues to shape supply dynamics, with miner rewards cut in half. Historically, such events spark 12–18 month price surges as supply tightens, according to academic studies. With fewer new coins entering circulation and institutional accumulation rising, Bitcoin whales have shown a strong defense of the $116K support zone.

BTC: UTXO Realized Price Distribution (URPD) chart. Source: Ali Martinez via X

This confluence of reduced supply and concentrated long-term holder activity strengthens the bullish case heading into the final quarter of 2025.

Expert Insights: Kiyosaki Calls Bitcoin “The People’s Money”

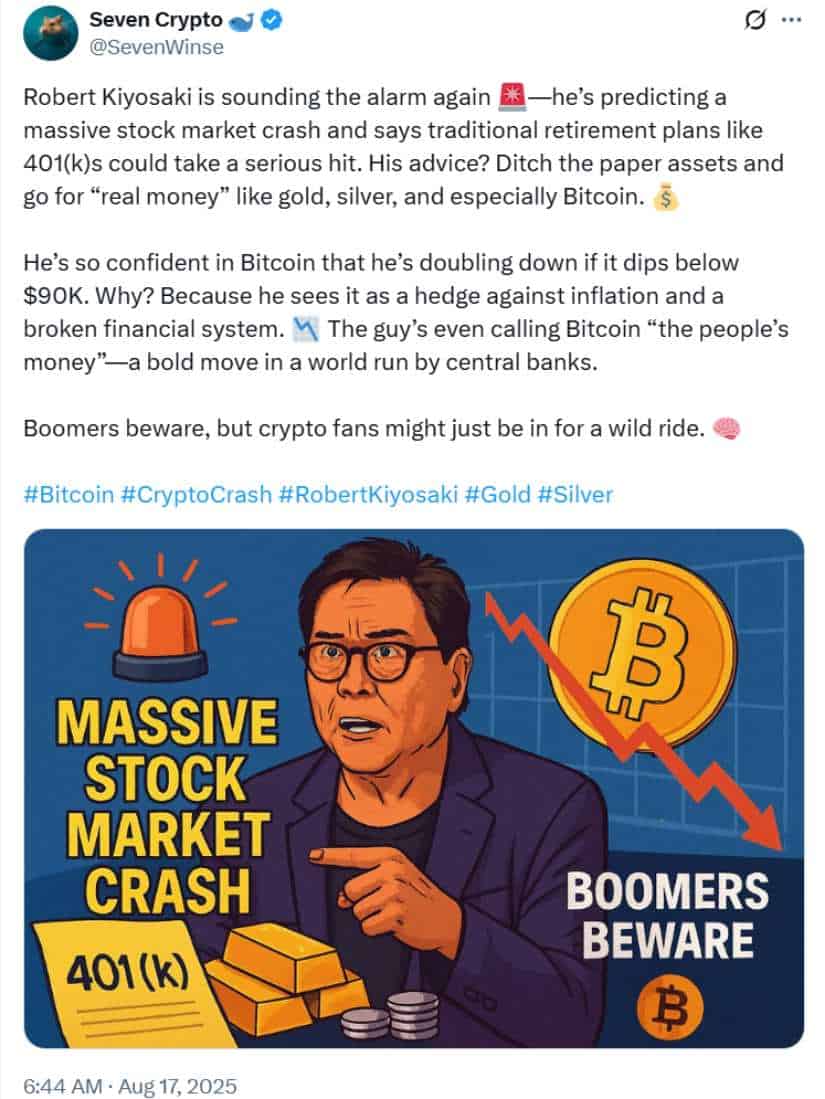

Robert Kiyosaki, author of Rich Dad Poor Dad, has been vocal about Bitcoin’s role in today’s fragile financial landscape. He warned of red flags in U.S. stock markets, particularly for baby boomers reliant on 401(k) retirement plans, and urged investors to diversify into “real money” assets—gold, silver, and Bitcoin.

Robert Kiyosaki warns of a looming stock market crash, urging investors to MOVE from traditional assets into gold, silver, and Bitcoin, which he calls “the people’s money.” Source: @SevenWinse via X

Kiyosaki described Bitcoin as “the people’s money,” emphasizing its digital scarcity, portability, and independence from government control. He argues BTC is better suited than Gold to withstand inflation, currency debasement, and systemic shocks. In his view, Bitcoin could climb to $1 million if confidence in fiat currencies continues to erode.

While his hedge strategy still includes gold and silver, Kiyosaki notes Bitcoin’s ease of wealth creation compared to real estate or traditional assets, calling BTC a “genius asset design.”

Looking Ahead: Bitcoin’s Next Move and Long-Term Outlook

Bitcoin’s consolidation NEAR $118K reflects both strong institutional backing and cautious market sentiment. ETF inflows, whale accumulation, and the aftereffects of the Bitcoin halving 2025 suggest that supply-demand dynamics remain in Bitcoin’s favor.

Bitcoin price could retest the $105K demand zone before cruising toward the new ATH near $135,000. Source: Xanrox on TradingView

As traders eye the next breakout, the debate over BTC vs gold is intensifying. For Kiyosaki and a growing number of investors, Bitcoin is not only a crisis hedge but also a superior form of “people’s money.” With price targets extending to $130K in the near term and much higher over the long run, Bitcoin’s long-term outlook continues to strengthen against traditional safe-haven assets.